Gold Price $10,000: Analyzing the Possibility and Global Implications

As gold prices continue their upward trajectory, breaking records and defying traditional market patterns, a question emerges with increasing frequency in financial circles: Could gold actually reach $10,000 per ounce? Once dismissed as fantasy, this price target has gained traction among serious analysts and economists. This analysis examines the economic foundations, expert opinions, and historical context behind this bold prediction—and what it would mean for the global economy if gold were to experience such a dramatic revaluation.

What Economists and Market Experts Are Saying About $10,000 Gold

Analysts are increasingly examining scenarios that could push gold to unprecedented price levels

The Bull Case: Why $10,000 Gold Could Become Reality

Several prominent voices in the financial community have put forward scenarios where gold could reach the $10,000 mark. Ed Yardeni, founder of Yardeni Research and a respected Wall Street strategist, has outlined a path to $10,000 gold by 2028, with intermediate targets of $5,000 by 2026. His analysis centers on central bank buying, geopolitical uncertainty, and fundamental shifts in global trade policies.

Mike Maloney, precious metals expert and author, presents a mathematical case based on the Federal Reserve’s balance sheet. He points to gold certificate accounts listed as collateral against Federal Reserve notes, calculating that if the U.S. returned to 100% gold backing for currency, gold would need to be priced at approximately $9,044 per ounce—making $10,000 a reasonable round-number target in a monetary reset scenario.

Adrian Hammond of SBG Securities suggests gold is in the “last leg” of a major rally, with potential to reach $10,000 if the Federal Reserve adopts a more accommodative policy stance. His base case projects $7,000 gold with three rate cuts, while a more dovish shift could push prices to the $10,000 mark.

The Skeptics: Arguments Against Extreme Price Targets

Not all experts share this bullish outlook. Skeptics point to several counterarguments that challenge the $10,000 gold thesis:

Factors Supporting $10,000 Gold

- Central bank diversification away from dollars

- Unprecedented global debt levels

- Potential currency debasement

- Geopolitical fragmentation of global trade

- Historical precedent of monetary system resets

Arguments Against $10,000 Gold

- Potential for price overshoot and sharp correction

- Higher interest rates could eventually pressure gold

- Production increases at higher price points

- Alternative safe havens (Bitcoin, other commodities)

- Historical resistance to monetary system changes

Jeffrey Christian of CPM Group represents the more cautious view, arguing that while gold will likely continue to appreciate, the $10,000 target represents “gold price hysteria” rather than sound analysis. He points to the potential for increased mining output at higher prices and the historical tendency for markets to find equilibrium.

The World Gold Council maintains a more measured stance, acknowledging gold’s strong performance while avoiding specific long-term price targets. Their research focuses on fundamental demand drivers rather than price speculation.

The Broader Economic Impact of $10,000 Gold

The ripple effects of $10,000 gold would transform multiple sectors of the global economy

Central Banks and Monetary Policy

A gold price of $10,000 would fundamentally alter central bank balance sheets worldwide. Nations holding substantial gold reserves—like the United States, Germany, and Italy—would see dramatic increases in their monetary base strength. The Federal Reserve’s balance sheet would be particularly affected, as the value of its gold certificates would surge relative to outstanding currency.

This revaluation could potentially provide central banks with greater flexibility in monetary policy, allowing for balance sheet expansion without proportional currency debasement. However, it would also likely force a reevaluation of how monetary policy is conducted, potentially leading to new frameworks that acknowledge gold’s enhanced role.

Currency Markets and the Dollar’s Status

The U.S. dollar’s reserve currency status could face its most serious challenge in decades if gold reached $10,000. As the International Monetary Fund has noted, reserve currency transitions historically occur during periods of economic stress and monetary uncertainty—precisely the conditions that would likely accompany such a dramatic gold revaluation.

Currency markets would likely experience extreme volatility, with gold-backed or gold-correlated currencies potentially gaining significant strength. Countries with minimal gold reserves might face currency crises, leading to a multi-tiered global currency system rather than the dollar-dominated framework that has prevailed since World War II.

Inflation, Interest Rates, and Bond Markets

| Economic Factor | Likely Impact of $10,000 Gold | Secondary Effects |

| Inflation Expectations | Significant increase | Consumer behavior shifts toward hard assets |

| Interest Rates | Initial spike followed by potential reset | Debt servicing challenges for governments |

| Bond Markets | Severe pressure on traditional sovereign debt | Flight to inflation-protected securities |

| Real Interest Rates | Deeply negative | Acceleration of capital into tangible assets |

Bond markets would likely experience significant disruption, as a gold price of $10,000 would signal severe concerns about fiat currency stability. Government bonds, traditionally considered “risk-free” assets, might see dramatic repricing as investors demand higher yields to compensate for perceived currency risk.

Industrial Impact: From Electronics to Jewelry

Industries dependent on gold as an input would face transformative pressures. The electronics sector, which uses gold for connectors and components, would need to develop alternatives or pass costs to consumers. The jewelry industry would likely shift toward lower gold content alloys and alternative metals, particularly in price-sensitive markets.

According to the World Gold Council’s demand statistics, jewelry and technology sectors currently account for approximately 50% of annual gold demand. This balance would likely shift dramatically at $10,000 gold, with investment demand dominating and industrial uses becoming increasingly specialized.

Trump Administration Policies and Gold’s Trajectory

Trump’s economic policies could create conditions favorable to gold’s continued rise

The Trump administration’s economic policies create several vectors that could accelerate gold’s rise toward the $10,000 mark. These include trade policy, fiscal approach, Federal Reserve relations, and broader geopolitical positioning.

Tariffs and Trade Policy

Trump’s “America First” trade stance, characterized by tariffs and bilateral trade agreements rather than multilateral frameworks, creates structural pressures that typically benefit gold. Tariffs tend to be inflationary in the short to medium term, raising input costs across supply chains. They also fragment global trade, potentially reducing efficiency and increasing economic friction.

According to analysis from the Peterson Institute for International Economics, broad-based tariffs can reduce economic efficiency while raising consumer prices—a combination that historically benefits gold as both an inflation hedge and economic uncertainty barometer.

Fiscal Policy and Deficit Spending

The fiscal approach under Trump has embraced significant deficit spending, with tax cuts and infrastructure initiatives expanding the national debt. This expansionary fiscal policy, particularly when combined with restrictive trade measures, creates conditions where gold typically thrives.

The Congressional Budget Office projections indicate continued growth in the federal debt-to-GDP ratio, a metric that has historically correlated with gold price appreciation when it reaches elevated levels.

Federal Reserve Relations and Monetary Independence

Trump’s relationship with the Federal Reserve has been characterized by public pressure for accommodative policy. This approach raises questions about central bank independence—a cornerstone of modern monetary policy. Markets typically assign a risk premium to assets in jurisdictions where central bank independence appears compromised, benefiting alternative stores of value like gold.

Recent statements from Trump indicating approval of dollar weakness further reinforce the potential for policies that could indirectly support gold prices. As he recently noted when asked about dollar weakness: “I think it’s great…look at the business we’re doing.”

The Global Economic Backdrop for $10,000 Gold

Current global economic conditions provide fertile ground for gold’s continued appreciation

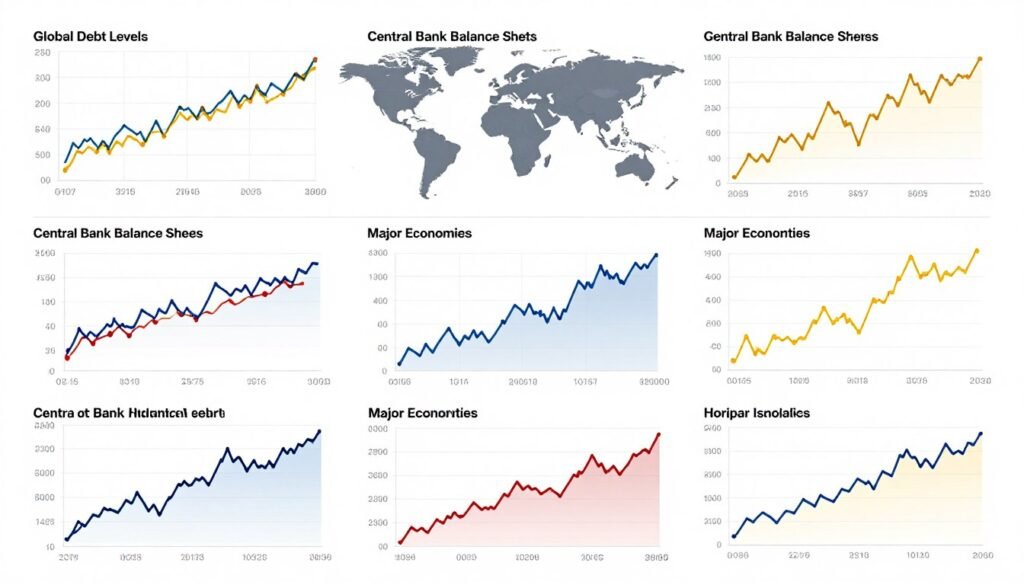

Record Global Debt Levels

According to the Institute of International Finance, global debt has reached unprecedented levels, exceeding 350% of global GDP. This debt burden creates structural fragility in the global financial system, as servicing costs rise with interest rates and growth remains constrained in many developed economies.

Historically, periods of excessive debt accumulation have ended in one of three ways: growth outpacing debt (rare), default (politically challenging), or currency devaluation (politically expedient). The third option—which effectively transfers wealth from savers to debtors through inflation—typically benefits gold as a store of value.

Central Bank Gold Buying

Central banks globally have shifted from net sellers to aggressive buyers of gold over the past decade. This trend accelerated in 2023-2025, with record purchases from emerging market central banks seeking to diversify reserves away from dollars and euros.

China, Russia, Turkey, and India have led this buying spree, with the People’s Bank of China adding gold to its reserves every month for over two years. According to World Gold Council data, central banks collectively added over 1,000 tonnes of gold to reserves in 2024 alone—the highest level since records began in 1950.

Geopolitical Fragmentation

The post-Cold War globalization consensus has given way to a more fragmented geopolitical landscape, with competing power centers and economic blocs. This fragmentation increases transaction costs in the global economy while raising the risk premium on cross-border investments.

Gold historically performs well during periods of geopolitical uncertainty, serving as a neutral reserve asset acceptable to all parties regardless of political alignment. The Bank for International Settlements has noted increasing settlement of international transactions in gold as an alternative to dollar-based systems in certain regions.

Historical Context: Comparing Today’s Gold Market to Past Bull Runs

Today’s gold bull market shares key similarities with previous rallies, but with important differences

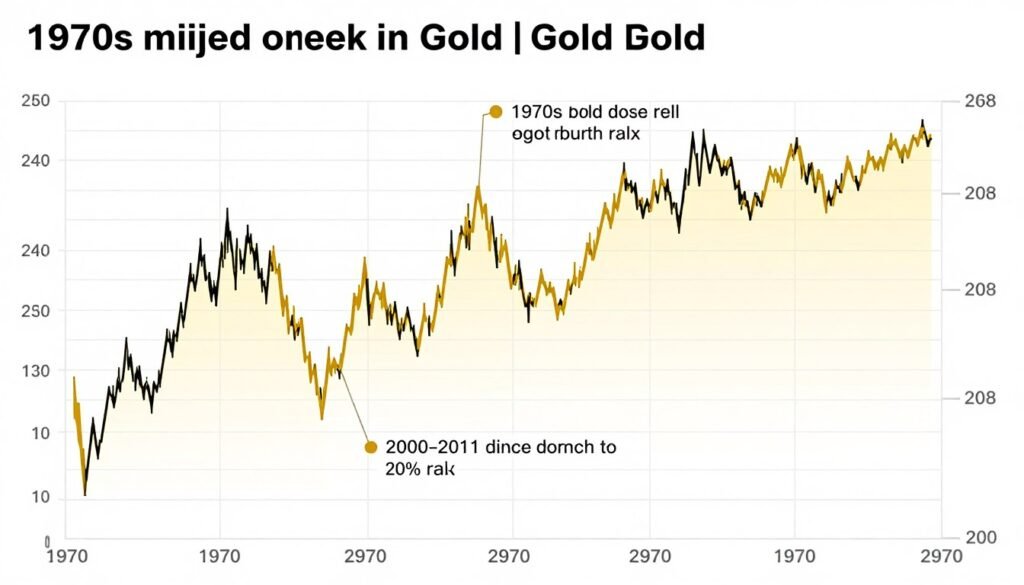

The 1970s: Inflation and Monetary System Change

The 1970s gold bull market saw prices rise from $35 to over $850—a 24-fold increase. This rally was triggered by the end of the Bretton Woods system in 1971 when President Nixon closed the gold window, ending dollar convertibility to gold for foreign governments.

Key similarities to today include:

- A major shift in the monetary system framework

- Rising inflation and negative real interest rates

- Geopolitical tensions and economic uncertainty

- Expanding government deficits and debt

The primary difference is that today’s starting point already reflects a fiat currency system, suggesting any comparable revaluation would represent a more fundamental reassessment of gold’s role in the global monetary order.

2000-2011: Financial Crisis and Quantitative Easing

The 2000-2011 bull market saw gold rise from around $250 to $1,900—a 7.6-fold increase. This rally was fueled by the dot-com bust, followed by the 2008 financial crisis and subsequent quantitative easing programs that expanded central bank balance sheets.

Parallels to the current environment include:

- Unprecedented central bank intervention in markets

- Concerns about currency debasement

- Low to negative real interest rates

- Growing distrust in financial institutions

The key difference today is the scale of central bank balance sheet expansion and government debt accumulation, which dwarfs the post-2008 period. Additionally, central banks have shifted from net sellers to aggressive buyers of gold—a fundamental change in market structure.

Current Bull Market: De-Dollarization and Systemic Reassessment

The current gold bull market, which began in earnest in 2019, has seen prices rise from around $1,200 to over $4,000—more than a 3-fold increase so far. Unlike previous rallies triggered by specific events, this move appears driven by structural shifts in the global monetary order.

Distinctive features of the current rally include:

- Coordinated central bank buying rather than selling

- Active de-dollarization policies by major economies

- Record global debt levels with limited deleveraging options

- Fragmentation of global trade and financial systems

- Technology enabling alternative settlement systems

Historical comparisons suggest that if the current rally follows patterns similar to previous bull markets, prices could indeed reach the $10,000 level—representing a roughly 8-fold increase from the starting point, less than the 1970s rally but comparable to the 2000-2011 move.

Conclusion: Pathways to $10,000 Gold

The path to $10,000 gold would likely involve fundamental changes to the global monetary system

The analysis of whether gold could reach $10,000 per ounce reveals several plausible pathways to this price target, though each carries significant implications for the global economy and financial system.

Most Likely Scenarios for $10,000 Gold

Monetary Reset Scenario

A formal or informal revaluation of gold’s role in the monetary system, potentially triggered by a sovereign debt crisis or loss of confidence in major currencies. This would likely involve central banks agreeing to a new framework that incorporates gold as a settlement asset or anchor for currency values.

Inflation Spiral Scenario

A period of sustained high inflation that erodes confidence in fiat currencies, driving investors and institutions toward gold as a store of value. This scenario would likely involve policy mistakes that allow inflation expectations to become unanchored, followed by a self-reinforcing cycle of currency avoidance.

Geopolitical Fragmentation Scenario

Accelerated breakdown of global trade and financial systems into competing blocs, with gold emerging as a neutral settlement asset acceptable to all parties. This scenario would involve the continued erosion of dollar hegemony without a clear replacement, creating a vacuum that gold naturally fills.

While the path to $10,000 gold faces significant obstacles—including potential central bank intervention, technological alternatives, and the market’s tendency toward equilibrium—the structural forces supporting higher gold prices appear firmly entrenched.

Central bank buying, de-dollarization initiatives, record debt levels, and geopolitical fragmentation create a backdrop where gold’s traditional roles as a store of value and neutral reserve asset become increasingly relevant. Whether these forces prove sufficient to drive gold to $10,000 remains uncertain, but the possibility can no longer be dismissed as mere speculation.

As investors and policymakers navigate this evolving landscape, understanding gold’s historical role during monetary transitions provides valuable context. While $10,000 gold would represent an extraordinary revaluation, history teaches us that monetary systems are not permanent—and that transitions between systems often involve significant repricing of fundamental assets.

The coming years will reveal whether gold’s current trajectory represents another cyclical bull market or something more profound: a structural reassessment of gold’s role in a changing global economic order.