2026 Tax Brackets and What You Need to Know: A Guide to The One, Big, Beautiful Bill Act

The One, Big, Beautiful Bill Act, signed into law on July 4, 2025, as Public Law 119-21, brings significant changes to federal taxes, credits, and deductions starting in 2025. This comprehensive guide breaks down the 2026 tax brackets and explains how the new provisions will affect individuals, families, and businesses. Whether you’re planning for the upcoming tax year or trying to understand how these changes impact your financial future, this article provides the essential information you need to navigate the new tax landscape.

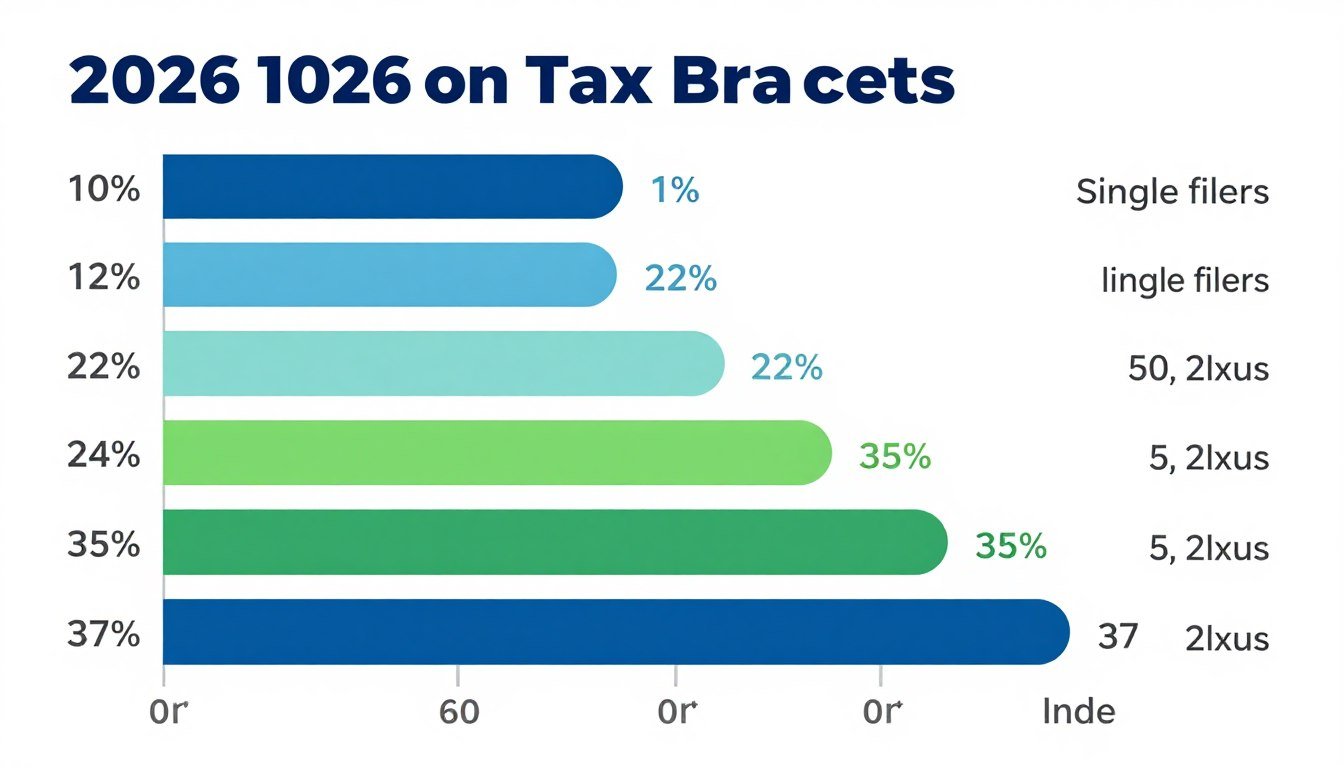

Understanding the 2026 Federal Tax Brackets

The 2026 federal tax brackets maintain the seven-tier progressive rate structure

The federal income tax system continues to use a progressive structure with seven tax brackets in 2026. While the tax rates remain unchanged at 10%, 12%, 22%, 24%, 32%, 35%, and 37%, the income thresholds for each bracket have been adjusted for inflation. These adjustments help prevent “bracket creep,” where taxpayers move into higher tax brackets due to inflation rather than actual increases in income.

It’s important to understand that you don’t pay a single tax rate on all your income. Instead, portions of your income are taxed at different rates as they fall into each bracket. Your marginal tax rate is the highest bracket your income reaches, while your effective tax rate is the actual percentage of your total income paid in taxes.

2026 Tax Brackets for Single Filers

| Tax Rate | Taxable Income Range | Taxes Owed |

| 10% | $0 to $12,400 | 10% of taxable income |

| 12% | $12,401 to $50,400 | $1,240 plus 12% of amount over $12,400 |

| 22% | $50,401 to $105,700 | $5,800 plus 22% of amount over $50,400 |

| 24% | $105,701 to $201,775 | $17,966 plus 24% of amount over $105,700 |

| 32% | $201,776 to $256,225 | $41,024 plus 32% of amount over $201,775 |

| 35% | $256,226 to $640,600 | $58,448 plus 35% of amount over $256,225 |

| 37% | Over $640,600 | $192,979.25 plus 37% of amount over $640,600 |

2026 Tax Brackets for Married Filing Jointly

| Tax Rate | Taxable Income Range | Taxes Owed |

| 10% | $0 to $24,800 | 10% of taxable income |

| 12% | $24,801 to $100,800 | $2,480 plus 12% of amount over $24,800 |

| 22% | $100,801 to $211,400 | $11,600 plus 22% of amount over $100,800 |

| 24% | $211,401 to $403,550 | $35,932 plus 24% of amount over $211,400 |

| 32% | $403,551 to $512,450 | $82,048 plus 32% of amount over $403,550 |

| 35% | $512,451 to $768,700 | $116,896 plus 35% of amount over $512,450 |

| 37% | Over $768,700 | $206,583.50 plus 37% of amount over $768,700 |

2026 Tax Brackets for Other Filing Statuses

Married Filing Separately

The income thresholds for married filing separately are generally half of those for married filing jointly, except at the higher brackets. The rates remain the same at 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

For the 37% bracket, married filing separately taxpayers reach this highest rate at income over $384,350, which is not exactly half of the $768,700 threshold for joint filers.

Head of Household

The head of household filing status offers more favorable tax brackets than single filing status for those who qualify. To qualify, you must be unmarried and pay more than half the cost of maintaining a home for yourself and a qualifying person.

For 2026, head of household filers reach the 37% bracket at income over $640,600, the same threshold as single filers.

2026 Standard Deduction Changes

The standard deduction, which reduces your taxable income, has increased for 2026 due to inflation adjustments. These higher standard deductions may reduce the need for some taxpayers to itemize deductions.

| Filing Status | 2026 Standard Deduction | Increase from 2025 |

| Single | $16,100 | $350 |

| Married Filing Jointly | $32,200 | $700 |

| Married Filing Separately | $16,100 | $350 |

| Head of Household | $24,150 | $525 |

Calculate Your 2026 Tax Liability

Understanding your tax bracket is just the first step. Use our tax calculator to estimate your 2026 tax liability based on the new brackets and provisions in The One, Big, Beautiful Bill Act.

Key Provisions of The One, Big, Beautiful Bill Act

The One, Big, Beautiful Bill Act introduces several significant changes to the tax code that will affect individuals, families, and businesses starting in 2025. Here’s a breakdown of the most important provisions:

The One, Big, Beautiful Bill Act was signed into law on July 4, 2025

Changes for Individuals and Workers

Tax Inflation Adjustments

Sections 70101, 70102, 70106, 70107, and 70401 implement inflation adjustments to tax brackets, standard deductions, and other tax provisions to prevent bracket creep and maintain purchasing power.

New Deduction for Seniors

Section 70103 introduces a special deduction exclusively for senior citizens, providing additional tax relief for those aged 65 and older to help manage retirement expenses.

No Tax on Tips

Section 70201 eliminates federal income tax on tip income, benefiting service industry workers who rely on tips as a significant portion of their compensation.

No Tax on Overtime

Section 70202 exempts overtime pay from federal income tax, providing a significant benefit to hourly workers who work beyond their standard hours.

No Tax on Car Loan Interest

Section 70203 makes car loan interest tax-deductible, reducing the effective cost of financing vehicle purchases for consumers.

Impact on Take-Home Pay

These provisions collectively increase take-home pay for many workers, especially those in service industries, hourly workers who earn overtime, and those financing vehicle purchases.

Speak with a Tax Professional

The new tax provisions are complex and may significantly impact your financial situation. Get personalized advice from a tax professional who can help you navigate these changes and optimize your tax strategy.

Changes for Families and Dependents

Trump Accounts

Section 70204 establishes “Trump Accounts” under the Working Families Tax Cuts provision. These accounts allow families to set aside pre-tax income for qualifying expenses related to childcare, education, and family support services.

Eligible families can contribute up to specified limits annually, with funds growing tax-free when used for qualified expenses. This provision aims to provide financial flexibility for working families managing the costs of raising children.

Enhanced Adoption Credit

Section 70402 significantly enhances the adoption credit, making it more accessible and valuable for families pursuing adoption. The enhancements include:

- Increased maximum credit amount

- Higher income phase-out thresholds

- Expanded eligibility criteria

- Improved refundability provisions

These changes reduce the financial barriers to adoption and provide greater support to adoptive families.

Healthcare Changes

Health Savings Account Expansion

Section 71307 significantly expands Health Savings Account (HSA) benefits for participants. The key expansions include:

- Increased annual contribution limits

- Expanded eligibility criteria beyond high-deductible health plans

- Broader definition of qualified medical expenses

- New options for using HSA funds for wellness programs

- Improved rollover and transfer provisions

These changes make HSAs more flexible and valuable as both healthcare funding vehicles and long-term savings tools. The expanded HSA provisions take effect immediately in 2025 and continue through 2026 and beyond.

Changes for Businesses

Passenger Vehicle Loan Interest Relief

Section 70203 provides transition relief for businesses regarding passenger vehicle loan interest for 2025. This temporary provision allows businesses to deduct interest on loans for passenger vehicles used for business purposes, even if they would otherwise be subject to interest deduction limitations.

Qualified Production Property

Section 70307 introduces new tax incentives for Qualified Production Property, benefiting manufacturers and producers. These incentives include accelerated depreciation, special tax credits, and simplified accounting methods for qualifying property used in production activities within the United States.

Third Party Network Transactions

Section 70432 revises reporting requirements for third-party network transactions, affecting platforms that process payments. The changes include adjusted thresholds for Form 1099-K reporting and modified timing requirements, reducing administrative burden for small businesses and gig economy workers.

Employee Retention Credit Limitations

Section 70605 implements new limitations on the Employee Retention Credit (ERC), restricting eligibility and establishing stricter documentation requirements. Businesses that previously claimed this credit should review these changes carefully to ensure compliance.

Download Our 2026 Business Tax Guide

Get our comprehensive guide to business tax changes under The One, Big, Beautiful Bill Act. Learn how to optimize your tax strategy and take advantage of new provisions.

Clean Energy Provisions

Clean Vehicle Credit Expirations

Sections 70501, 70502, and 70503 establish expiration dates for various clean vehicle tax credits. These provisions affect credits for new electric vehicles, used clean vehicles, and commercial clean vehicles, with most set to phase out or expire by specific dates in 2026 and 2027.

Home Energy Credit Expirations

Sections 70505, 70506, and 70507 set expiration dates for home energy efficiency credits, including those for energy-efficient home improvements, residential clean energy, and new energy-efficient homes. Homeowners should plan accordingly to take advantage of these credits before they expire.

Carbon Capture Credit

Section 70522 modifies the carbon capture and sequestration credit, adjusting the credit rates, eligibility requirements, and compliance standards. These changes aim to better incentivize carbon capture technologies while ensuring environmental integrity.

Investment and Community Development

Rural Opportunity Zones

Section 70421 establishes Rural Opportunity Zones, creating tax incentives for investments in designated rural areas. These incentives include:

- Capital gains tax deferrals for investments in qualified opportunity funds

- Step-up in basis for long-term investments

- Tax credits for job creation in designated zones

- Accelerated depreciation for qualifying business property

These provisions aim to stimulate economic development and job creation in rural communities facing economic challenges.

Agricultural and Rural Lending Benefits

Section 70435 introduces tax benefits for agricultural and rural lending, providing incentives for financial institutions to increase lending in rural areas. The benefits include:

- Special deductions for interest income from qualified rural loans

- Tax credits for originating loans to small agricultural businesses

- Favorable tax treatment for loan loss reserves related to rural lending

- Simplified reporting requirements for qualifying loans

These provisions aim to increase access to capital in rural communities and support agricultural businesses.

Tax-Exempt Entities and Charitable Giving

Indian Tribal Governments and Adoption Credit

Section 70403 extends adoption credit benefits to Indian tribal governments, allowing them to certify tribal adoptions for purposes of the federal adoption credit. This provision ensures that adoptions through tribal governments receive the same tax benefits as other adoptions.

Scholarship Organization Donations

Section 70411 creates a new tax credit for donations to qualified scholarship organizations. This credit allows taxpayers to receive a federal tax credit for contributions to organizations that provide educational scholarships, with special provisions for scholarships to low-income students.

Other Tax Changes

Dyed Fuel Claims

Section 70525 modifies the rules for dyed fuel claims, affecting businesses that use dyed diesel fuel for off-road purposes. The changes include revised claim procedures, documentation requirements, and compliance standards.

Excise Tax on Remittance Transfers

Section 70604 implements a new excise tax on certain remittance transfers, primarily affecting money transfer services that facilitate international money transfers. The provision includes specific exemptions and special rules for qualifying transactions.

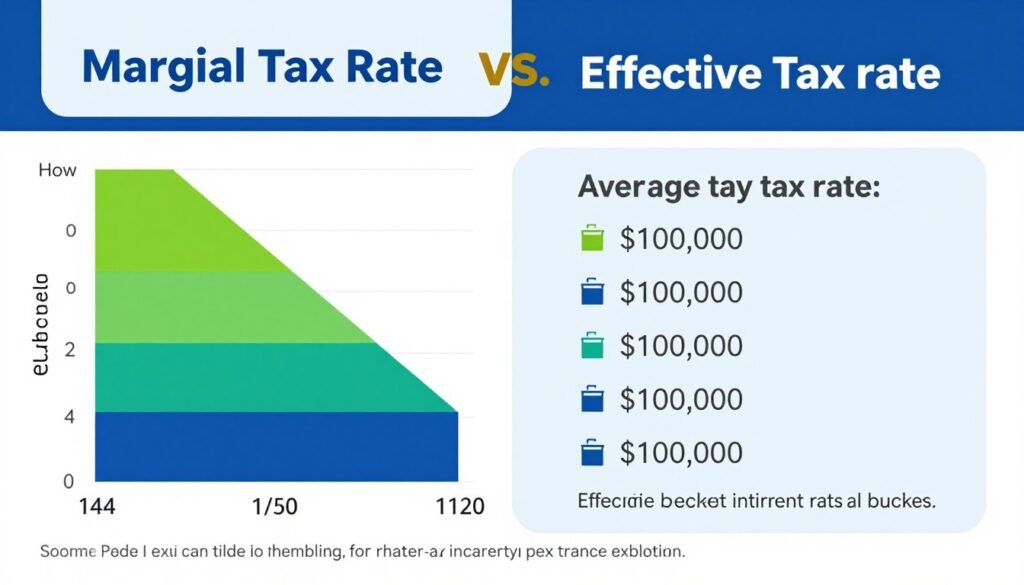

Understanding Marginal vs. Effective Tax Rates

Marginal Tax Rate

Your marginal tax rate is the rate you pay on your last dollar of income—the highest bracket your income reaches. For example, if you’re a single filer with $60,000 in taxable income in 2026, your marginal tax rate would be 22%, as your income falls within the 22% bracket ($50,401 to $105,700).

However, this doesn’t mean you pay 22% on all your income. You only pay 22% on the portion of your income that falls within that bracket—in this case, the amount over $50,400.

Effective Tax Rate

Your effective tax rate is the actual percentage of your total taxable income that you pay in taxes. It’s calculated by dividing your total tax liability by your total taxable income.

For example, a single filer with $60,000 in taxable income in 2026 would pay:

- 10% on the first $12,400 = $1,240

- 12% on income from $12,401 to $50,400 = $4,560

- 22% on income from $50,401 to $60,000 = $2,112

Total tax: $7,912 on $60,000 income = 13.2% effective tax rate

Tax Planning Strategies for 2026

Maximize New Deductions

Take full advantage of the new deductions introduced by The One, Big, Beautiful Bill Act, including the senior deduction and car loan interest deduction. Ensure you maintain proper documentation to substantiate these deductions.

Optimize Retirement Contributions

Continue to maximize contributions to tax-advantaged retirement accounts like 401(k)s and IRAs. These contributions reduce your taxable income and help you save for retirement simultaneously.

Leverage HSA Expansions

With the expanded HSA provisions, consider increasing your HSA contributions to take advantage of the tax benefits for healthcare expenses while building tax-free savings for future medical needs.

Time Your Income and Deductions

Consider the timing of income and deductions to optimize your tax situation. If possible, defer income to future years if you expect to be in a lower tax bracket, or accelerate deductions into the current year if you expect to be in a higher bracket.

Explore Trump Accounts

If you have qualifying expenses for childcare or education, investigate whether a Trump Account could provide tax advantages for your family. These accounts offer tax-free growth for qualifying expenses.

Review Business Entity Structure

Business owners should review their entity structure in light of the new tax provisions. Different entity types (sole proprietorship, LLC, S-corporation, etc.) may offer different tax advantages under the new law.

Resources and Guidance

For more detailed information about The One, Big, Beautiful Bill Act and its impact on your taxes, consult these official resources:

IRS Resources

- IRS newsroom updates

- Official fact sheets

- Tax tips and guidance

- Ready-to-use articles

Technical Guidance

- Frequently asked questions (FAQs)

- IRS notices

- Official announcements

- Revenue procedures

Professional Assistance

- Certified Public Accountants (CPAs)

- Enrolled Agents (EAs)

- Tax attorneys

- Financial advisors

Conclusion

The One, Big, Beautiful Bill Act introduces significant changes to the federal tax landscape for 2026 and beyond. While the seven tax brackets remain at the same rates (10% to 37%), the income thresholds have been adjusted for inflation, and numerous new provisions affect everything from individual deductions to business incentives.

Understanding these changes is crucial for effective tax planning. The provisions for tax-free tips and overtime, new deductions for seniors and car loan interest, expanded HSAs, and new investment incentives all present opportunities to optimize your tax situation.

As with any major tax legislation, the full implications of The One, Big, Beautiful Bill Act will continue to unfold as the IRS issues guidance and regulations. Consulting with a tax professional is highly recommended to ensure you’re taking full advantage of the new provisions while remaining compliant with tax laws.

Ready to Optimize Your 2026 Tax Strategy?

Our tax professionals can help you navigate the changes introduced by The One, Big, Beautiful Bill Act and develop a personalized tax strategy that maximizes your benefits under the new law.