Gold and Silver Price Surge: Causes, Global Impact, and Investment Considerations

The precious metals market is experiencing a historic moment as gold and silver prices reach unprecedented heights. Gold has broken through the $5,000 per ounce barrier while silver has surged past $100 per ounce, marking extraordinary gains that have caught the attention of investors, policymakers, and everyday consumers worldwide. This remarkable rally isn’t merely a short-term fluctuation but reflects profound shifts in the global economic landscape, monetary policy, and geopolitical realities.

This comprehensive analysis explores the primary drivers behind the current gold and silver price surge, examines potential benefits for the United States, considers the implications of a possible power shift based on precious metals holdings, analyzes impacts on daily life, and provides balanced insights on whether now is the time to buy or hold these assets.

Primary Reasons Behind the Gold and Silver Price Surge

Gold and silver prices have reached historic highs, with gold breaking $5,000 and silver exceeding $100 per ounce

The current precious metals rally is driven by multiple converging factors creating a perfect storm for price appreciation. Understanding these elements is crucial for anyone considering precious metals as an investment or trying to make sense of broader economic trends.

Unprecedented Central Bank Buying

Central banks worldwide have transformed from net sellers to aggressive buyers of gold, fundamentally altering market dynamics. According to the World Gold Council’s latest data, central banks purchased over 1,000 tonnes of gold annually in recent years—the highest levels since 1967.

Countries including China, Russia, Turkey, and India have significantly expanded their gold reserves as they diversify away from dollar-denominated assets. The People’s Bank of China alone has increased its gold holdings for 18 consecutive months, signaling growing concerns about fiat currency stability and the long-term structure of the global monetary system.

Monetary Policy and Inflation Concerns

The Federal Reserve’s approach to interest rates has created an environment where real yields (interest rates adjusted for inflation) remain compressed. When real yields are low or negative, gold becomes more attractive as the opportunity cost of holding a non-yielding asset diminishes.

Markets are currently pricing in expectations of up to 150 basis points of Federal Reserve rate cuts through the year, further supporting precious metals prices. This monetary policy stance, combined with persistent inflation concerns despite official moderation, has investors seeking tangible stores of value.

Federal Reserve monetary policy decisions have significantly influenced precious metals performance

Geopolitical Tensions and Economic Uncertainty

Escalating geopolitical conflicts have historically driven investors toward safe-haven assets. Current tensions in the Middle East, ongoing Russia-Ukraine conflict, and growing U.S.-China strategic competition have all contributed to market uncertainty.

These geopolitical factors are compounded by concerns about global economic stability. According to International Monetary Fund projections, global growth remains uneven and vulnerable to shocks, creating an environment where risk hedging becomes increasingly important.

Industrial Demand Driving Silver’s Outperformance

While gold has performed impressively, silver has delivered even stronger gains, with prices more than tripling from their 2023 levels. This outperformance reflects silver’s dual role as both a precious metal and an industrial commodity.

The green energy transition has dramatically increased industrial silver demand. Solar panels require approximately 20 grams of silver each, while electric vehicles use 25-50 grams per vehicle. The Silver Institute projects industrial consumption will reach approximately 700 million ounces annually, creating significant supply pressure.

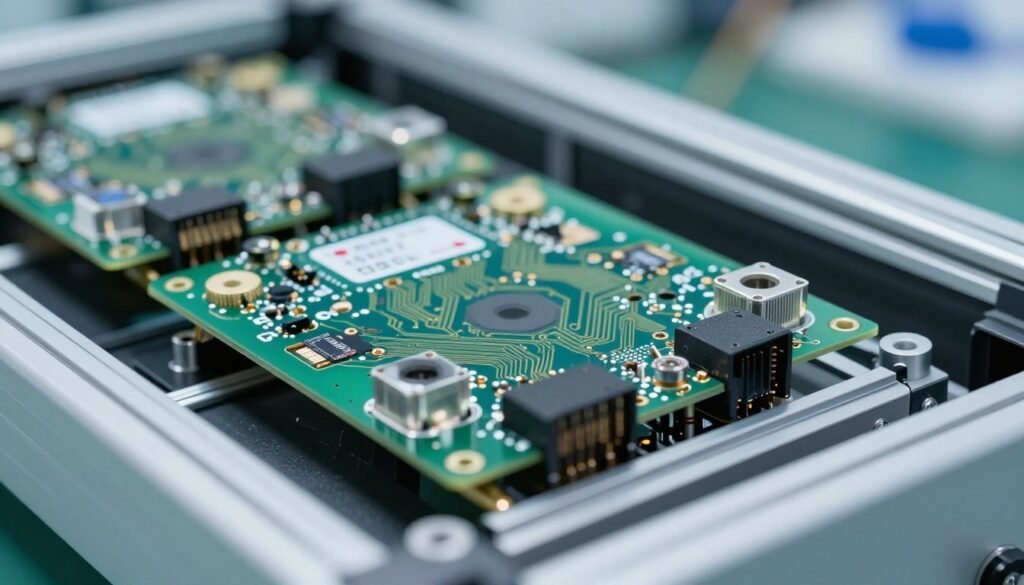

Additionally, artificial intelligence infrastructure development requires substantial amounts of silver for high-performance electronics and data centers, further straining available supply. This industrial demand creates a fundamental difference between gold and silver market dynamics.

Physical Supply Constraints

Unlike purely paper assets, physical precious metals face real-world supply limitations. Nearly 70% of global silver production comes as a byproduct of mining other metals, limiting producers’ ability to quickly increase output in response to higher prices.

These supply constraints have led to visible inventory drawdowns in major vaults and exchanges. The COMEX registered silver inventories have reached multi-year lows, while London Bullion Market Association (LBMA) stocks have also declined significantly.

Silver’s limited mining output struggles to meet growing industrial demand from green energy and technology sectors

Dollar Weakness and Currency Concerns

The U.S. dollar’s relative performance against major currencies has significant implications for precious metals prices. Recent dollar weakness has supported gold and silver, as they become less expensive for holders of other currencies.

More fundamentally, growing concerns about the long-term stability of fiat currencies given unprecedented debt levels have increased interest in hard assets. U.S. federal debt now exceeds $34 trillion—more than 120% of GDP—while global debt levels have reached historic highs across developed and emerging economies.

How the United States Could Benefit from the Price Surge

While rising precious metals prices are often viewed as a signal of economic uncertainty, they also create specific opportunities for the United States at both governmental and private sector levels.

Strategic Reserve Valuation

The United States holds the world’s largest official gold reserves at approximately 8,133 tonnes, according to the U.S. Treasury. The surge in gold prices has substantially increased the value of these holdings, strengthening America’s balance sheet during a period of elevated federal debt.

At current prices near $5,000 per ounce, U.S. gold reserves are worth over $1.3 trillion—a significant increase from their valuation just a few years ago. This enhanced reserve value provides greater financial flexibility and potentially strengthens the country’s negotiating position in international financial matters.

The value of U.S. gold reserves held at facilities like Fort Knox has increased substantially with rising prices

Domestic Mining Industry Growth

The United States ranks among the world’s top gold producers and has significant silver mining operations. Higher sustained prices make previously marginal deposits economically viable, potentially spurring investment in domestic mining capacity.

According to the U.S. Geological Survey, Nevada alone accounts for about 75% of U.S. gold production and 8% of world production. Expanded mining operations create jobs, generate tax revenue, and strengthen domestic supply chains for critical materials.

Financial Market Leadership

As the home to the world’s most sophisticated financial markets, the United States benefits from increased trading activity in precious metals. The COMEX (part of the CME Group) remains the dominant global exchange for gold and silver futures trading, generating significant fee revenue and maintaining U.S. influence over price discovery mechanisms.

This financial infrastructure advantage allows U.S. institutions to maintain leadership in precious metals trading, investment products, and market innovations even as physical demand shifts toward other regions.

Dollar Reserve Status Preservation

While some view gold’s rise as a challenge to dollar hegemony, a more nuanced perspective suggests the U.S. can leverage the situation to preserve its currency’s global role. By acknowledging precious metals as a complementary rather than competing asset class, American policymakers can potentially accommodate the desire for monetary diversification without abandoning the dollar-centered system.

This balanced approach could help prevent a disorderly transition away from dollar dominance, giving the U.S. time to address structural economic challenges while maintaining the significant advantages that come with issuing the world’s primary reserve currency.

Potential Global Power Shift Based on Precious Metals

The revaluation of gold and silver raises important questions about potential shifts in global economic and political influence, particularly if nations continue to accumulate precious metals as strategic assets.

Nations with substantial gold reserves gain increased financial flexibility and geopolitical leverage

Emerging Market Advantage

Several emerging economies have systematically increased their gold reserves over the past decade. Russia has more than quadrupled its gold holdings since 2010, while China continues regular purchases despite already being the world’s largest gold producer.

These accumulations, now significantly more valuable, provide these nations with enhanced financial buffers against external shocks and potentially greater influence in international financial institutions. Countries with substantial precious metals reserves may gain leverage in negotiations regarding global monetary reform or during financial crises.

Reduced Dollar Dependency

The continued accumulation of gold by central banks represents a gradual move toward reducing dependency on the U.S. dollar. According to Bank for International Settlements data, the dollar’s share of global foreign exchange reserves has declined from about 70% in 2000 to approximately 59% today.

While this doesn’t signal an imminent collapse of the dollar system, it does suggest a multipolar currency world may be emerging, with gold playing an increasingly important role as a neutral reserve asset that isn’t controlled by any single nation.

New Financial Alliances

The revaluation of precious metals could accelerate the formation of new financial alliances and mechanisms that operate partially outside the traditional Western-dominated system. The BRICS group (Brazil, Russia, India, China, South Africa, and new members) has discussed creating alternative payment systems that could potentially incorporate gold in some capacity.

These developments don’t necessarily threaten U.S. interests if managed cooperatively, but they do suggest a more complex global financial architecture in which precious metals play an enhanced role in facilitating international trade and investment.

BRICS nations have collectively increased their gold reserves significantly over the past decade

Resource Nationalism

Higher precious metals prices may accelerate resource nationalism trends, with countries imposing export restrictions, higher royalties, or even nationalization of mining assets. This could reshape global supply chains and potentially benefit nations with both substantial reserves and domestic production capacity.

Countries that control significant precious metals production may gain additional geopolitical leverage, particularly as industrial demand for silver continues to grow with the green energy transition and technological advancement.

Impact on Daily Life of the World Population

The gold and silver price surge extends beyond investment portfolios and central bank reserves to affect the daily lives of people worldwide in both obvious and subtle ways.

Consumer Goods and Electronics

Silver is an essential component in electronics, from smartphones and laptops to household appliances. As prices rise, manufacturers face increased production costs that may eventually be passed on to consumers.

According to industry analysts, a typical smartphone contains about 0.34 grams of silver, while larger electronic devices use substantially more. Sustained high silver prices could incrementally increase the cost of consumer electronics, though technological improvements and substitution may partially offset this effect.

Electronics manufacturers face higher component costs as silver prices rise, potentially affecting consumer prices

Jewelry and Cultural Significance

Gold and silver jewelry holds cultural and religious significance across many societies. Higher prices make traditional practices involving precious metals more expensive, potentially altering cultural traditions or creating financial strain for families observing important ceremonies.

In countries like India, where gold plays a central role in weddings and family wealth preservation, the price surge has forced adaptations such as purchasing lighter pieces or exploring alternatives like gold-plated jewelry for certain occasions.

Renewable Energy Costs

Silver is a critical component in solar panels due to its unmatched electrical conductivity. Each solar panel contains approximately 20 grams of silver, making the renewable energy sector a major consumer of the metal.

Higher silver prices contribute to increased production costs for solar technology, potentially slowing the adoption rate of renewable energy. However, technological innovations are gradually reducing the amount of silver required per panel, helping to mitigate this impact.

Investment Behavior and Savings

The dramatic performance of precious metals influences how individuals approach saving and investing. In countries experiencing currency instability or high inflation, physical gold and silver often become preferred stores of value for ordinary citizens.

This shift in savings behavior can have broader economic implications, potentially reducing bank deposits and affecting domestic investment patterns. It may also create or reinforce wealth disparities between those who owned precious metals before the price surge and those who did not.

Families increasingly consider precious metals allocation in their investment and savings strategies

Medical Costs and Healthcare

Silver has important medical applications due to its antimicrobial properties. It’s used in wound dressings, medical devices, and certain pharmaceutical products. Higher silver prices incrementally increase healthcare costs, though these effects are generally modest compared to other factors driving medical inflation.

Gold also has specialized medical applications, particularly in certain cancer treatments and diagnostic tools. While the volume used is relatively small, price increases do affect the cost structure of these specialized treatments.

Inflation Psychology

Rising precious metals prices can influence broader inflation psychology. When consumers see gold and silver prices surging, it may reinforce perceptions that inflation will remain persistent, potentially affecting wage demands and spending patterns.

This psychological factor is difficult to quantify but represents an important channel through which precious metals prices can influence everyday economic decisions and expectations.

Is It a Good Time to Buy Gold and Silver or Time to Hold?

With prices at historic highs, potential investors face the challenging question of whether now is the time to enter the market or whether caution is warranted. While this analysis cannot provide personalized investment advice, it can outline key considerations for those evaluating precious metals in the current environment.

Investors must weigh multiple factors when deciding whether to buy, hold, or avoid precious metals

Arguments for Buying

- Central bank buying provides ongoing structural support

- Industrial demand for silver continues to grow with green energy and AI development

- Geopolitical tensions show few signs of resolution

- Physical supply constraints limit downside risk

- Monetary policy remains accommodative with rate cuts expected

- Debt levels continue to rise globally, supporting hard assets

Arguments for Caution

Historical Context for Current Prices

To evaluate whether current prices represent value or excess, historical context is essential. While nominal prices are at record highs, inflation-adjusted comparisons offer additional perspective.

Gold’s previous inflation-adjusted peak occurred in 1980, when it reached approximately $2,800 in today’s dollars. The current price of $5,000+ represents a significant premium to that level, suggesting either fundamental revaluation or potential overextension.

For silver, the inflation-adjusted 1980 high would equate to roughly $130 in current dollars, suggesting that despite its impressive rally, silver may have less historical overvaluation than gold relative to previous cycle peaks.

Inflation-adjusted historical price comparison provides context for evaluating current market levels

Portfolio Allocation Strategies

Rather than trying to time perfect entry or exit points, many financial professionals recommend a strategic allocation approach to precious metals investing. This typically involves:

| Investor Profile | Suggested Allocation | Implementation Approach | Risk Management |

| Conservative | 5-10% of portfolio | Dollar-cost averaging with emphasis on gold | Focus on physical ownership or fully-allocated products |

| Moderate | 10-15% of portfolio | Balanced gold/silver mix with periodic rebalancing | Combination of physical and select investment products |

| Aggressive | 15-25% of portfolio | Higher silver allocation for leverage potential | Position sizing and defined exit strategies |

According to CPM Group research, investors who maintain a consistent allocation to precious metals through market cycles typically achieve better long-term results than those who attempt to time entries and exits based on price movements alone.

Entry Strategy Considerations

For those who decide to initiate or add to precious metals positions despite elevated prices, several approaches can help manage risk:

- Dollar-cost averaging: Spreading purchases over time rather than investing a lump sum can reduce the impact of short-term volatility and avoid the regret of poorly timed entries.

- Scaling in during corrections: Having predetermined price levels at which to add positions during pullbacks can create a disciplined approach to building exposure.

- Gold-to-silver ratio analysis: The current ratio of approximately 50:1 (gold price divided by silver price) provides information about relative value. Historically, this ratio averages around 65:1, suggesting silver may still offer relative value despite its strong performance.

- Physical vs. financial exposure: Different investment vehicles offer varying risk-reward profiles. Physical ownership provides direct exposure without counterparty risk, while mining stocks potentially offer leverage to metal prices but introduce company-specific factors.

Dollar-cost averaging can help manage entry risk when investing during periods of elevated prices

Key Indicators to Monitor

Regardless of whether one decides to buy, hold, or avoid precious metals, monitoring certain indicators can provide valuable context for future decision-making:

- Real yield trends: The relationship between interest rates and inflation remains a primary driver of gold prices. Federal Reserve Economic Data (FRED) provides updated information on real yields.

- Central bank purchasing patterns: Continued strong official sector buying would provide important structural support for prices.

- ETF flows: Investment flows into and out of major gold and silver ETFs can signal shifting institutional sentiment.

- COMEX positioning: Futures market positioning by speculative traders often provides insights into short-term price dynamics.

- Dollar strength: The U.S. dollar’s performance against major currencies typically has an inverse relationship with precious metals prices.

Conclusion: Navigating the Gold and Silver Price Surge

The precious metals surge reflects fundamental changes in the global financial landscape

The current gold and silver price surge represents more than just a market rally—it reflects fundamental reassessment of precious metals’ role in a changing global financial landscape. Central bank buying, industrial demand, geopolitical tensions, and monetary policy have converged to create extraordinary price momentum.

For the United States, this trend creates both challenges and opportunities. While rising precious metals prices may signal concerns about traditional financial assets, they also enhance the value of America’s substantial gold reserves and support domestic mining industries.

The potential for global power shifts based on precious metals holdings remains a longer-term consideration rather than an immediate transformation. Nations with substantial reserves gain increased financial flexibility, but the international monetary system evolves gradually rather than through sudden disruption.

For everyday citizens worldwide, the price surge affects everything from electronics costs to jewelry purchases, renewable energy adoption, and personal investment strategies. These impacts vary significantly by region and economic circumstance.

Regarding investment timing, the dramatic gains already recorded suggest caution, while structural factors support the case for continued exposure. Rather than making binary buy/sell decisions, a thoughtful allocation strategy that considers individual circumstances, risk tolerance, and time horizon offers the most prudent approach.

As this historic precious metals rally continues to unfold, staying informed about underlying drivers while maintaining perspective on longer-term trends will help both investors and policymakers navigate an increasingly complex global financial landscape.

Frequently Asked Questions About the Gold and Silver Price Surge

What are the main factors driving gold above ,000 per ounce?

The primary drivers include unprecedented central bank buying (over 1,000 tonnes annually), expectations of Federal Reserve rate cuts, geopolitical tensions in multiple regions, concerns about government debt levels, and dollar weakness. These factors have converged to create extraordinary demand while supply remains relatively constrained.

Why is silver outperforming gold during this rally?

Silver’s outperformance stems from its dual role as both a precious metal and industrial commodity. While benefiting from the same monetary and safe-haven demand as gold, silver faces additional pressure from surging industrial use in solar panels, electric vehicles, and electronics. With approximately 70% of silver produced as a byproduct of other mining operations, supply struggles to keep pace with this combined investment and industrial demand.

How does the gold-to-silver ratio help investors make decisions?

The gold-to-silver ratio (gold price divided by silver price) provides insight into relative valuation between the metals. Currently around 50:1, this ratio has compressed significantly from recent years when it exceeded 80:1. Historically, the ratio averages approximately 65:1, with extremes below 40:1 during precious metals bull markets. Investors often use this metric to determine which metal might offer better relative value at a given time.

What impact could sustained high precious metals prices have on technology development?

Prolonged high prices, particularly for silver, could accelerate research into alternative materials and technologies that reduce precious metals content. For example, solar panel manufacturers are already working to reduce silver usage per panel through design innovations. However, for many applications, silver’s unique properties make substitution difficult. The result may be a combination of higher production costs, technological adaptation, and potential delays in scaling certain green technologies.

Are current precious metals prices in a bubble?

While prices have risen dramatically, several factors distinguish the current rally from classic bubble behavior. Central bank buying provides structural support rather than speculative demand. Physical supply constraints create fundamental tightness. Industrial demand for silver represents real consumption rather than purely investment positioning. That said, the pace of gains suggests potential for significant corrections within the broader uptrend, particularly if speculative positioning becomes excessive or fundamental drivers weaken.

Further Reading and Resources

Official Data Sources

Comprehensive research using multiple data sources helps develop informed perspectives on precious metals markets

The resources above provide reliable data and analysis for those seeking to deepen their understanding of precious metals markets and the factors driving the current price surge. While market conditions continue to evolve rapidly, these sources offer valuable context for both investment decisions and broader economic analysis.