Bonds, Interest Rates, and Trump’s Big Beautiful Bill: What Investors Should Expect in the 2030s

President Donald Trump’s “One Big Beautiful Bill Act” has made it through Congress, bringing sweeping changes to America’s fiscal landscape. For bond investors, this legislation raises critical questions about future interest rates, inflation risks, and investment strategies that will shape portfolios well into the 2030s. With the bill adding an estimated $3.4 trillion to the national debt according to Congressional Budget Office projections, bond markets face a new era of challenges and opportunities.

Wall Street never doubted that Republicans would renew the 2017 tax cuts, as failure would have risked economic contraction. However, the scale of additional tax breaks and spending cuts has created a complex outlook for fixed-income investors. This analysis examines how Trump’s signature legislation will reshape bond markets, interest rate trajectories, and investment strategies for the decade ahead.

The Deficit Effect: Bond Yields Under Pressure

The Congressional Budget Office’s analysis of the One Big Beautiful Bill Act (OBBBA) reveals significant deficit implications. Based on the current-law baseline, which assumed expiration of most 2017 tax cuts, the OBBBA includes $4.5 trillion in tax cuts and $1.1 trillion in spending cuts, raising deficits by a net $3.4 trillion over ten years.

The deficit impact is front-loaded, with increases of $443 billion in fiscal 2026, $538 billion in 2027, and $508 billion in 2028. The deficit increase then moderates to between $256 billion and $319 billion annually from 2030 onward. This pattern creates a challenging environment for bond markets, particularly in the near term.

Bond yields have already responded, with the 10-year Treasury yield rising to 4.34% following the bill’s passage. This upward pressure on yields reflects market concerns about increased Treasury issuance needed to finance larger deficits. For investors, this signals a potential end to the era of historically low interest rates that characterized much of the 2010s and early 2020s.

Key Tax Provisions Affecting Investors

The OBBBA makes permanent Trump’s 2017 tax cuts while adding new tax relief measures. Understanding these provisions is essential for bond investors assessing future economic conditions and market dynamics:

| Tax Provision | Details | 10-Year Cost | Bond Market Impact |

| Income Tax Rates | Makes permanent the 2017 cut in marginal income-tax rates | $2.2 trillion | Increased consumer spending, potential inflation pressure |

| Business Deduction | 20% deduction for pass-through businesses made permanent | $737 billion | Business investment boost, potential economic growth |

| Senior “Bonus” | $6,000 deduction for seniors (ages 65+) through 2028 | $93 billion | Increased retiree spending, potential pressure on Social Security trust funds |

| Child Tax Credit | Increased to $2,200 from $2,000, indexed for inflation | $817 billion | Modest consumer spending increase |

| Estate Tax | Limited exposure through higher exemptions | $212 billion | Wealth preservation, potential shift in investment patterns |

These tax provisions will likely stimulate economic activity in the near term, potentially putting upward pressure on inflation and interest rates. For bond investors, this suggests a challenging environment where real returns (nominal yields minus inflation) may remain compressed despite higher nominal yields.

Spending Cuts: Medicaid and Beyond

The OBBBA includes significant spending cuts that partially offset tax reductions. The largest cuts target Medicaid, with approximately $930 billion in reductions over ten years. These cuts come primarily through new work requirements for able-bodied adults, limitations on state provider taxes, and changes to reimbursement rates.

Additional spending reductions include approximately $186 billion from the Supplemental Nutrition Assistance Program (SNAP), $307 billion from student loan limitations, and roughly $550 billion from terminating green energy tax credits. These cuts represent a substantial shift in federal priorities that will affect economic growth patterns and potentially bond market dynamics.

For municipal bond investors, the Medicaid cuts raise particular concerns. States that expanded Medicaid under the Affordable Care Act may face increased fiscal pressure as federal support declines. This could affect state credit ratings and municipal bond yields, especially in states with already-strained budgets.

The Fed’s Response: Navigating Fiscal Expansion

The Federal Reserve faces a delicate balancing act in response to Trump’s fiscal expansion. With larger deficits potentially stimulating economic growth but also raising inflation risks, the Fed’s monetary policy decisions will be crucial for bond market outcomes in the 2030s.

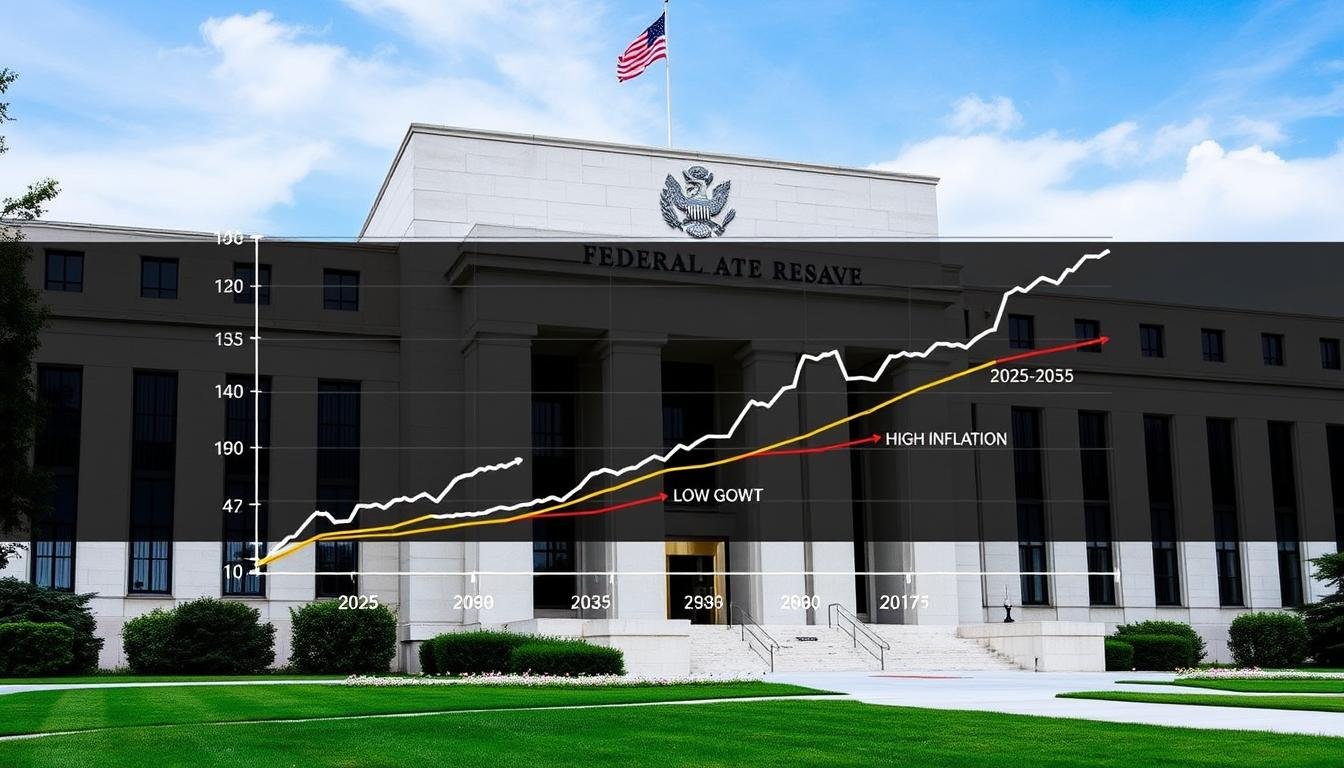

Federal Reserve building with interest rate projection scenarios (2025-2035)

Market observers anticipate several potential Fed responses to the fiscal expansion:

Higher Interest Rates

If inflation pressures build due to fiscal stimulus, the Fed may maintain higher interest rates for longer than previously anticipated. This would directly impact bond prices, particularly for longer-duration securities.

Balance Sheet Management

The Fed may adjust its balance sheet policies, potentially continuing quantitative tightening to offset some of the fiscal stimulus effects. This could further pressure bond prices across the yield curve.

The Fed’s independence will be tested as it navigates these challenges. Political pressure for accommodative policy could intensify if economic growth slows, creating potential volatility in bond markets. Investors should prepare for a range of scenarios, from continued tightening to a return to more accommodative policies if growth falters.

Municipal Bonds Under Pressure

The OBBBA’s changes to state and local tax (SALT) deductions and Medicaid funding will significantly impact municipal bond markets. The legislation temporarily increases the SALT deduction cap from $10,000 to $40,000 starting in 2025, with 1% annual increases through 2029, before reverting to $10,000 in 2030.

States with high tax burdens, including New York, New Jersey, California, Connecticut, and Massachusetts, will see the greatest impact from these changes. In 2022, the average SALT deduction in these states was close to $10,000, indicating that many taxpayers were already at the cap limit.

For municipal bond investors, these changes create both opportunities and risks:

Opportunities

- Temporary SALT cap increase may boost demand for municipal bonds in high-tax states through 2029

- Potential yield premiums for bonds from states facing Medicaid funding challenges

- Selective opportunities in essential service revenue bonds less affected by federal funding changes

Risks

- Potential credit downgrades for states heavily reliant on Medicaid funding

- Volatility when SALT cap reverts to $10,000 in 2030

- Increased state borrowing needs to offset federal funding reductions

Municipal bond investors should carefully evaluate state fiscal conditions and exposure to federal funding changes when constructing portfolios for the 2030s. Geographic diversification and focus on essential service revenue bonds may help mitigate these risks.

Corporate Bonds: Winners and Losers

The OBBBA creates a varied landscape for corporate bond investors, with certain sectors poised to benefit while others face headwinds. Understanding these sector-specific impacts is crucial for corporate bond allocation strategies in the 2030s.

| Sector | OBBBA Impact | Bond Outlook |

| Energy | Termination of green energy tax credits; favorable regulatory environment | Positive for traditional energy; negative for renewable-focused issuers |

| Healthcare | Medicaid funding cuts; potential pressure on providers | Mixed; hospital bonds face challenges while pharmaceutical and insurance sectors may benefit |

| Financial | Tax cuts boost consumer spending; potential regulatory easing | Generally positive; bank bonds may outperform |

| Manufacturing | Business tax incentives; overtime pay deduction | Positive, especially for domestic manufacturers |

| Technology | Mixed; business investment incentives but potential trade tensions | Neutral to slightly positive; company-specific factors will dominate |

Corporate bond investors should consider these sector-specific impacts when allocating portfolios. The combination of tax cuts, spending reductions, and regulatory changes creates a complex environment where careful credit analysis will be essential for identifying opportunities and avoiding pitfalls.

Inflation vs. Growth: The Bond Investor’s Dilemma

The OBBBA creates a fundamental tension for bond investors: will the fiscal stimulus primarily boost economic growth, or will it fuel inflation? This question will shape bond market returns throughout the 2030s.

The tax cuts in the OBBBA are likely to stimulate consumer spending and business investment, potentially boosting economic growth. However, this stimulus comes at a time when the economy is already operating near full capacity, raising inflation risks. The spending cuts partially offset these risks but may create their own economic headwinds in affected sectors.

For bond investors, this creates several potential scenarios:

Growth-Dominant Scenario

If the tax cuts primarily boost productivity and economic growth without significant inflation, longer-term bonds could perform well as real yields rise. Corporate bonds, particularly in sectors benefiting from the tax cuts, would likely outperform.

Inflation-Dominant Scenario

If the fiscal stimulus primarily fuels inflation, Treasury Inflation-Protected Securities (TIPS) would outperform nominal bonds. Short-duration strategies would help minimize price declines as yields rise to compensate for higher inflation.

Stagflation Risk

The worst-case scenario combines sluggish growth with persistent inflation. In this environment, most fixed-income assets would struggle, though floating-rate securities and very short-term instruments might provide some protection.

Given these uncertainties, bond investors should consider diversified strategies that can perform reasonably well across multiple scenarios. Laddered portfolios, barbell strategies, and allocations to both nominal and inflation-protected securities can help manage these complex risks.

Historical Comparison: Bush and Trump Tax Cuts

The OBBBA has notable parallels with previous major tax cuts, particularly those enacted under President George W. Bush in 2001 and 2003. Examining the bond market impact of these earlier tax cuts provides valuable context for investors.

The Bush tax cuts of 2001 and 2003 were followed by a period of relatively stable bond yields, despite concerns about deficit impacts. Several factors contributed to this outcome, including strong foreign demand for U.S. Treasuries, moderate inflation, and the Federal Reserve’s measured approach to monetary policy.

Trump’s 2017 tax cuts similarly did not trigger the bond market selloff that some analysts had feared. Yields did rise initially but remained contained as global economic uncertainties and the Federal Reserve’s eventual pivot to more accommodative policy supported bond prices.

However, the current environment differs from these historical episodes in several important ways:

These differences suggest that bond market reactions to the OBBBA may be less benign than in previous tax cut episodes. Investors should prepare for potentially greater volatility and higher risk premiums in fixed-income markets.

Frequently Asked Questions

How will the OBBBA affect my retirement bond portfolio?

Retirement bond portfolios may face challenges from potentially higher inflation and interest rates. Consider increasing allocation to TIPS, shortening duration, and adding high-quality corporate bonds in sectors likely to benefit from the tax cuts. Review your asset allocation to ensure it aligns with your risk tolerance and time horizon in this changing environment.

Should I avoid municipal bonds given the Medicaid funding cuts?

Rather than avoiding municipal bonds entirely, consider being more selective. Focus on essential service revenue bonds (water, sewer, electric) that are less dependent on federal funding. Diversify across states with varying exposure to Medicaid cuts. States with stronger fiscal positions and diverse revenue sources will likely weather the changes better than those already facing budget challenges.

Could the OBBBA trigger a 1970s-style stagflation?

While there are some parallels to the 1970s (fiscal stimulus, supply constraints), there are also important differences. Today’s economy has more flexible labor markets, greater productivity potential, and a Federal Reserve with stronger inflation-fighting credibility. A full return to 1970s-style stagflation seems unlikely, but investors should still prepare for periods of above-target inflation combined with moderate growth.

How will the SALT deduction changes affect municipal bond demand?

The temporary increase in the SALT deduction cap to ,000 may slightly reduce demand for municipal bonds in high-tax states through 2029, as the tax advantage becomes less critical for some investors. However, when the cap reverts to ,000 in 2030, we could see renewed demand. Investors should prepare for potential price volatility around these transition points, particularly for bonds from high-tax states.

What bond sectors might benefit from the OBBBA’s spending cuts?

Traditional energy companies may benefit from the elimination of green energy tax credits. Financial services firms could see improved profitability from higher interest rates and increased consumer spending. Defense contractors may benefit from military spending priorities. Corporate bonds in these sectors could offer attractive risk-adjusted returns if the companies maintain disciplined financial policies.

Investment Strategies for the 2030s

Based on our analysis of the OBBBA’s impact on bond markets, here are strategic considerations for fixed-income investors navigating the 2030s:

Duration Management

Consider shortening portfolio duration to reduce sensitivity to rising interest rates. Laddered portfolios can provide regular reinvestment opportunities at potentially higher yields. For those requiring longer-duration exposure, consider pairing with inflation hedges like TIPS.

Sector Allocation

Diversify across Treasury, agency, municipal, and corporate bonds. Within corporates, favor sectors benefiting from tax cuts and reduced regulations. Consider underweighting sectors facing headwinds from spending cuts, particularly healthcare providers dependent on Medicaid funding.

Credit Quality

Maintain a quality bias in corporate and municipal bonds, as fiscal stimulus may temporarily mask underlying credit weaknesses. Higher-quality bonds typically provide better downside protection if economic growth disappoints or inflation forces aggressive Fed tightening.

Investors should also consider international diversification, as U.S. fiscal expansion may create opportunities in markets with different policy trajectories. Emerging market bonds, particularly from countries with strong fiscal positions, may offer attractive yields and diversification benefits.

Conclusion: Navigating Uncertainty

Trump’s “One Big Beautiful Bill Act” creates a complex environment for bond investors extending into the 2030s. The combination of tax cuts, spending reductions, and regulatory changes will reshape economic growth patterns, inflation dynamics, and interest rate trajectories.

While historical comparisons with previous tax cuts provide some guidance, the current context of higher debt levels, recent inflation pressures, and evolving global dynamics suggests that bond markets may react differently this time. Investors should prepare for a range of scenarios and maintain flexible strategies that can adapt to changing conditions.

The coming decade will likely feature periods of both opportunity and challenge for bond investors. Those who understand the fundamental drivers of bond market performance and maintain disciplined, diversified approaches will be best positioned to navigate this uncertain landscape.