Global Economic Recession: Analyzing Risks, Causes, and Preparedness Strategies

Economic uncertainty has become a persistent theme in global discussions, with terms like “recession,” “inflation,” and “economic downturn” frequently appearing in headlines. As central banks adjust policy rates and growth forecasts fluctuate, many wonder if we’re heading toward a global economic recession. This comprehensive analysis examines current economic indicators, underlying causes of instability, and practical strategies for navigating potential economic challenges ahead.

Is the Global Economy Truly Crumbling?

Despite widespread concerns, the global economy shows mixed signals rather than uniform decline. According to the International Monetary Fund’s latest World Economic Outlook, global growth has demonstrated resilience in 2023, with inflation rates falling faster than anticipated. However, this doesn’t mean all is well.

Global GDP growth projections show slowing but not collapsing economic activity

The World Bank notes that while the risk of a global recession has receded in 2024, we’re still facing what they describe as a “sluggish” outlook. Global trade growth is projected at 3.3% in 2024, well below its historical average of 4.9%. This indicates a struggling but not collapsing global economy.

Key Economic Indicators to Watch

Positive Indicators

- U.S. labor markets remain relatively strong

- Inflation has been moderating in many economies

- Consumer spending has shown resilience in some regions

- Corporate earnings have remained stable in key sectors

Concerning Indicators

- Two G7 economies (Japan and UK) entered recession in late 2023

- Consumer confidence remains low in many countries

- Manufacturing activity has contracted in several major economies

- Rising government debt levels across developed nations

J.P. Morgan Research has reduced the probability of a U.S. and global recession occurring in 2025 from 60% to 40%, suggesting that while risks remain significant, they’ve diminished somewhat. However, as Joseph Lupton, global economist at J.P. Morgan notes, “We still see considerable downside risk, with a 40% probability of a U.S. and global recession.”

Primary Reasons Behind Current Economic Instability

The current economic landscape has been shaped by a perfect storm of factors that continue to create uncertainty and volatility in global markets. Understanding these underlying causes helps contextualize the risks of a potential global economic recession.

Multiple interconnected factors contributing to global economic instability

Pandemic Aftermath

The COVID-19 pandemic created unprecedented economic disruption. According to World Bank estimates, the pandemic caused the largest global recession since World War II. While many economies have rebounded from initial lockdowns, lingering effects persist in labor markets, supply chains, and public finances.

Geopolitical Tensions

Ongoing conflicts have significant economic implications. The Russia-Ukraine war has disrupted energy markets and agricultural exports, while tensions in the Middle East threaten oil supplies. Trade disputes between major economies, particularly U.S.-China relations, continue to create uncertainty for global commerce and investment.

Supply Chain Disruptions

Global supply chains remain vulnerable after pandemic-related disruptions. While some bottlenecks have eased, new challenges have emerged. The World Trade Organization reports that shipping costs remain elevated and delivery times extended compared to pre-pandemic norms.

Monetary Policy Shifts

Central banks worldwide have aggressively raised interest rates to combat inflation. The Federal Reserve, European Central Bank, and Bank of England have all implemented significant rate hikes. While necessary to control inflation, these higher rates increase borrowing costs for businesses and consumers, potentially slowing economic activity.

| Factor | Impact on Global Economy | Current Status |

| Inflation Pressures | Reduced purchasing power, increased production costs | Moderating but still above target in many economies |

| Energy Crisis | Higher production costs, reduced consumer spending | Prices stabilized but remain elevated compared to historical norms |

| Debt Levels | Reduced fiscal flexibility, increased vulnerability | Rising in both developed and emerging economies |

| Housing Market Slowdown | Reduced construction activity, wealth effect on consumers | Cooling in many markets due to higher interest rates |

Is a Global Economic Recession Imminent?

While economic growth has slowed, the evidence doesn’t conclusively point to an imminent global economic recession. Instead, we’re seeing a mixed picture with significant regional variations and conflicting signals.

Recession probability forecasts vary significantly across major economies

Expert Forecasts

According to the World Economic Forum’s Chief Economists Outlook, just over half of surveyed economists (56%) expect the global economy to weaken in 2024, while 43% foresee unchanged or stronger conditions. This division highlights the uncertainty in current forecasts.

The International Monetary Fund projects global growth at 3.1% for 2024, below the historical average but not indicating a recession. However, they caution that risks remain tilted to the downside due to potential escalation of existing conflicts, persistent inflation, or financial market stress.

Warning Signs to Monitor

Several indicators merit close attention as potential harbingers of recession:

Leading Indicators

- Inverted Yield Curves: The U.S. Treasury yield curve has been inverted, historically a reliable recession predictor

- Purchasing Managers’ Indices: Manufacturing PMIs have contracted in several major economies

- Consumer Confidence: Remains below historical averages in many regions

Lagging Indicators

- Unemployment Rates: Still low in many economies but beginning to rise in some regions

- Corporate Defaults: Showing modest increases but not yet at alarming levels

- Credit Conditions: Banks tightening lending standards across major economies

The National Bureau of Economic Research defines a recession as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators.” By this definition, we’re not currently in a global recession, though certain countries have entered recession individually.

“We no longer see a U.S. recession, but expect material headwinds to keep growth weak through the rest of this year.”

How Can Nations, Businesses, and Individuals Tackle This Situation?

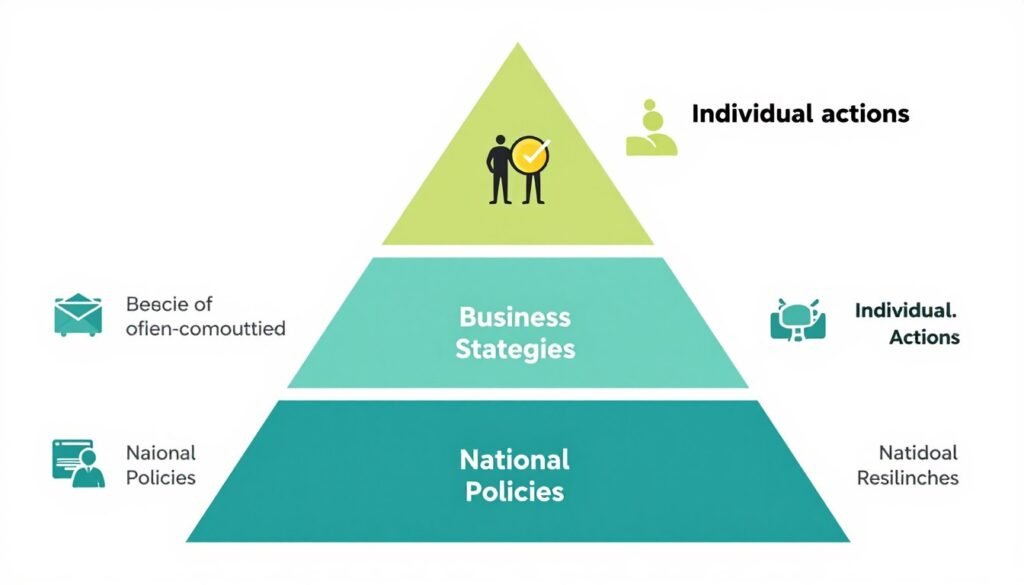

Economic uncertainty requires proactive strategies at all levels. Here’s how different stakeholders can build resilience against potential recession impacts:

Multi-level approach to economic resilience during uncertain times

For National Economies

Governments and central banks have several tools to mitigate recession risks and impacts:

- Fiscal Policy Flexibility: Targeted spending programs can support vulnerable sectors and populations while avoiding excessive debt accumulation

- Infrastructure Investment: Public works projects can stimulate growth while addressing long-term needs

- Supply-Side Reforms: Reducing regulatory barriers can enhance productivity and economic resilience

- Trade Diversification: Reducing dependence on single markets or suppliers improves economic security

According to IMF recommendations, fiscal policy should remain agile, ready to provide targeted support if growth deteriorates sharply while avoiding measures that might fuel inflation.

For Businesses

Companies can implement several strategies to weather economic uncertainty:

- Balance Sheet Strengthening: Reducing debt and increasing liquidity provides cushion against downturns

- Operational Efficiency: Streamlining processes and reducing waste improves profitability

- Diversification: Expanding into multiple markets or product lines reduces vulnerability

- Scenario Planning: Developing contingency plans for various economic outcomes improves adaptability

- Digital Transformation: Investing in technology can improve efficiency and create new revenue streams

For Individuals

Personal financial resilience becomes crucial during economic uncertainty:

- Emergency Fund: Maintaining 3-6 months of expenses in accessible savings

- Debt Management: Reducing high-interest debt improves financial flexibility

- Skill Development: Enhancing marketable skills improves employment security

- Diversified Investments: Spreading investments across asset classes can reduce risk

- Reduced Discretionary Spending: Creating budget flexibility by identifying non-essential expenses

The Consumer Financial Protection Bureau offers resources to help individuals prepare financially for economic downturns, emphasizing the importance of building savings and managing debt strategically.

Is the USA Ready for a Potential Downturn?

As the world’s largest economy, the United States’ preparedness for recession has global implications. The U.S. presents a mixed picture of strengths and vulnerabilities.

Dashboard of key US economic indicators showing mixed signals

Strengths in the U.S. Economy

- Labor Market Resilience: Unemployment remains low at around 3.7%, according to the Bureau of Labor Statistics

- Consumer Spending: Retail sales have shown resilience despite inflation pressures

- Banking System: Major banks maintain stronger capital positions than before the 2008 crisis

- Energy Independence: Reduced vulnerability to global energy shocks compared to previous decades

Vulnerabilities in the U.S. Economy

- High Government Debt: Federal debt exceeds 120% of GDP, limiting fiscal flexibility

- Inflation Persistence: While moderating, inflation remains above the Federal Reserve’s 2% target

- Housing Affordability: High mortgage rates and home prices strain household finances

- Income Inequality: Widening wealth gaps may amplify recession impacts on vulnerable populations

- Political Polarization: May complicate implementation of economic policies

The Federal Reserve has maintained higher interest rates to combat inflation, which Michael Feroli, chief U.S. economist at J.P. Morgan, suggests will continue: “After December, we see a further three sequential cuts, taking the funds rate target range to 3.25–3.5% by the second quarter of 2026.”

This measured approach to monetary policy reflects the Fed’s dual mandate of price stability and maximum employment, but raises questions about whether they can achieve a “soft landing” – reducing inflation without triggering recession.

“Our updated labor market outlook is less demanding of immediate action to stem employment risks. For the Fed, we are pushing back the timing of the resumption of rate cuts from September to December.”

What Will Happen on the Global Stage?

The international economic landscape is likely to evolve in complex ways as countries navigate potential recession risks. Several key themes will shape global economic dynamics in the coming years.

Projected economic growth varies significantly across global regions

Divergent Regional Trajectories

Economic performance will likely vary significantly by region:

- North America: The U.S. is expected to maintain modest growth, though below historical averages

- Europe: Facing greater recession risks due to energy challenges and proximity to geopolitical conflicts

- Asia-Pacific: China’s slowdown affects regional growth, though India continues to expand rapidly

- Latin America: Commodity exporters may benefit from high prices, but face inflation challenges

- Africa: Diverse outcomes with some countries showing resilience while others struggle with debt

According to the World Bank’s Global Economic Prospects, emerging market and developing economies face particular challenges from tighter financial conditions and reduced fiscal space.

Trade and Globalization Shifts

Global trade patterns are evolving in response to recent disruptions:

- Supply Chain Regionalization: Companies prioritizing resilience over efficiency by moving production closer to end markets

- Trade Blocs: Increasing economic alignment along geopolitical lines

- Digital Trade: Continued growth in cross-border digital services despite physical trade tensions

- Resource Nationalism: Countries increasingly protecting critical resources and industries

Financial Market Implications

Investment landscapes will continue to evolve with economic conditions:

- Market Volatility: Expect continued fluctuations as economic data and policy decisions unfold

- Sector Rotation: Defensive sectors typically outperform during slowdowns

- Currency Movements: Dollar strength often accompanies global uncertainty

- Alternative Investments: Growing interest in assets with inflation protection and recession resistance

The Bank for International Settlements warns that financial vulnerabilities have built up during years of low interest rates, creating potential fragilities that could amplify economic shocks.

Navigating the Uncertain Economic Landscape

While a global economic recession isn’t inevitable, significant challenges lie ahead. The global economy faces its “weakest half-decade performance in 30 years,” according to the World Bank, suggesting a period of subdued growth rather than catastrophic decline.

The most likely scenario appears to be continued economic fragmentation, with some regions and sectors struggling while others demonstrate resilience. This uneven landscape will require nuanced strategies from policymakers, business leaders, and individuals.

As Joseph Lupton of J.P. Morgan notes, “On balance, we still see considerable downside risk, with a 40% probability of a U.S. and global recession.” This assessment captures the current economic reality: recession is a significant risk but not a certainty.

By understanding the complex factors driving economic uncertainty, monitoring key indicators, and implementing appropriate resilience strategies, stakeholders at all levels can better navigate whatever economic conditions emerge. The most successful approach will combine prudent preparation for downside risks with the flexibility to capitalize on opportunities that inevitably arise even in challenging times.