Education Funding Under the Big Beautiful Bill: Cuts or Innovation?

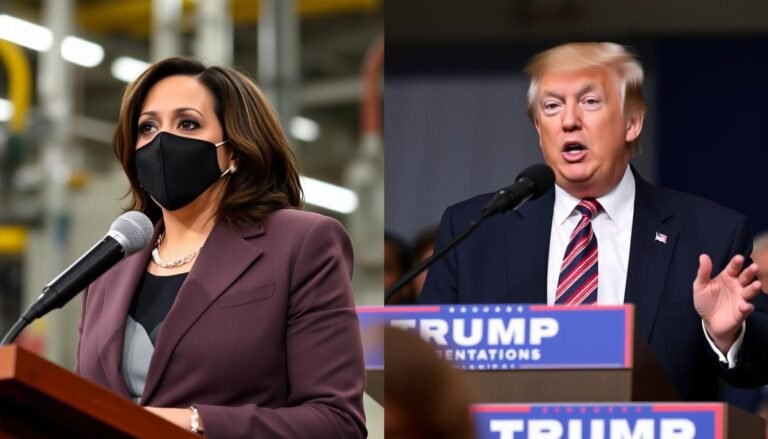

As President Trump’s “Big Beautiful Bill” moves from proposal to reality, educators, parents, and policymakers are grappling with its far-reaching implications for America’s education system. This sweeping legislation promises to fundamentally reshape how we fund and structure education in the United States, raising critical questions about priorities and outcomes.

Will these changes represent necessary innovation in an education system many view as outdated, or do they signal concerning cuts to vital programs that support our most vulnerable students? This analysis examines the bill’s key provisions affecting education funding, compares perspectives from across the political spectrum, and helps you understand what these changes might mean for students, schools, and communities nationwide.

Stay Informed on Education Policy Changes

Sign up for our weekly education policy newsletter to receive the latest updates on how the “Big Beautiful Bill” and other legislation affects schools and students across America.

Understanding the “Big Beautiful Bill”: Key Education Provisions

President Trump’s signature legislation, officially known as the Comprehensive Budget Reconciliation Act but commonly called the “Big Beautiful Bill,” contains several provisions that directly impact education funding and policy across the country. The nearly 900-page bill represents one of the most significant overhauls of federal education policy in decades.

Major Education Components of the Bill

Medicaid Funding Changes

The bill makes historic cuts to Medicaid, which serves as the fourth-largest source of federal funding for schools. These cuts could significantly impact school budgets nationwide, particularly affecting services for students with disabilities and mental health resources.

SNAP Eligibility Restrictions

Changes to the Supplemental Nutrition Assistance Program (SNAP) will affect automatic eligibility for free school meals, potentially reducing the number of students who receive nutritional support through school breakfast and lunch programs.

Private School Scholarship Tax Credits

The legislation creates a new nationwide voucher-like program offering tax credits of up to $1,700 for donations to organizations that award private school scholarships. States can opt out of this program, which may limit its reach.

Workforce Pell Grant Expansion

Starting in 2026-27, Pell Grants will become available for short-term workforce training programs lasting 8-15 weeks, expanding educational opportunities beyond traditional college pathways.

Student Loan Program Overhaul

The bill significantly restructures federal student loan programs, reducing repayment options to just two plans and eliminating certain deferment options for economic hardship.

Immigration Enforcement Funding

A $31 billion increase for immigration enforcement may indirectly impact schools with immigrant populations, potentially affecting attendance and school climate in certain communities.

Medicaid Cuts: Impact on School Budgets

One of the most significant aspects of the “Big Beautiful Bill” affecting education is the substantial reduction in Medicaid funding. Schools rely heavily on Medicaid dollars to provide essential health services to students, particularly those with disabilities.

How Schools Use Medicaid Funding

- Salaries for school nurses, psychologists, and speech therapists

- Specialized equipment for students with disabilities

- Mental health services and behavioral interventions

- Health screenings and preventive care

- Coordination with community health providers

According to a recent survey by the Healthy Schools Campaign, approximately 90% of school districts use Medicaid funding to pay for health staff salaries. The proposed cuts could force difficult decisions about staffing and services, particularly in rural communities where schools often serve as critical health care access points.

“Cutting Medicaid is equivalent to cutting school district budgets. School districts are very much aware of how important Medicaid dollars are to serve students with disabilities, address the youth mental crisis, and address students’ behavioral health needs.”

Rural Schools Face Disproportionate Impact

Rural school districts, where a higher percentage of students are enrolled in Medicaid, are expected to feel these cuts more acutely. In many rural communities, schools represent the most accessible point of contact with health care professionals for many families.

Understand Your School’s Medicaid Funding

Download our state-by-state analysis of how Medicaid cuts will affect school funding in your area, including potential impacts on special education services.

SNAP Changes and School Meal Programs

The “Big Beautiful Bill” makes significant changes to the Supplemental Nutrition Assistance Program (SNAP), which has direct implications for school meal programs nationwide. These changes could affect millions of children who currently receive free or reduced-price meals at school.

Key SNAP Changes Affecting Schools

| Policy Change | Current System | New System | Potential Impact |

| Work Requirements | Limited work requirements for parents | More parents of school-aged children required to work | Families may lose SNAP benefits, affecting automatic eligibility for school meals |

| Refugee Eligibility | Refugees and asylum seekers eligible | Eligibility scrapped for refugees and asylum seekers | Immigrant children may lose access to nutritional support |

| State Funding Requirements | Lower state contribution | Increased state funding requirement | Some states may reduce SNAP coverage, affecting school meal eligibility |

The School Meal Connection

When children are enrolled in SNAP, they automatically qualify for free breakfast and lunch at school through a process called direct certification. If families lose SNAP benefits, they may not realize they need to complete separate paperwork to maintain their children’s eligibility for free school meals.

“The cuts to SNAP that are currently proposed will increase hunger in homes and in classrooms. It’s really going to be this kind of double whammy for families.”

Additionally, when a high percentage of students qualify for free meals through SNAP, schools can implement community eligibility provisions that allow them to provide free meals to all students. Reduced SNAP enrollment could jeopardize this option in many districts.

Private School Choice: The New Tax-Credit Scholarship Program

A significant education innovation in the “Big Beautiful Bill” is the creation of a nationwide tax-credit scholarship program that functions similarly to school vouchers. This program represents a major victory for school choice advocates who have long pushed for federal support of private education options.

How the Tax-Credit Scholarship Works

Under this program, individuals can receive a dollar-for-dollar tax credit of up to $1,700 for donations made to qualifying nonprofit organizations that provide scholarships for K-12 students to attend private schools. This effectively allows taxpayers to redirect what would have been federal tax dollars to private school scholarships instead.

Key Detail: States can opt out of this program, and many Democrat-led states are expected to do so, potentially limiting its nationwide impact.

State Participation Projections

Likely to Participate

- Florida

- Texas

- Ohio

- Arizona

- Indiana

- Tennessee

- South Carolina

Likely to Opt Out

- California

- New York

- Illinois

- Washington

- Massachusetts

- Oregon

- Connecticut

Perspectives on School Choice Expansion

Supporters Say

- Provides educational options for families dissatisfied with public schools

- Creates competition that may improve all schools

- Allows parents more control over their children’s education

- May benefit students in underperforming districts

Critics Say

- Diverts funding from already struggling public schools

- May lack accountability measures required of public schools

- Could increase educational inequality

- Private schools can select students, unlike public schools

Workforce Pell Grants: Expanding Educational Pathways

One of the more widely supported provisions in the “Big Beautiful Bill” expands Pell Grant eligibility to short-term workforce training programs. Starting with the 2026-27 school year, students from low-income backgrounds who would typically qualify for Pell Grants for college can now use this aid for training programs lasting 8-15 weeks.

Qualifying Programs

To be eligible for the new Workforce Pell Grants, training programs must:

- Lead to a credential or academic credit toward a degree/certificate

- Prepare students for high-skill, high-wage, or in-demand jobs

- Align with the federal Perkins Career and Technical Education Act

- Be approved by governors and state school boards

This expansion represents a significant shift in federal education funding philosophy, acknowledging that traditional four-year college degrees aren’t the only valuable educational pathway.

“This bipartisan initiative recognizes that many good-paying jobs require specialized training but not necessarily a four-year degree. By expanding Pell Grant eligibility to quality short-term programs, we’re helping more Americans access the skills they need for today’s workforce.”

Initial Program Size

According to Congressional Budget Office projections, the Workforce Pell Grant program will start relatively small, with estimated funding of $17 million in the first year and $20 million in the second year. However, many education experts expect the program to grow significantly as awareness increases and more training providers develop qualifying programs.

Explore Workforce Training Opportunities

Want to learn more about how Workforce Pell Grants could help you or someone you know access career training? Sign up for our guide to qualifying programs and eligibility requirements.

Student Loan Overhaul: New Limits and Repayment Options

The “Big Beautiful Bill” makes sweeping changes to federal student loan programs that will affect millions of current and future borrowers. These changes represent some of the most significant restructuring of student loan policy in years.

New Borrowing Limits

| Student Category | Annual Limit | Lifetime Limit |

| Graduate Students | $20,500 | $100,000 |

| Medical/Law Students | $50,000 | $200,000 |

| Parent PLUS Loans | $20,000 per student | $65,000 |

| All Federal Loans Combined | Varies by program | $257,500 |

Simplified Repayment Plans

Starting in mid-2026, the current array of repayment options will be consolidated into just two choices:

Standard Repayment Plan

Fixed monthly payments over a period of 10-25 years, depending on the amount borrowed.

- Predictable monthly payments

- Faster payoff timeline

- Higher monthly payments

Repayment Assistance Plan (RAP)

Income-based payments with potential forgiveness after 30 years of payments (up from 20-25 years under current plans).

- Payments based on income

- Longer payoff timeline

- Potential forgiveness after 30 years

Elimination of Hardship Protections

The bill eliminates unemployment deferment and economic hardship deferment options, which currently allow borrowers to temporarily pause payments during financial difficulties. This change has raised concerns among student advocacy groups about how borrowers will manage during periods of economic stress.

“This reconciliation bill will be catastrophic for millions of Americans by restricting access to higher education and exacerbating the student debt crisis for both federal and private student loans. While it is difficult to imagine how much worse the student debt crisis can become, this reconciliation bill does exactly that.”

Immigration Enforcement Funding and School Communities

The “Big Beautiful Bill” includes $31 billion in additional funding for U.S. Immigration and Customs Enforcement (ICE) to hire more agents and cover deportation costs. While not directly an education policy, this increased immigration enforcement is expected to have significant indirect effects on many school communities.

Potential Impacts on Schools

- Increased student absences due to fear of immigration enforcement

- Additional resources needed for student emotional support

- New transportation and safety measures to reassure families

- Staff time dedicated to advocacy for detained students or parents

- Changes in school climate and community trust

Recent research from Stanford University found that immigration raids carried out earlier this year in California’s Central Valley significantly increased daily absences from school, especially among younger children. Schools in communities with large immigrant populations are already preparing for potential impacts.

Legal Reminder: All children, regardless of immigration status, have a constitutional right to public education in the United States under the Supreme Court’s ruling in Plyler v. Doe (1982).

Child Tax Credit Changes and Education Implications

The “Big Beautiful Bill” increases the Child Tax Credit from $2,000 to $2,200 per child starting in 2025, with inflation adjustments in subsequent years. However, education advocates note that the bill does not expand eligibility to reach more low-income families who don’t earn enough to claim the full credit.

Limited Benefit for Low-Income Families

According to analysis from the Center on Poverty and Social Policy at Columbia University, approximately 19 million children are in families who would receive only some, or none, of the revised tax credit because their income is too low. This represents an increase from 17 million children under the current system.

During the pandemic, the federal government temporarily expanded the Child Tax Credit to $3,000 per child ($3,600 for younger children) and made it fully available to low-income families. Research showed this expansion helped families afford school supplies and other educational necessities, but these pandemic-era enhancements were not included in the new legislation.

“It’s a huge pendulum swing. The child tax credit doesn’t really do anything extra for families.”

Educational Impact

The limited expansion of the Child Tax Credit has educational implications, as research consistently shows that reducing child poverty improves educational outcomes. When families have more financial resources, children tend to have better attendance, higher test scores, and improved graduation rates.

Trump Accounts: New Child Savings Program

A novel feature of the “Big Beautiful Bill” is the creation of “Trump Accounts,” a new savings program for children born between 2025 and 2028. These accounts represent an innovative approach to encouraging long-term educational savings.

How Trump Accounts Work

- One-time $1,000 federal deposit for each U.S. citizen child born 2025-2028

- Parents can contribute up to $5,000 annually

- Employers can contribute up to $2,500 (not counted as taxable income)

- Funds invested in diversified U.S. stock index funds

- Earnings grow tax-deferred

- Qualified withdrawals taxed as long-term capital gains

While the accounts aren’t specifically designated for education expenses, they could provide a valuable savings vehicle for future educational needs. However, some financial experts suggest that existing 529 college savings plans may offer better tax advantages for families specifically saving for education.

| Feature | Trump Accounts | 529 College Savings Plans |

| Initial Government Funding | $1,000 one-time deposit | None |

| Annual Contribution Limit | $5,000 | $17,000+ (varies by state) |

| Tax Treatment of Withdrawals | Long-term capital gains tax | Tax-free for qualified education expenses |

| Qualified Expenses | Flexible | Education-specific |

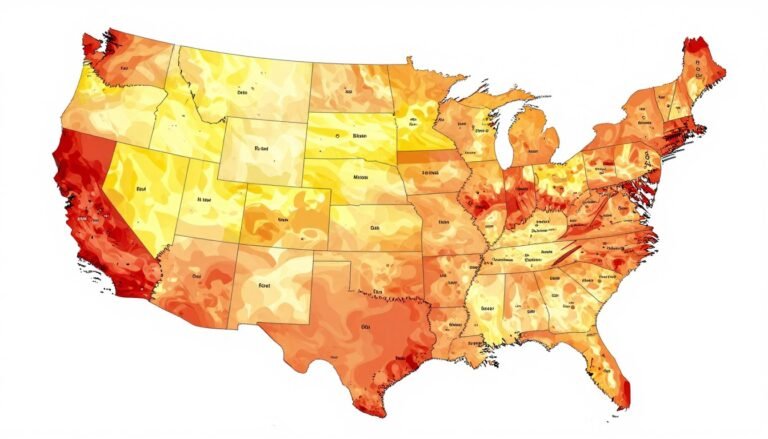

State-by-State Impact of Education Funding Changes

The education funding provisions in the “Big Beautiful Bill” will affect states differently based on their current funding models, political leadership, and demographic makeup. Here’s how some key states may experience these changes:

Texas

Likely Participant in School Choice Program

- Expected to opt into the tax-credit scholarship program

- 25% of students on Medicaid – significant budget impact from cuts

- Rural districts particularly vulnerable to health service reductions

- Large immigrant population affected by enforcement funding

California

Expected to Opt Out of School Choice

- Likely to reject the tax-credit scholarship program

- State may need to increase education funding to offset Medicaid cuts

- Significant immigrant student population affected by enforcement

- May create state-level protections for school meal programs

Pennsylvania

Swing State with Mixed Impact

- Political divisions may complicate school choice implementation

- Rural and urban districts affected differently by Medicaid cuts

- Workforce Pell Grants could benefit industrial training programs

- Existing state education funding challenges compounded

States with strong existing school choice programs like Florida and Arizona are expected to quickly implement the new tax-credit scholarship program, while states with strong teachers’ unions and Democratic leadership like New York and Illinois will likely opt out.

Find Your State’s Education Funding Outlook

Enter your state to receive a detailed analysis of how the “Big Beautiful Bill” will affect education funding, school choice options, and student services in your area.

Expert Perspectives on Education Funding Changes

Education policy experts and stakeholders have offered varied perspectives on the education funding provisions in the “Big Beautiful Bill.” These viewpoints help illustrate the complex trade-offs and potential consequences of these policy changes.

“This legislation represents a historic opportunity to empower parents with more educational choices while reducing wasteful federal bureaucracy. By creating tax-credit scholarships and focusing resources on workforce development, we’re preparing the next generation for success in ways that traditional education funding has failed to do.”

“When you take it all together it’s kind of like an assault on children and families policy-wise. We’re going to see that the effects reverberate well beyond what we’re even understanding right now, and schools are going to be on the front lines.”

Education Economists Weigh In

Education economists point to several potential long-term consequences of the funding changes:

- Increased educational inequality between wealthy and poor districts

- Potential acceleration of private school enrollment in participating states

- Reduced resources for special education services in public schools

- Greater emphasis on workforce training over traditional higher education

- More financial burden shifted to states and local communities

“The bill represents a fundamental shift in how we conceptualize federal support for education. We’re moving from a model focused on equity and access toward one that prioritizes choice and workforce alignment. The question is whether this shift will leave behind the students who have historically relied most on federal support.”

Education Funding Under the Big Beautiful Bill: Pros and Cons

Potential Benefits

- Expanded educational choice through tax-credit scholarships

- New pathways to career training through Workforce Pell Grants

- Simplified student loan repayment system

- New savings opportunities through Trump Accounts

- Potential for increased educational innovation through competition

- Greater state and local control over education priorities

Potential Drawbacks

- Reduced health services in schools due to Medicaid cuts

- Fewer students eligible for free school meals

- Limited hardship options for student loan borrowers

- Potential diversion of funds from public to private schools

- Increased burden on state education budgets

- Disruption to school communities affected by immigration enforcement

Who Stands to Gain or Lose?

| Stakeholder Group | Potential Gains | Potential Losses |

| Private Schools | Increased enrollment through scholarship program | Minimal |

| Public Schools | Potential competition incentives | Reduced funding, student enrollment |

| Low-Income Students | Possible scholarship access | Reduced health and nutrition services |

| Students with Disabilities | Minimal | Reduced services due to Medicaid cuts |

| Trade/Vocational Students | New Workforce Pell Grant access | Minimal |

| Graduate Students | Simplified loan repayment | Reduced borrowing capacity |

Historical Context: Education Funding Through Presidential Administrations

To understand the significance of the education funding changes in the “Big Beautiful Bill,” it’s helpful to place them in historical context. Each presidential administration has approached education funding with different priorities and philosophies.

| Administration | Major Education Initiatives | Funding Approach | Legacy |

| Reagan (1981-1989) | A Nation at Risk report; reduced federal role | Significant cuts to federal education programs | Shifted education responsibility to states |

| Bush (2001-2009) | No Child Left Behind Act | Increased funding tied to testing and accountability | Standardized testing emphasis; mixed results |

| Obama (2009-2017) | Race to the Top; college affordability | Competitive grants; expanded income-based repayment | Common Core standards; expanded loan forgiveness |

| Trump 1.0 (2017-2021) | School choice advocacy; deregulation | Proposed cuts; emphasis on private alternatives | Limited legislative impact; regulatory changes |

| Biden (2021-2025) | American Rescue Plan; SAVE repayment plan | Pandemic recovery funding; student debt relief | Expanded school resources; loan forgiveness attempts |

| Trump 2.0 (2025-) | “Big Beautiful Bill”; school choice expansion | Safety net cuts; tax credits for private options | To be determined |

The “Big Beautiful Bill” represents a significant departure from the Biden administration’s approach to education funding, which emphasized public school resources and student debt relief. It more closely aligns with traditional Republican priorities of school choice, reduced federal involvement, and market-based solutions.

Frequently Asked Questions About Education Funding Changes

How will the “Big Beautiful Bill” affect my child’s public school?

The impact will vary by location, but many public schools may face budget challenges due to Medicaid funding cuts and potential enrollment decreases if students use tax-credit scholarships for private education. Schools with high percentages of students receiving free meals through SNAP may also see changes to their nutrition programs. Contact your local school district for specific information about potential impacts in your area.

Will my student loans be affected by these changes?

If you’re a current federal student loan borrower, you’ll need to transition to one of two repayment plans between July 2026 and July 2028: either the standard repayment plan or the new Repayment Assistance Plan (RAP). Payments made under your current plan will still count toward forgiveness timelines. However, new hardship protections will be more limited, as unemployment and economic hardship deferments are being eliminated.

How do I access the new tax-credit scholarship program for private school?

First, check whether your state has opted into the program, as many states may choose not to participate. If your state does participate, you’ll need to apply through a qualifying scholarship-granting organization in your state. These organizations will receive donations from taxpayers claiming the tax credit and will distribute scholarships based on their own criteria, within federal guidelines. Your state’s department of education should provide information about participating organizations once the program is implemented.

Will my child still qualify for free school meals?

If your family currently receives SNAP benefits that automatically qualify your child for free school meals, you should check whether the new SNAP requirements affect your eligibility. If your family loses SNAP benefits, you may need to complete a separate application for free or reduced-price school meals. Contact your school’s nutrition services department for assistance with this process.

How can I set up a “Trump Account” for my child?

Trump Accounts will only be available for children born between 2025 and 2028. If your child is born during this period, the federal government will automatically deposit

Frequently Asked Questions About Education Funding Changes

How will the “Big Beautiful Bill” affect my child’s public school?

The impact will vary by location, but many public schools may face budget challenges due to Medicaid funding cuts and potential enrollment decreases if students use tax-credit scholarships for private education. Schools with high percentages of students receiving free meals through SNAP may also see changes to their nutrition programs. Contact your local school district for specific information about potential impacts in your area.

Will my student loans be affected by these changes?

If you’re a current federal student loan borrower, you’ll need to transition to one of two repayment plans between July 2026 and July 2028: either the standard repayment plan or the new Repayment Assistance Plan (RAP). Payments made under your current plan will still count toward forgiveness timelines. However, new hardship protections will be more limited, as unemployment and economic hardship deferments are being eliminated.

How do I access the new tax-credit scholarship program for private school?

First, check whether your state has opted into the program, as many states may choose not to participate. If your state does participate, you’ll need to apply through a qualifying scholarship-granting organization in your state. These organizations will receive donations from taxpayers claiming the tax credit and will distribute scholarships based on their own criteria, within federal guidelines. Your state’s department of education should provide information about participating organizations once the program is implemented.

Will my child still qualify for free school meals?

If your family currently receives SNAP benefits that automatically qualify your child for free school meals, you should check whether the new SNAP requirements affect your eligibility. If your family loses SNAP benefits, you may need to complete a separate application for free or reduced-price school meals. Contact your school’s nutrition services department for assistance with this process.

How can I set up a “Trump Account” for my child?

Trump Accounts will only be available for children born between 2025 and 2028. If your child is born during this period, the federal government will automatically deposit $1,000 into an account. The Treasury Department will provide specific guidance on how parents can access and manage these accounts, including making additional contributions of up to $5,000 annually. This program is still being developed, so complete details aren’t yet available.

,000 into an account. The Treasury Department will provide specific guidance on how parents can access and manage these accounts, including making additional contributions of up to ,000 annually. This program is still being developed, so complete details aren’t yet available.

Conclusion: Cuts or Innovation?

The education funding provisions in the “Big Beautiful Bill” represent both significant cuts to traditional funding streams and innovative approaches to educational access and choice. Whether these changes ultimately benefit or harm American education depends largely on one’s educational priorities and values.

For those who prioritize school choice, workforce preparation, and reduced federal involvement in education, the bill offers promising innovations. The tax-credit scholarship program, Workforce Pell Grants, and simplified student loan system align with market-based approaches to education reform.

For those concerned with educational equity, student well-being, and robust public school systems, the cuts to Medicaid funding, changes to nutrition program eligibility, and potential diversion of resources from public to private education raise serious concerns.

What’s clear is that the “Big Beautiful Bill” represents a fundamental shift in federal education policy that will reshape American education for years to come. As implementation begins, educators, families, and policymakers will need to adapt to these new realities while working to ensure that all students have access to quality educational opportunities.

Stay Informed on Education Policy

Education policy continues to evolve. Sign up for our newsletter to receive regular updates on how the “Big Beautiful Bill” implementation affects schools and students nationwide.