How Trump’s Big Beautiful Bill Could Reshape Family Life in America

As the One Big Beautiful Bill Act (OBBBA) moves from legislation to implementation, American families are facing what could be the most significant policy shift affecting their daily lives in decades. This sweeping legislation touches virtually every aspect of family economics—from how much you’ll pay in taxes to the healthcare options available for your children. With provisions affecting housing affordability, childcare costs, healthcare access, and educational opportunities, the bill represents a fundamental recalibration of how government policy intersects with family life. The question facing millions of households isn’t just whether they’ll pay more or less in taxes, but how these changes will reshape their long-term financial security, healthcare decisions, and educational choices for years to come.

The bill’s proponents argue it will strengthen families by putting more money in their pockets through tax cuts and creating economic growth. Critics counter that it may benefit some families while leaving others—particularly those dependent on Medicaid and food assistance—more vulnerable. As partisan debates continue, families are left wondering: Will this legislation stabilize their financial future or introduce new uncertainties? This comprehensive analysis examines how the OBBBA’s provisions could transform American family life across economic classes, geographic regions, and family structures.

Understanding Trump’s Big Beautiful Bill: A Family-Focused Overview

The One Big Beautiful Bill Act represents one of the most extensive domestic policy packages in recent American history. At its core, the legislation permanently extends the tax cuts from Trump’s first term while implementing significant changes to government programs that millions of families rely on. Before diving into specific impacts, it’s essential to understand the bill’s fundamental components that most directly affect family life.

Core Family-Related Provisions

- Permanent extension of the 2017 tax cuts, which were set to expire

- Increase in the child tax credit to $2,200 (up from $2,000)

- New tax exemptions for tips and overtime pay

- Significant Medicaid restructuring with new work requirements

- Changes to SNAP (food stamps) eligibility and administration

- Creation of “Trump Accounts” allowing parents to establish tax-deferred savings for children

- Increased cap on state and local tax deductions to $40,000 (for five years)

According to the Congressional Budget Office, the bill is projected to add approximately $3.3 trillion to the national debt over the next decade. This fiscal impact has significant implications for future generations of American families, potentially affecting everything from interest rates on mortgages to the long-term sustainability of social programs.

Stay Informed About Policy Changes

As the bill moves into implementation, understanding how these changes will affect your family is crucial. Sign up for our monthly Family Policy Update to receive expert analysis on how new regulations might impact your household finances.

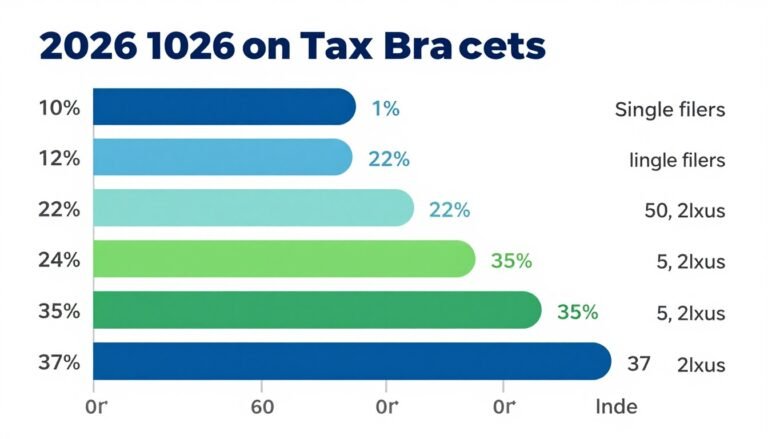

Tax Changes and Family Finances

The OBBBA’s tax provisions represent some of the most direct impacts on family finances. By making permanent the individual tax rates from the 2017 Tax Cuts and Jobs Act, the bill provides continuity for family financial planning, though the benefits are distributed unevenly across income levels.

Child Tax Credit Expansion

One of the most significant family-focused provisions is the permanent increase of the child tax credit to $2,200 per child. This represents a modest increase from the current $2,000 level but falls short of the temporary $3,600 per child that was available during the pandemic under the American Rescue Plan.

Former Treasury Secretary Janet Yellen has noted that “the expanded child tax credit implemented during the pandemic was the most effective anti-child poverty measure in a generation. The more modest increase in this bill will help families, but won’t have the same transformative impact on child poverty rates.”

Tax Exemptions for Tips and Overtime

The bill creates new tax exemptions for tip income and overtime pay, potentially benefiting service industry workers and hourly employees who rely on these income sources. For families with members working in restaurants, hospitality, or industries with significant overtime opportunities, these provisions could mean substantial tax savings.

Labor economist Heidi Shierholz of the Economic Policy Institute points out: “The tip and overtime exemptions will primarily benefit middle-income working families in service and blue-collar industries. This represents a targeted tax break for working families rather than the broader cuts that disproportionately benefit higher earners.”

State and Local Tax (SALT) Deduction Changes

The bill increases the cap on state and local tax deductions from $10,000 to $40,000 for five years, after which it reverts to the lower cap. This change primarily benefits families in high-tax states like New York, California, and New Jersey, particularly those with higher incomes and more valuable properties.

| Family Income Level | Estimated Annual Tax Savings | Primary Benefits |

| Under $50,000 | $500-$800 | Child tax credit, standard deduction |

| $50,000-$100,000 | $1,000-$2,000 | Child tax credit, tip/overtime exemptions |

| $100,000-$200,000 | $2,000-$5,000 | Tax rate reductions, partial SALT benefits |

| $200,000-$500,000 | $5,000-$15,000 | Tax rate reductions, SALT deduction |

| Over $500,000 | $15,000+ | Tax rate reductions, investment income benefits |

Representative Alexandria Ocasio-Cortez (D-NY) has criticized the distribution of these benefits: “While the SALT cap increase will help some middle-class families in high-cost areas, the overall tax structure of this bill continues to favor the wealthy over working families. The temporary nature of the SALT relief compared to the permanent cuts for the highest earners tells you everything about the priorities.”

Calculate Your Family’s Tax Impact

Every family’s situation is unique. Use our interactive calculator to estimate how the OBBBA’s tax provisions might affect your specific household finances.

Healthcare Restructuring and Family Wellbeing

Perhaps no aspect of the OBBBA has generated more concern among families than its healthcare provisions. The bill makes substantial changes to Medicaid, which currently provides health coverage to 72 million Americans, including many children, pregnant women, and people with disabilities.

Medicaid Work Requirements and Eligibility Changes

The bill institutes new work requirements for Medicaid recipients, mandating that able-bodied adults ages 19-64 work at least 80 hours per month to maintain coverage. While there are exemptions for parents with children under 14 and those with medical conditions, these changes could significantly alter healthcare access for millions of families.

Dr. Atul Gawande, surgeon and public health researcher, warns: “The introduction of work requirements creates administrative barriers that historically cause eligible people to lose coverage. Research from states that previously implemented similar requirements showed that many people who meet the work criteria or qualify for exemptions still lose coverage due to paperwork and reporting challenges.”

Provider Tax Changes and Rural Healthcare

The bill gradually reduces the Medicaid provider tax from 6% to 3.5% by 2031. This technical change has significant implications for healthcare access, particularly in rural areas where hospitals often operate on thin margins and rely heavily on Medicaid funding.

To address concerns about rural healthcare access, the bill establishes a $50 billion Rural Hospital Fund. Senator Lisa Murkowski (R-AK) secured this provision, stating: “Rural communities face unique healthcare challenges, and this fund will help ensure that families in less populated areas maintain access to essential medical services despite the broader Medicaid changes.”

Impact on Family Healthcare Decisions

For families currently relying on Medicaid, the bill’s changes may necessitate difficult healthcare decisions. The Congressional Budget Office estimates that approximately 11.8 million Americans could lose Medicaid coverage over the next decade as a result of these provisions.

Potential Healthcare Benefits

- $50 billion Rural Hospital Fund to support facilities in underserved areas

- Potential reduction in administrative costs through streamlined eligibility verification

- Increased state flexibility in program administration

- Potential for more targeted assistance to most vulnerable populations

Potential Healthcare Concerns

- Estimated 11.8 million Americans could lose Medicaid coverage

- New administrative burdens for families to prove work requirement compliance

- Reduced funding for state Medicaid programs through provider tax changes

- Potential hospital closures in vulnerable communities despite relief fund

Ohio Governor Mike DeWine has expressed mixed feelings about the changes: “While we support encouraging self-sufficiency through work, we must ensure that vulnerable Ohioans don’t fall through the cracks. Our state has successfully expanded Medicaid to cover more working families, and we’re concerned about maintaining that progress under these new requirements.”

Understand Your Healthcare Options

With significant changes coming to Medicaid and other healthcare programs, families need to prepare. Download our comprehensive guide to navigating the new healthcare landscape.

Nutrition Assistance and Family Food Security

The OBBBA makes substantial changes to the Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, which currently helps feed approximately 42 million Americans, including many children. These changes could significantly impact how families access food assistance.

Expanded Work Requirements

Similar to the Medicaid provisions, the bill expands work requirements for SNAP recipients. Currently, able-bodied adults between 18 and 54 must meet work requirements to qualify for benefits. The OBBBA extends this age range to 18-64, with some exemptions for parents and other caregivers.

Figure 4: Families using SNAP benefits often carefully budget their grocery purchases

State Cost-Sharing Requirements

In a significant shift, the bill requires states with error rates above 6% to contribute up to 15% of SNAP benefit costs, which are currently fully funded by the federal government. This change could create pressure on state budgets and potentially lead to tighter eligibility requirements at the state level.

Former Agriculture Secretary Tom Vilsack has criticized this approach: “Shifting costs to states doesn’t improve program integrity; it simply transfers the financial burden. States facing these new costs may be forced to restrict eligibility or reduce other essential services to compensate, ultimately hurting the families who rely on these programs.”

Impact on Family Food Security

For families currently receiving SNAP benefits, these changes could mean new hurdles to maintaining food assistance. The expanded work requirements will affect older adults previously exempt from these rules, while the state cost-sharing provisions may lead to stricter state-level policies.

“Food security is the foundation of family stability. When parents worry about putting food on the table, it affects everything from their children’s educational outcomes to their own ability to maintain employment. These changes risk undermining that foundation for millions of vulnerable families.”

The bill does include special provisions for Alaska and Hawaii, allowing potential waivers from some requirements after lobbying from their senators. This geographic disparity highlights how the impact of these changes will vary significantly depending on where families live.

Educational Opportunities and Family Advancement

While the OBBBA doesn’t include comprehensive education reform, several provisions could significantly impact educational opportunities for families, particularly regarding higher education financing and savings options.

Trump Accounts for Educational Savings

One of the bill’s innovative features is the creation of “Trump Accounts,” which allow parents to contribute $1,000 at a child’s birth and up to $5,000 annually thereafter. These accounts grow tax-deferred and can be used for higher education, job training, or a down payment on a home.

Figure 5: Trump Accounts offer new educational savings options for families

Financial advisor Suze Orman has commented: “These accounts provide a new tax-advantaged vehicle for family educational planning, similar to 529 plans but with more flexibility in how the funds can be used. For families who can afford to contribute, they represent a valuable tool for long-term educational planning.”

Student Loan Changes

The bill also includes significant changes to student loan programs that could affect how families finance higher education. It caps unsubsidized student loans for graduate students at $20,500 per year and $100,000 lifetime, while limiting loans for professional degrees to $50,000 annually and $200,000 lifetime.

Additionally, the bill adds a lifetime student loan borrowing limit of $257,000 and restructures income-based repayment programs. These changes could significantly alter how families approach financing higher education, potentially limiting access to certain graduate and professional programs.

| Education Level | Current Loan Limits | OBBBA Loan Limits | Potential Family Impact |

| Undergraduate | $31,000-$57,500 total | Unchanged, but with $257,000 lifetime cap | Minimal change for most students |

| Graduate | $138,500 total (including undergraduate) | $20,500 annual, $100,000 lifetime | May require private loans or limit program choices |

| Medical/Law School | No specific cap beyond graduate PLUS | $50,000 annual, $200,000 lifetime | Significant financing challenges for many families |

| Parent PLUS Loans | Cost of attendance minus other aid | Subject to new lifetime borrowing limits | May limit options for family financing of education |

Impact on College Endowments

The bill also increases taxes on investment income from college endowments, with rates ranging from 1.4% to 8% depending on endowment size. This provision primarily affects wealthier private institutions and could indirectly impact financial aid availability and tuition costs at these schools.

Harvard University President Alan Garber has expressed concern: “Taxing educational endowments diverts resources that would otherwise support student financial aid, research, and educational programs. This could ultimately lead to higher costs for students or reduced financial aid availability, affecting access for middle and working-class families.”

Plan Your Family’s Educational Future

With significant changes to educational financing options, now is the time to review your family’s college savings strategy. Download our guide to the new educational landscape under the OBBBA.

Working Parents and Dual-Income Households

Several provisions of the OBBBA specifically affect working parents and dual-income households, potentially changing the financial calculus of work decisions for many families.

Tax Exemptions for Tips and Overtime

The bill’s exemption of tip income and overtime pay from federal income taxes could significantly benefit working parents in service industries and hourly positions. For a family with one or both parents working in restaurants, hospitality, or industries with overtime opportunities, these exemptions could mean substantial tax savings.

Figure 6: Working parents often balance multiple responsibilities across work and home

Labor Secretary Julie Su has noted: “The tip and overtime exemptions acknowledge the reality that many working parents rely on these income sources to support their families. By reducing the tax burden on these earnings, the bill provides targeted relief to working families in sectors where wages have historically lagged behind productivity growth.”

Work Requirements and Childcare Considerations

The expanded work requirements for Medicaid and SNAP create new considerations for parents, particularly those with children between the ages of 10-14. While parents with children under 10 are exempt from SNAP work requirements, and those with children under 14 are exempt from Medicaid work requirements, parents with children in the 10-14 age range face a complex situation where they must meet work requirements for food assistance but might be exempt for healthcare.

Work Requirement Exemptions for Parents

Medicaid: Parents with children under 14 are exempt

SNAP: Parents with children under 10 are exempt

This creates a potential “gap period” where parents must navigate different requirements for different essential benefits.

Child welfare advocate Dr. Janet Currie points out: “The differing age thresholds for work requirement exemptions create unnecessary complexity for families. A parent with a 12-year-old child might be exempt from Medicaid work requirements but still need to fulfill SNAP work requirements, creating a confusing and potentially burdensome situation.”

Childcare Affordability Challenges

While the bill includes tax benefits that could help working families, it doesn’t address one of the most significant challenges facing working parents: childcare costs. Unlike previous proposals that included direct childcare subsidies, the OBBBA relies primarily on tax benefits that families receive annually rather than assistance with ongoing childcare expenses.

“The absence of childcare provisions in this bill is a missed opportunity to address one of the most significant barriers to workforce participation for parents, particularly mothers. Tax credits help, but they don’t solve the immediate cashflow problem of paying for childcare each month.”

For dual-income households, the bill’s overall impact will depend heavily on their specific circumstances, including income levels, industry of employment, state of residence, and childcare needs. Families with service industry workers may benefit significantly from the tip exemption, while those in high-tax states could see advantages from the increased SALT deduction cap.

Housing Affordability and Family Stability

Housing represents the largest expense for most American families, and several provisions of the OBBBA could affect housing affordability and homeownership opportunities.

SALT Deduction and Housing Markets

The temporary increase in the state and local tax (SALT) deduction cap from $10,000 to $40,000 could significantly impact housing markets, particularly in high-tax states. By making property taxes more deductible, this change could ease some of the tax burden of homeownership in expensive markets.

Figure 7: Homeownership remains a central aspiration for many American families

Real estate economist Lawrence Yun of the National Association of Realtors explains: “The higher SALT cap could provide meaningful tax relief for homeowners in high-cost, high-tax markets like California, New York, and New Jersey. This could help stabilize housing values in these regions and make homeownership more affordable for some families.”

Auto Loan Interest Deduction

The bill includes a provision allowing car buyers to deduct up to $10,000 per year in auto loan interest for cars assembled in the United States. For families in areas with limited public transportation, where car ownership is essential for commuting to work, this deduction could provide meaningful savings.

Transportation Secretary Pete Buttigieg has criticized this approach: “While tax deductions for auto loans may help some families, they don’t address the fundamental transportation challenges many Americans face. A more comprehensive approach would include investments in public transit and infrastructure that reduce the necessity of car ownership in the first place.”

Trump Accounts for Home Purchases

The creation of Trump Accounts provides a new savings vehicle that can be used for home down payments. Parents can contribute up to $5,000 annually to these accounts, which grow tax-deferred until withdrawn for qualified expenses including first-time home purchases.

| Housing Market Type | Potential OBBBA Impact | Family Considerations |

| High-cost, high-tax areas (CA, NY, NJ) | Significant benefit from SALT cap increase; potential property value stabilization | Tax savings may offset high housing costs; benefit diminishes after 5 years |

| Moderate-cost suburban areas | Moderate SALT benefits; potential benefit from Trump Accounts for new buyers | May improve affordability for middle-class families; savings vehicles helpful for future buyers |

| Low-cost rural areas | Limited SALT impact; auto loan deduction may be significant | Transportation costs often higher; auto loan deduction could provide meaningful relief |

| Rental markets | Limited direct benefits; potential indirect effects on rental prices | Few direct provisions for renters; Trump Accounts may help future transition to ownership |

Housing advocate Diane Yentel of the National Low Income Housing Coalition notes: “While the bill includes some provisions that may help middle and upper-income homeowners, it does little to address the affordable housing crisis facing lower-income families. The focus on tax deductions primarily benefits those who already have resources rather than addressing the structural housing challenges facing the most vulnerable families.”

Evaluate Your Housing Options

With changing tax implications for homeownership, now is a good time to reassess your family’s housing situation. Download our guide to housing decisions under the new tax landscape.

Geographic Disparities: How Location Shapes Family Impacts

The OBBBA’s effects on families will vary significantly depending on where they live. Geographic factors—including state tax policies, rural vs. urban location, and regional economic conditions—will create disparate outcomes across the country.

High-Tax vs. Low-Tax States

Perhaps the most obvious geographic disparity comes from the increased SALT deduction cap, which primarily benefits families in states with high state and local taxes. Families in California, New York, New Jersey, Connecticut, and similar high-tax states will see more significant benefits from this provision than those in states with lower tax burdens.

New York Governor Kathy Hochul has welcomed the SALT cap increase: “New York families have been disproportionately harmed by the $10,000 SALT cap since 2017. This temporary relief will help middle-class homeowners across our state who have been unfairly double-taxed on their income.”

Rural vs. Urban Family Impacts

The bill’s healthcare provisions create particular concerns for rural families. While the $50 billion Rural Hospital Fund aims to mitigate the impact of Medicaid cuts on rural healthcare facilities, access remains a significant concern in less populated areas where hospitals already operate on thin margins.

Senator Jon Tester (D-MT) has expressed concern: “Rural families often have fewer healthcare options to begin with, and these Medicaid changes could further strain an already fragile rural healthcare system. While the Rural Hospital Fund provides some mitigation, it’s unclear whether it will be sufficient to prevent closures that would leave rural families with even fewer options.”

State-Specific Case Study: Ohio

Ohio provides an illustrative example of how the bill’s impacts will vary even within states. As a state that expanded Medicaid under the Affordable Care Act, Ohio has approximately 3.1 million residents enrolled in the program, including many working families.

Ohio Medicaid by the Numbers:

• 3.1 million total enrollees (26% of state population)

• 1.2 million children covered

• 36% of births covered by Medicaid

• Estimated 230,000 Ohioans could lose coverage under new work requirements

Ohio Department of Medicaid Director Maureen Corcoran notes: “Our state has worked hard to implement Medicaid expansion in a way that supports working families while controlling costs. The new work requirements and funding changes will require significant adjustments to our program and could affect coverage for many Ohioans who are working but in jobs that don’t offer health insurance.”

State-Specific Case Study: Florida

Florida, which did not expand Medicaid under the ACA, faces different challenges. The state has approximately 5.2 million residents on Medicaid, primarily children, pregnant women, elderly, and disabled individuals. Florida also has a large service industry with many workers who could benefit from the tip income tax exemption.

“Florida’s large tourism and hospitality sector means many working families could see meaningful benefits from the tip income exemption. At the same time, our state’s decision not to expand Medicaid means we’re starting from a different baseline than expansion states when implementing these changes.”

These regional variations highlight how the OBBBA’s impact on families will not be uniform across the country. State policy decisions, local economic conditions, and regional cost differences will create a patchwork of outcomes that defy simple categorization as universally beneficial or harmful to American families.

Different Family Structures, Different Impacts

The OBBBA’s provisions will affect various family structures differently, creating disparate outcomes depending on family composition, marital status, and caregiving responsibilities.

Single-Parent Households

Single-parent families, which make up approximately 23% of American households with children, face unique challenges under the bill. While they benefit from the increased child tax credit, the work requirements for benefits could be particularly challenging for single parents juggling work and childcare responsibilities.

Figure 9: Single parents often balance multiple responsibilities with limited support

Single parent advocate Emma Johnson notes: “The work requirements don’t adequately account for the logistical challenges single parents face. When you’re the only adult in the household, managing 80 hours of work per month while also handling childcare, school responsibilities, and household management can be extremely difficult, especially without family support nearby.”

Multigenerational Households

Multigenerational households, which have been increasing in the U.S., may find both challenges and opportunities in the bill. The senior tax deduction of up to $6,000 could benefit older adults living with family members, while the work requirements could affect families where older adults provide childcare that enables parents to work.

AARP CEO Jo Ann Jenkins comments: “The senior tax deduction acknowledges the financial challenges many older Americans face. However, the bill doesn’t fully recognize the economic value of unpaid caregiving that many seniors provide to their families, which often enables younger family members to participate in the workforce.”

Families with Disabilities

Families that include members with disabilities face particular concerns regarding the Medicaid changes. While there are exemptions from work requirements for individuals with medical conditions, the administrative burden of proving and maintaining these exemptions could create barriers to continued coverage.

“For families supporting members with disabilities, Medicaid often provides essential services that aren’t covered by private insurance. The new administrative requirements could create significant stress and uncertainty for these families, even if they ultimately qualify for exemptions.”

Immigrant Families

The bill includes several provisions specifically affecting immigrant families, including a five-year waiting period for green card holders before applying for Medicaid and limitations on premium tax credits for immigrants. Additionally, the bill establishes a 1% tax on remittances, which could affect families who send money to relatives abroad.

Immigration policy expert Julia Gelatt of the Migration Policy Institute explains: “These provisions create additional barriers for legal immigrant families trying to access healthcare and support relatives. The remittance tax, while lower than initially proposed, will affect many immigrant families who support relatives in their countries of origin, essentially taxing money that has already been taxed as income.”

| Family Structure | Potential Benefits | Potential Challenges |

| Two-parent, dual-income | Tax cuts, tip/overtime exemptions, increased child tax credit | No direct childcare assistance, potential healthcare disruption |

| Two-parent, single-income | Tax cuts, child tax credit, no work requirement concerns | Limited benefit from tip/overtime exemptions if not in relevant industries |

| Single-parent | Child tax credit, potential tip/overtime benefits | Work requirement logistics, limited childcare support |

| Multigenerational | Senior tax deduction, potential for pooled resources | Complex healthcare needs, potential Medicaid disruption |

| Families with disabilities | Exemptions from work requirements, tax benefits | Administrative burden of proving exemptions, potential coverage gaps |

| Immigrant families | General tax provisions if eligible | Waiting periods for benefits, remittance tax, reduced premium tax credits |

Find Resources for Your Family Type

Every family structure faces unique challenges and opportunities under the new legislation. Get customized information for your specific family situation.

The Long-Term Outlook for American Families

Beyond the immediate impacts, the OBBBA raises important questions about the long-term trajectory for American families. The bill’s fiscal implications, combined with its policy shifts, could reshape family economic security for years to come.

Fiscal Sustainability and Future Generations

The Congressional Budget Office projects that the OBBBA will add approximately $3.3 trillion to the national debt over the next decade. This fiscal impact raises questions about long-term economic stability and the potential burden on future generations of American families.

Figure 10: Policy decisions today will shape opportunities for future generations

Economist Larry Summers, former Treasury Secretary, warns: “The bill’s fiscal impact could lead to higher interest rates and reduced fiscal capacity to respond to future crises. This creates a form of intergenerational inequity, where today’s tax cuts may come at the expense of tomorrow’s economic opportunities for our children and grandchildren.”

In contrast, economist Stephen Moore, who advised Trump’s 2016 campaign, argues: “The tax cuts will stimulate economic growth that will benefit families across generations. By creating a more dynamic economy with more opportunities, we’re setting up future generations for success rather than burdening them.”

Changing Safety Net Structure

The OBBBA represents a significant restructuring of America’s social safety net, with implications for how families navigate economic challenges. The shift toward more work requirements and state cost-sharing for programs like Medicaid and SNAP signals a changing philosophy about government support for families.

“This bill represents the most significant restructuring of America’s social safety net in decades. By emphasizing work requirements and state responsibility, it fundamentally alters the compact between government and families facing economic hardship. The question is whether this new approach will better support family self-sufficiency or leave more vulnerable families without adequate support during difficult times.”

Family Formation and Economic Security

Economic factors significantly influence family formation decisions, from whether and when to have children to marriage timing. The OBBBA’s various provisions could affect these decisions in complex ways, potentially influencing demographic trends over time.

Demographer Lyman Stone observes: “Economic uncertainty often leads young adults to delay family formation. To the extent that the OBBBA provides greater economic security for some families while creating new uncertainties for others, we may see divergent family formation patterns across different demographic groups in the coming years.”

Potential Long-Term Benefits

- Tax certainty through permanent extension of 2017 rates

- New savings vehicles for education and homeownership

- Potential economic growth from tax incentives

- Increased work participation through requirement incentives

- Greater state flexibility in program administration

Potential Long-Term Concerns

- Increased national debt affecting future generations

- Potential gaps in safety net for vulnerable families

- Healthcare access challenges in underserved communities

- Increased administrative burdens for benefit access

- Temporary nature of some benefits creating future uncertainty

The full long-term impact of the OBBBA on American families will take years to fully manifest and will depend not only on the bill’s provisions but also on how they interact with broader economic trends, future policy adjustments, and the diverse circumstances of American families themselves.

Frequently Asked Questions About the OBBBA and Families

How will the OBBBA affect single-parent households?

Single-parent households will see mixed impacts. They’ll benefit from the increased child tax credit (,200 per child) and potentially from the tip and overtime tax exemptions if they work in relevant industries. However, they may face challenges with the new work requirements for Medicaid and SNAP, as balancing 80 hours of monthly work with sole parenting responsibilities can be difficult. The bill doesn’t include specific childcare assistance, which is often a significant challenge for single parents.

Will the child tax credit changes be permanent?

Yes, the OBBBA permanently increases the child tax credit to ,200 per child, up from the current ,000. This is different from the temporary expansion to ,600 during the pandemic, which expired. The permanent nature of this increase provides families with more certainty for long-term financial planning, though the amount is lower than what was available during the pandemic enhancement.

How do the Medicaid work requirements affect families with children?

Parents with children under 14 are exempt from the Medicaid work requirements. However, parents with older children would need to work at least 80 hours per month to maintain coverage. There are also exemptions for individuals with medical conditions. The administrative process of proving and maintaining these exemptions could create challenges for some families, even if they technically qualify for exemptions.

What are “Trump Accounts” and how can families use them?

Trump Accounts are new tax-advantaged savings vehicles created by the OBBBA. Parents can contribute

Frequently Asked Questions About the OBBBA and Families

How will the OBBBA affect single-parent households?

Single-parent households will see mixed impacts. They’ll benefit from the increased child tax credit ($2,200 per child) and potentially from the tip and overtime tax exemptions if they work in relevant industries. However, they may face challenges with the new work requirements for Medicaid and SNAP, as balancing 80 hours of monthly work with sole parenting responsibilities can be difficult. The bill doesn’t include specific childcare assistance, which is often a significant challenge for single parents.

Will the child tax credit changes be permanent?

Yes, the OBBBA permanently increases the child tax credit to $2,200 per child, up from the current $2,000. This is different from the temporary expansion to $3,600 during the pandemic, which expired. The permanent nature of this increase provides families with more certainty for long-term financial planning, though the amount is lower than what was available during the pandemic enhancement.

How do the Medicaid work requirements affect families with children?

Parents with children under 14 are exempt from the Medicaid work requirements. However, parents with older children would need to work at least 80 hours per month to maintain coverage. There are also exemptions for individuals with medical conditions. The administrative process of proving and maintaining these exemptions could create challenges for some families, even if they technically qualify for exemptions.

What are “Trump Accounts” and how can families use them?

Trump Accounts are new tax-advantaged savings vehicles created by the OBBBA. Parents can contribute $1,000 at a child’s birth and up to $5,000 annually thereafter. The money grows tax-deferred and can be used for higher education, job training, or a down payment on a first home. These accounts function similarly to 529 college savings plans but offer more flexibility in how the funds can be used, potentially helping families save for various aspects of their children’s future.

How will the SALT deduction changes affect homeowners?

The OBBBA temporarily increases the state and local tax (SALT) deduction cap from $10,000 to $40,000 for five years, after which it reverts to $10,000. This primarily benefits homeowners in high-tax states like New York, California, and New Jersey. Families with homes in these areas could see significant tax savings, particularly if they have high property taxes. However, the benefit phases out for individuals making over $500,000 annually, and its temporary nature creates uncertainty for long-term financial planning.

Will families currently receiving SNAP benefits lose their food assistance?

Some families could lose SNAP benefits due to the expanded work requirements, which now apply to able-bodied adults ages 18-64 (previously 18-54). Parents with children under 10 are exempt. Additionally, states with error rates above 6% will need to contribute up to 15% of benefit costs, which could lead some states to tighten eligibility requirements. Families should check with their state SNAP office to understand how these changes might affect their specific situation.

How does the bill affect immigrant families?

The OBBBA includes several provisions specifically affecting immigrant families. It requires a five-year waiting period for green card holders before they can apply for Medicaid, reduces premium tax credits for immigrants, and establishes a 1% tax on remittances (money sent abroad). Legal immigrant families will still be eligible for general tax benefits like the child tax credit if they meet the qualifying criteria, but may face additional barriers to accessing healthcare and other benefits.

What happens to the SALT deduction after five years?

After five years, the state and local tax (SALT) deduction cap will revert from $40,000 back to $10,000. This means that homeowners in high-tax states will see a significant reduction in their tax deductions after this period. The temporary nature of this provision creates uncertainty for long-term financial planning and could affect housing markets in high-tax areas as the expiration date approaches.

How will the bill affect college affordability for families?

The OBBBA makes several changes affecting college affordability. It caps student loans for graduate students at $20,500 annually and $100,000 lifetime, while limiting professional degree loans to $50,000 annually and $200,000 lifetime. It also adds a $257,000 lifetime borrowing limit. The Trump Accounts provide a new savings vehicle for education, but the bill also increases taxes on college endowments, which could affect financial aid availability at some institutions. Families should reassess their college financing strategies in light of these changes.

Will the tip and overtime tax exemptions expire?

Yes, the tax exemptions for tips and overtime pay are scheduled to expire in 2028. This temporary nature means that families benefiting from these provisions should plan accordingly and not assume these tax advantages will be permanent. As with many temporary tax provisions, there could be future legislation to extend them, but this is not guaranteed.

Have More Questions?

Our team of policy experts continues to analyze the OBBBA and its implications for families. Subscribe to our newsletter for ongoing updates and answers to your questions.

,000 at a child’s birth and up to ,000 annually thereafter. The money grows tax-deferred and can be used for higher education, job training, or a down payment on a first home. These accounts function similarly to 529 college savings plans but offer more flexibility in how the funds can be used, potentially helping families save for various aspects of their children’s future.

How will the SALT deduction changes affect homeowners?

The OBBBA temporarily increases the state and local tax (SALT) deduction cap from ,000 to ,000 for five years, after which it reverts to ,000. This primarily benefits homeowners in high-tax states like New York, California, and New Jersey. Families with homes in these areas could see significant tax savings, particularly if they have high property taxes. However, the benefit phases out for individuals making over 0,000 annually, and its temporary nature creates uncertainty for long-term financial planning.

Will families currently receiving SNAP benefits lose their food assistance?

Some families could lose SNAP benefits due to the expanded work requirements, which now apply to able-bodied adults ages 18-64 (previously 18-54). Parents with children under 10 are exempt. Additionally, states with error rates above 6% will need to contribute up to 15% of benefit costs, which could lead some states to tighten eligibility requirements. Families should check with their state SNAP office to understand how these changes might affect their specific situation.

How does the bill affect immigrant families?

The OBBBA includes several provisions specifically affecting immigrant families. It requires a five-year waiting period for green card holders before they can apply for Medicaid, reduces premium tax credits for immigrants, and establishes a 1% tax on remittances (money sent abroad). Legal immigrant families will still be eligible for general tax benefits like the child tax credit if they meet the qualifying criteria, but may face additional barriers to accessing healthcare and other benefits.

What happens to the SALT deduction after five years?

After five years, the state and local tax (SALT) deduction cap will revert from ,000 back to ,000. This means that homeowners in high-tax states will see a significant reduction in their tax deductions after this period. The temporary nature of this provision creates uncertainty for long-term financial planning and could affect housing markets in high-tax areas as the expiration date approaches.

How will the bill affect college affordability for families?

The OBBBA makes several changes affecting college affordability. It caps student loans for graduate students at ,500 annually and 0,000 lifetime, while limiting professional degree loans to ,000 annually and 0,000 lifetime. It also adds a 7,000 lifetime borrowing limit. The Trump Accounts provide a new savings vehicle for education, but the bill also increases taxes on college endowments, which could affect financial aid availability at some institutions. Families should reassess their college financing strategies in light of these changes.

Will the tip and overtime tax exemptions expire?

Yes, the tax exemptions for tips and overtime pay are scheduled to expire in 2028. This temporary nature means that families benefiting from these provisions should plan accordingly and not assume these tax advantages will be permanent. As with many temporary tax provisions, there could be future legislation to extend them, but this is not guaranteed.

Have More Questions?

Our team of policy experts continues to analyze the OBBBA and its implications for families. Subscribe to our newsletter for ongoing updates and answers to your questions.

Key Takeaways: Preparing Your Family for the Changes Ahead

The One Big Beautiful Bill Act represents a significant shift in how government policy intersects with family life in America. Its impacts will vary widely depending on family structure, income level, geographic location, and specific circumstances. As implementation begins, families should consider several key points:

Figure 11: Families should proactively plan for the policy changes ahead

- Tax planning is essential. With permanent extensions of tax rates but temporary provisions for SALT deductions and tip/overtime exemptions, families should work with tax professionals to optimize their situation.

- Healthcare coverage may require new navigation. Families currently relying on Medicaid should understand the new work requirements and exemptions, and potentially explore alternative coverage options.

- Educational savings strategies should be reassessed. The new Trump Accounts offer additional options for educational savings, while student loan changes may affect college financing strategies.

- Benefit eligibility may change. Families receiving SNAP or other benefits should stay informed about changing requirements and prepare accordingly.

- Regional variations will be significant. The bill’s impact will vary substantially based on state of residence, with particularly notable differences between high-tax and low-tax states.

As with any major legislation, the full impact of the OBBBA will emerge gradually as implementation proceeds and families, states, and institutions adjust to the new landscape. The bill represents not just a set of policy changes but a shift in philosophy about the relationship between government, families, and economic security.

“Beyond the specific provisions, this bill reflects fundamental questions about what supports families need to thrive, who should provide those supports, and how we balance immediate benefits against long-term sustainability. These are questions that transcend partisan politics and speak to our shared values about family, community, and opportunity in America.”

As you consider how the OBBBA might affect your own family, the key question isn’t simply whether you’ll pay more or less in taxes, but how these changes align with your family’s long-term goals, values, and needs. Is your family better positioned for economic security under this new framework? What adjustments might you need to make to navigate the changing landscape of benefits, tax incentives, and savings options?

The answers will be as diverse as American families themselves, reflecting the complex interplay between policy, personal circumstances, and the ongoing evolution of family life in America.

Prepare Your Family for the Changes Ahead

Get our comprehensive Family Policy Guide, with detailed analysis of the OBBBA’s impacts and actionable strategies for navigating the changes.