Declining Labor Force Participation: How It Could Impact the U.S. Economy in 2026 and Beyond

A quiet transformation is reshaping the American economy. Across the nation, fewer adults are choosing to work or actively seek employment. This shift represents one of the most significant economic threats facing the United States as we move toward 2026 and beyond.

The labor force participation rate measures the percentage of adults who are either employed or actively looking for work. Recent data from the Bureau of Labor Statistics shows this rate hovering near historic lows. This matters because when fewer people participate in the workforce, the entire economic engine slows down.

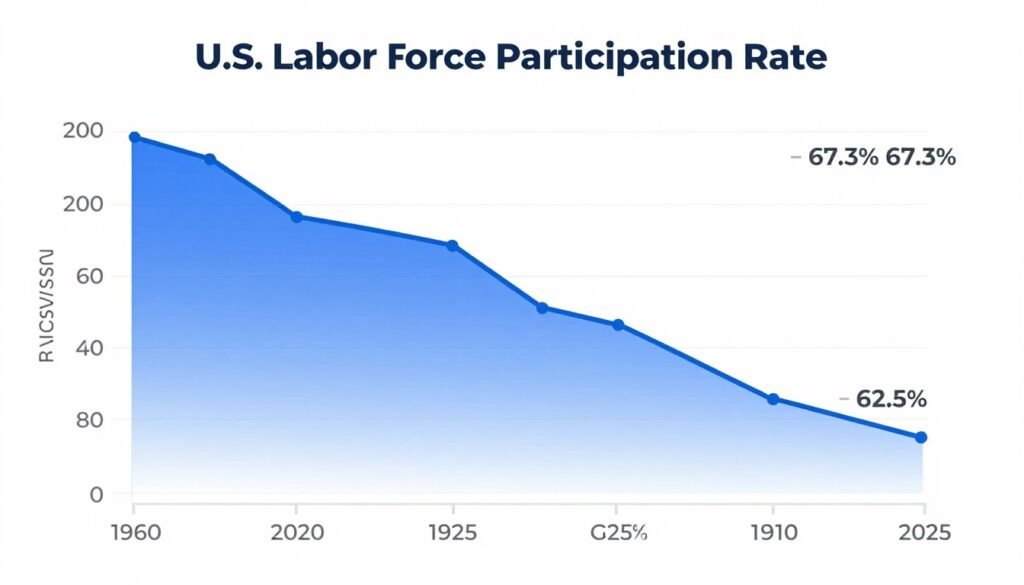

In early 2025, the labor force participation rate stands at approximately 62.5 percent. That figure sits well below the pre-pandemic level of 63.3 percent recorded in February 2020. More concerning, it remains far from the peak of 67.3 percent reached in early 2000. These numbers translate into millions of Americans who could be working but are not.

Related insight: Understanding how demographic shifts connect to workforce trends helps explain broader economic patterns. Explore the root causes driving this participation decline below.

The implications extend beyond simple employment statistics. When labor force participation declines, businesses struggle to find workers. Economic growth slows. Tax revenues decrease. Social programs face funding pressures. The ripple effects touch nearly every aspect of American life.

This article examines the multi-layered threat of declining labor force participation. We will explore its causes, measure its impact across different sectors of the economy, and discuss what it means for your financial future. The data paints a sobering picture, but understanding the challenge represents the first step toward addressing it.

What Is This Economic Threat?

Labor force participation represents the share of the population aged 16 and older who are either working or actively searching for work. The Bureau of Labor Statistics calculates this rate monthly through the Current Population Survey. This metric serves as a vital sign for economic health.

The participation rate differs from the unemployment rate. Unemployment measures only those actively seeking work who cannot find jobs. The labor force participation rate captures a broader picture. It includes everyone who wants to work, whether employed or unemployed. Critically, it excludes those who have stopped looking for work entirely.

Historical Context of Labor Force Participation Rates

The story of American labor force participation spans several decades. The rate climbed steadily from the 1960s through the late 1990s. This growth reflected two major trends. More women entered the workforce during this period. Baby boomers reached their peak working years.

The participation rate peaked at 67.3 percent in January 2000. Since then, it has declined steadily. The Great Recession accelerated this trend. Many workers left the labor force during the economic downturn. Unlike previous recessions, many never returned.

The COVID-19 pandemic created another sharp drop. The rate fell to 60.2 percent in April 2020. While it has recovered somewhat, it remains below pre-pandemic levels. This sustained decline represents more than a temporary shock. It signals structural changes in the American economy.

Key Statistics Defining the Current Landscape

The current labor force participation rate tells only part of the story. Breaking down the data by demographic groups reveals deeper patterns. Men have experienced the steepest long-term decline. Their participation rate dropped from 86.4 percent in 1950 to approximately 67.9 percent today.

Women’s participation rate grew dramatically through the late 1990s. It climbed from 33.9 percent in 1950 to a peak of 60.3 percent in 1999. Since then, it has plateaued and slightly declined. As of 2025, women’s participation stands near 56.5 percent.

Age plays a crucial role in participation trends. Workers aged 25 to 54, considered prime working age, show participation rates around 83 percent. This marks a decline from pre-pandemic levels. Older workers aged 55 and above show lower rates. Their participation has actually increased over time as people work longer before retirement.

Prime-Age Workers (25-54)

This demographic traditionally shows the highest participation rates. Recent data indicates approximately 83 percent participation. This group faces unique pressures including childcare costs and caregiving responsibilities.

Older Workers (55+)

Participation among older adults has risen over recent decades. Many delay retirement due to financial necessity. However, health concerns and aging population dynamics create downward pressure on overall workforce participation.

Young adults aged 16 to 24 show participation rates near 55 percent. Many in this age group attend college full-time. The percentage of young people enrolled in higher education affects this statistic significantly. Educational pursuits remove millions from the immediate labor pool.

Geographic variation adds another layer of complexity. States show different participation patterns. The Midwest and Mountain West regions typically report higher rates. Coastal states, particularly those with higher costs of living, sometimes show lower participation among certain age groups.

The Current Population Survey, conducted monthly by the Bureau of Labor Statistics, provides the foundation for these measurements. The survey reaches approximately 60,000 households. It asks detailed questions about employment status and job-seeking activities. This data collection method has remained consistent for decades, allowing reliable trend analysis.

What Is Causing the Problem?

Multiple forces converge to drive down labor force participation. No single factor explains the entire trend. Instead, demographic shifts, policy choices, market changes, and structural transformations each contribute to the decline. Understanding these causes helps predict future trajectories.

Policy Factors Influencing Workforce Participation

- Disability Insurance Expansion: The Social Security Administration has expanded disability insurance programs over recent decades. More adults now qualify for benefits. Once enrolled in disability programs, few people return to work. This creates permanent exits from the labor force.

- Early Retirement Incentives: Federal and state policies sometimes encourage early retirement. Social Security benefits become available at age 62. Many workers claim benefits before reaching full retirement age. These policy structures influence workforce exit timing.

- Childcare Policy Gaps: The United States lacks comprehensive childcare support compared to other developed nations. High childcare costs force many parents, particularly mothers, to leave the workforce. The absence of paid family leave policies compounds this challenge.

- Education Loan Programs: Expanded access to student loans enables more young adults to attend college full-time. While education provides long-term benefits, it temporarily removes millions from the labor force. Extended time in higher education delays workforce entry.

- Healthcare Coverage Changes: The Affordable Care Act decoupled health insurance from employment for millions. Some workers near retirement age chose to leave jobs earlier knowing they could access healthcare coverage. This policy change influenced participation timing for older workers.

Market Trends Reshaping Employment

- Wage Stagnation Effects: Real wages for many workers have grown slowly over the past two decades. When work does not provide sufficient income to cover rising costs, some people question whether employment makes financial sense. Low wages particularly affect participation among lower-skilled workers.

- Automation and Technology: Technology has eliminated certain job categories entirely. Workers displaced by automation face difficult transitions. Some lack skills needed for available jobs. Others become discouraged and stop searching. The pace of technological change accelerates workforce disruption.

- Gig Economy Growth: The rise of gig work and contract employment changes how people relate to traditional employment. Some workers cobble together multiple part-time opportunities rather than seeking full-time work. This fragmentation affects how labor statistics capture actual work patterns.

- Housing Market Dynamics: High housing costs in job-rich metropolitan areas create barriers. Workers cannot afford to live near available jobs. Geographic mismatches between workers and opportunities reduce participation. This challenge has intensified in recent years.

- Remote Work Evolution: The COVID-19 pandemic accelerated remote work adoption. While this opened opportunities for some, it also enabled others to retire early or reduce work hours. The flexibility of remote work changed calculations about workforce participation for many adults.

Global Influences on American Workforce Trends

- International Competition: Globalization shifted many manufacturing jobs overseas. Communities built around specific industries faced mass layoffs. Displaced workers often struggled to find comparable employment. These global market forces permanently altered regional labor markets.

- Trade Policy Impacts: Trade agreements and international economic integration affected American industries unevenly. Some sectors thrived while others contracted. Workers in declining industries faced difficult adjustments. Geographic concentration of these effects intensified local participation declines.

- Immigration Policy Changes: Immigration provides workforce replenishment in aging societies. Restrictive immigration policies limit this source of labor force growth. The Organization of the Petroleum Exporting Countries and other international dynamics affect economic conditions that influence workforce participation.

- Pandemic Effects: The COVID-19 pandemic created worldwide economic disruption. International supply chain breakdowns affected American businesses. Global health concerns changed how people thought about work and risk. These international events had direct domestic workforce participation consequences.

- International Remote Work: Globalization of remote work enables companies to hire workers anywhere. This creates new competition for American workers. It also provides opportunities but changes traditional employment dynamics in complex ways.

Structural Economic Changes Driving Long-Term Trends

- Demographic Aging: The aging of the baby boomer generation represents the single largest structural driver. As this massive cohort reaches retirement age, millions exit the workforce permanently. This demographic wave creates sustained downward pressure on participation rates that will continue through 2030.

- Educational Attainment Shifts: Higher college enrollment rates delay workforce entry. Graduate degree pursuit extends this delay further. While education enhances long-term productivity, it reduces current labor force participation. The share of young adults in college has grown significantly over recent decades.

- Healthcare Cost Escalation: Rising healthcare costs affect workforce decisions in multiple ways. Expensive treatments and chronic conditions force some workers into early disability retirement. High premiums consume wages, reducing work incentives. Healthcare economics intertwine with participation patterns.

- Family Structure Changes: American families have evolved. More single-parent households face unique childcare challenges. Changes in household composition affect workforce participation differently across demographic groups. These structural shifts create new barriers to employment for many adults.

- Wealth Accumulation Patterns: Some Americans accumulated significant wealth through real estate appreciation and stock market gains. This wealth enables earlier retirement for fortunate households. Growing wealth inequality means these effects distribute unevenly across the population.

- Criminal Justice System Impact: The United States has high incarceration rates. Criminal records create lasting employment barriers. Millions of adults with past convictions struggle to find work. They often drop out of active job searching. This represents a structural barrier affecting participation rates.

- Mental Health Challenges: Rising rates of depression, anxiety, and substance abuse affect workforce participation. Mental health conditions and addiction create barriers to sustained employment. The opioid crisis particularly impacted prime-age male participation in certain regions.

These factors interact in complex ways. Demographic aging creates the clearest long-term trend. Policy choices either mitigate or accelerate demographic effects. Market forces and structural changes layer additional pressures. No single solution can address all these drivers simultaneously.

The Congressional Budget Office projects continued gradual decline in labor force participation through 2030. Their models account for continued baby boomer retirement and other demographic trends. Without significant policy interventions or unexpected economic shifts, the downward trajectory appears likely to continue.

Impact on the U.S. Economy

Declining labor force participation sends shock waves through every corner of the American economy. The effects compound over time. What begins as a workforce shortage evolves into constrained growth, altered inflation dynamics, and fundamental shifts in how the economy functions.

GDP Growth Implications

Economic growth depends fundamentally on two factors. The size of the workforce and the productivity of each worker determine overall output. When labor force participation falls, fewer workers produce goods and services. This directly constrains gross domestic product growth potential.

The Congressional Budget Office estimates that a one percentage point decline in labor force participation reduces potential GDP growth by approximately 0.5 to 0.7 percentage points annually. With participation several points below early 2000s levels, billions of dollars in potential economic output evaporate each year.

Consider the mathematics. The current working-age population exceeds 260 million people. A one percent decline in participation means 2.6 million fewer workers. If each worker produces $80,000 in annual economic value on average, that represents over $200 billion in lost output.

The International Monetary Fund has highlighted labor force participation as a key factor in long-term U.S. growth prospects. Their analysis suggests participation trends could reduce potential GDP growth by 0.2 to 0.3 percentage points annually through 2030. Over a decade, this compounds into trillions of dollars in foregone economic activity.

Short-Term Growth Effects

Immediate impacts include labor shortages in key industries. Businesses cannot expand production to meet demand. This constrains economic growth even when consumer spending remains strong. The economy operates below its potential capacity.

Service sector businesses particularly feel these constraints. Restaurants, healthcare facilities, and retail establishments struggle to maintain operations. Reduced hours and limited services become common. These operational constraints directly reduce GDP.

Long-Term Growth Trajectory

Sustained participation decline creates persistent growth drag. The economy settles into a lower growth path. This affects everything from government revenue projections to business investment decisions. Lower growth becomes the new normal.

Demographic trends suggest this challenge will intensify. Baby boomer retirement continues through 2030. Unless participation among other age groups rises significantly, overall rates will likely decline further. This structural headwind to growth appears difficult to reverse.

Inflation Dynamics and Price Pressures

Labor shortages drive wage increases as employers compete for limited workers. Higher wages represent a production cost that businesses pass along through price increases. This creates inflationary pressure throughout the economy.

The relationship between labor scarcity and inflation operates through multiple channels. Direct wage-price spirals occur when rising labor costs push up prices. Reduced production capacity limits supply while demand remains constant. This supply-demand imbalance elevates prices.

Recent inflation surges partly reflect tight labor markets. The Federal Reserve has noted workforce shortages as a factor in persistent inflation. When participation rates decline, the economy can sustain fewer workers at any given unemployment rate before inflation accelerates.

The Bureau of Labor Statistics data shows wages growing faster in recent years than the previous decade. This wage growth reflects both economic recovery and fundamental labor scarcity. While higher wages benefit workers, they also contribute to broader inflation when productivity gains do not match wage increases.

Inflation affects different Americans unequally. Those on fixed incomes face particular hardship as prices rise. Retirees and disability recipients often see purchasing power decline. The labor force participation decline thus indirectly harms those already outside the workforce.

Employment Market Transformation

The nature of work itself changes when labor force participation declines. Employers adapt to workforce scarcity in multiple ways. These adaptations reshape the employment landscape fundamentally.

Businesses invest more heavily in automation when workers become scarce. Technology substitutes for human labor. While this enhances productivity, it also means certain jobs disappear permanently. The acceleration of automation creates a feedback loop that further discourages workforce participation among displaced workers.

Worker bargaining power increases in tight labor markets. Employees can demand higher wages, better benefits, and improved working conditions. This represents a positive development for workers who remain in the labor force. However, it also creates challenges for small businesses operating on thin margins.

Notable Employment Shifts

Several industries face acute worker shortages. Healthcare needs millions of additional workers to serve an aging population. Construction struggles to attract young workers. Manufacturing cannot fill skilled positions. These sector-specific shortages constrain economic activity in critical areas.

Part-time work and flexible arrangements become more common. Employers offer creative schedules to attract workers. While flexibility helps some people participate in the workforce, it also fragments traditional employment relationships. This complicates how we measure and understand work patterns.

Unemployment rates tell an incomplete story when participation declines. The economy can show low unemployment while millions of potential workers remain sidelined. This paradox confuses policy discussions. Traditional metrics provide less useful guidance when participation trends diverge from historical patterns.

Financial Markets Response

Stock markets react to labor force participation trends through multiple pathways. Corporate profitability faces pressure from rising wage costs. Companies in labor-intensive industries particularly feel this squeeze. Lower profit margins can depress stock valuations.

Economic growth prospects shape market valuations fundamentally. When analysts and investors conclude that participation decline will constrain long-term growth, they adjust expectations downward. Lower growth projections translate into reduced stock valuations across the market.

Interest rates move in response to labor market tightness. The Federal Reserve raises rates to combat inflation driven by wage pressures. Higher interest rates increase borrowing costs for businesses and consumers. Stock markets typically decline when interest rates rise significantly.

Bond markets price in long-term growth expectations. Persistent participation decline suggests lower potential growth decades into the future. This affects long-term bond yields and shapes the entire yield curve. Fixed income markets thus reflect workforce participation trends in subtle but important ways.

Equity Market Impacts

- Technology companies benefit from automation demand

- Labor-intensive sectors face margin compression

- Growth stock valuations adjust to lower GDP forecasts

- Dividend yields rise as growth expectations moderate

Fixed Income Considerations

- Long-term yields decline with growth prospects

- Inflation expectations embed wage pressure assumptions

- Federal Reserve policy path becomes less predictable

- Corporate bond spreads widen for struggling sectors

Real estate markets respond to demographic and workforce shifts. Housing demand patterns change as population aging accelerates. Commercial real estate faces challenges as remote work reduces office space needs. These property market adjustments reflect underlying participation trends.

Consumers and Businesses Navigate New Realities

Consumer spending patterns shift when fewer adults work. Household incomes stagnate or decline when earners exit the workforce. This reduces purchasing power and constrains consumer spending growth. Since consumer spending drives approximately 70 percent of U.S. GDP, these effects ripple broadly.

Households with adults who leave the labor force face difficult adjustments. Living standards may decline. Retirement savings prove insufficient. Family members compensate by working more hours or delaying their own retirement. These individual hardships aggregate into broader economic effects.

Young adults face unique challenges. They enter a workforce shaped by demographic changes beyond their control. Career advancement opportunities may expand as experienced workers retire. However, they also inherit the economic consequences of lower growth and stressed social programs.

Business planning becomes more complex when workforce availability proves uncertain. Companies struggle to forecast labor costs and availability. This uncertainty discourages investment and expansion. Businesses may relocate to areas with better workforce availability, creating regional economic disruption.

Small businesses face particular challenges. They cannot offer compensation packages that compete with large corporations. Many small enterprises operate in sectors requiring physical presence and human interaction. These businesses find adaptation to workforce scarcity especially difficult.

Supply chain reliability suffers when labor shortages create production bottlenecks. Manufacturing delays cascade through the economy. Service delivery becomes less consistent. These operational challenges reduce overall economic efficiency and productivity growth.

Recent Data and Trends

Current data from the Bureau of Labor Statistics provides a detailed snapshot of labor force participation as we move through 2025. The numbers reveal both continuity with long-term trends and some unexpected developments worth examining closely.

Latest Labor Force Participation Statistics

The overall labor force participation rate stood at 62.5 percent in early 2025. This represents a slight uptick from the 62.3 percent recorded six months earlier. However, the modest increase provides little comfort. The rate remains 0.8 percentage points below pre-pandemic levels and more than four percentage points below the year 2000 peak.

Breaking down participation by gender reveals diverging trends. Men’s participation rate registers at 67.9 percent. This continues a multi-decade decline from over 86 percent in the 1950s. The trend shows no signs of reversing. Each year, more men leave the workforce than enter it.

Women’s participation tells a more complex story. The rate currently sits near 56.5 percent. After decades of increases through the 1990s, women’s participation has plateaued. The COVID-19 pandemic created a sharp drop as childcare responsibilities fell disproportionately on mothers. Recovery has been gradual and incomplete.

Prime-age workers between 25 and 54 show participation rates around 83 percent. This demographic traditionally exhibits the highest workforce attachment. Their participation has recovered better than other age groups following the pandemic. However, the rate still trails the 84.3 percent recorded in February 2020.

Younger workers aged 16 to 24 participate at approximately 55 percent. College enrollment explains much of this lower rate. The National Center for Education Statistics reports that about 40 percent of high school graduates immediately enroll in four-year colleges. Many others attend community colleges or trade programs. Educational pursuits delay workforce entry for millions of young adults.

Older adults show the most interesting trend reversal. Workers aged 55 and above have seen rising participation rates over recent decades. Financial necessity drives many to work longer. Healthcare costs and insufficient retirement savings compel continued employment. The participation rate for this age group now exceeds 38 percent, up from below 30 percent in the 1990s.

Government and Institutional Data Sources

The Bureau of Labor Statistics remains the authoritative source for labor force participation data. Their monthly Current Population Survey interviews approximately 60,000 households. Questions cover employment status, job-seeking activities, and reasons for not working. This survey methodology has remained consistent for decades, ensuring reliable trend comparisons.

The Congressional Budget Office publishes regular analyses of labor force trends. Their February 2025 report projects continued gradual decline in participation through 2030. The CBO estimates the participation rate will fall to approximately 61.3 percent by decade’s end. Demographic aging drives most of this projected decline.

The U.S. Department of the Treasury incorporates labor force participation projections into long-term budget forecasts. Lower participation reduces tax revenue while increasing pressure on social programs. Treasury analysis highlights the fiscal consequences of participation decline. Their models suggest significant budget challenges emerge after 2030 as demographic pressures intensify.

The Federal Reserve tracks participation closely as part of its dual mandate to maximize employment. Fed economists have published extensive research on participation trends. Their analysis informs monetary policy decisions. Chair Jerome Powell has repeatedly cited workforce participation as a key economic indicator deserving attention.

The International Monetary Fund provides comparative international context. IMF data shows the United States lags peer nations in prime-age male participation. Countries like Germany, Japan, and Canada show higher participation rates among men aged 25 to 54. This suggests room for improvement through policy interventions.

The World Bank tracks global workforce trends. Their analysis places U.S. participation decline within broader international patterns. Many developed economies face similar demographic challenges. However, the U.S. decline appears more pronounced than in comparable nations. Policy differences help explain some of this gap.

Regional and Demographic Variations

Labor force participation varies significantly across American states. The Midwest traditionally shows higher participation rates. States like Minnesota, Nebraska, and Iowa consistently rank near the top. Participation rates in these states exceed 67 percent.

Southern states show more mixed patterns. Some, like Georgia and Texas, report participation near national averages. Others, particularly West Virginia and Mississippi, show rates well below 60 percent. Economic conditions, educational attainment, and health factors all contribute to these regional differences.

Coastal states present an interesting paradox. California’s participation rate sits near 62 percent, slightly below the national average. New York reports similar figures. High costs of living in these states may discourage some potential workers. However, these states also attract educated workers, creating complex offsetting effects.

| Region | Participation Rate | Change from 2020 | Prime Factor |

| Northeast | 63.1% | -0.7% | Aging population, high costs |

| Midwest | 64.8% | -0.4% | Strong work culture, manufacturing |

| South | 61.7% | -0.9% | Health challenges, education gaps |

| West | 62.9% | -0.6% | Cost of living, immigration patterns |

Educational attainment correlates strongly with labor force participation. Adults with bachelor’s degrees participate at rates exceeding 75 percent. Those with only high school diplomas show participation near 60 percent. High school dropouts participate at rates below 50 percent. Education thus emerges as a powerful predictor of workforce attachment.

Race and ethnicity show persistent participation gaps. Asian Americans report the highest participation rates among racial groups. White Americans show rates near the national average. Black Americans historically showed lower participation, though gaps have narrowed somewhat. Hispanic Americans show participation rates that vary significantly by immigrant generation and education level.

Emerging Trends Worth Monitoring

Several developing patterns deserve attention as we look toward 2026 and beyond. Remote work continues evolving in ways that affect participation. Some workers who left the labor force during the pandemic have re-entered through remote opportunities. Others have used remote work flexibility to reduce hours or semi-retire. The net effect remains uncertain.

Mental health challenges appear increasingly prominent in participation discussions. Rates of anxiety and depression rose during the pandemic. Substance abuse continues affecting certain communities severely. The opioid crisis particularly impacted prime-age male participation in Appalachia and parts of the Midwest. Addressing these health challenges may prove crucial to reversing participation decline.

Automation acceleration creates both opportunities and threats. Technology enables some people with disabilities to work remotely. It also eliminates jobs that previously provided entry points to employment. The balance between these effects will shape future participation patterns.

Immigration policy significantly affects labor force growth. The United States has historically relied on immigration to supplement workforce growth. Restrictive policies since 2016 reduced this source of labor supply. Any policy changes could materially impact future participation trends and overall workforce size.

Climate change may emerge as an unexpected factor. Extreme weather events disrupt local economies and displace workers. Heat stress makes outdoor work more difficult and dangerous. These environmental pressures could affect participation in unexpected ways over coming decades.

Expert Opinions or Forecasts

Leading economists and policy analysts have studied labor force participation decline extensively. Their projections range from cautiously optimistic to deeply concerned. Understanding these expert perspectives helps frame realistic expectations about future economic trajectories.

Congressional Budget Office Projections

The Congressional Budget Office publishes the most comprehensive official projections. Their baseline forecast anticipates continued gradual participation decline through 2030. The CBO projects the rate will fall to approximately 61.3 percent by decade’s end. This represents another 1.2 percentage point drop from current levels.

CBO analysts attribute most of this decline to demographic factors. Baby boomer retirement continues as the large cohort born between 1946 and 1964 reaches traditional retirement ages. By 2030, all baby boomers will exceed age 65. This demographic wave creates inexorable downward pressure on participation rates.

The CBO model incorporates several offsetting factors. Rising educational attainment among younger cohorts should boost participation. Improvements in health and longevity enable people to work longer. However, these positive factors prove insufficient to overcome demographic headwinds. The net effect remains negative through 2030.

Beyond 2030, CBO projections show stabilization. As the baby boom retirement wave completes, demographic pressures should moderate. The agency projects participation will level off near 61 percent in the 2030s. This assumes no major policy changes or unexpected economic shocks.

Federal Reserve Analysis

Federal Reserve economists approach participation from a monetary policy perspective. They focus on how participation affects inflation and employment dynamics. Fed research suggests the decline creates a tighter relationship between unemployment and inflation than existed in previous decades.

Fed Chair Jerome Powell has described labor force participation as a key economic challenge. In congressional testimony, he noted that lower participation constrains economic growth potential. The Fed’s own staff projects participation will remain below pre-pandemic levels throughout 2025 and 2026.

Some Fed researchers see potential for participation recovery among certain groups. Prime-age women who left during the pandemic might return if childcare availability improves. Older workers might extend careers if health outcomes improve. However, these optimistic scenarios require significant policy interventions or favorable trends.

The Federal Reserve Bank of Atlanta maintains a Labor Force Participation Dynamics tool. This interactive model allows users to explore how different demographic assumptions affect overall participation. The tool illustrates how sensitive aggregate participation is to changes in specific demographic groups.

Academic Economist Perspectives

University researchers have published hundreds of papers examining participation trends. MIT economist David Autor has studied how automation and trade affected male participation particularly. His research links manufacturing job losses to declining participation among non-college-educated men. These displaced workers often never re-enter the workforce.

Princeton economist Alan Krueger conducted influential research before his death in 2019. He documented how the opioid crisis contributed to prime-age male participation decline. Krueger estimated that prescription opioid proliferation explained 20 to 25 percent of the participation drop among prime-age men between 1999 and 2015.

Harvard economist Raj Chetty has examined geographic variation in economic mobility and workforce participation. His research shows that children growing up in areas with low participation rates face diminished economic prospects. This suggests participation decline creates intergenerational effects that compound over time.

“The decline in labor force participation represents one of the most significant economic challenges facing the United States. Without policy interventions, we face a future of slower growth and increased fiscal stress.”

Former Treasury Secretary Lawrence Summers has been particularly vocal about participation decline. He argues that weak labor force growth constrains economic potential in fundamental ways. Summers advocates for policies to encourage workforce participation, including expanded childcare support and improved disability program design.

International Perspectives

The International Monetary Fund has compared U.S. participation trends to peer nations. IMF analysis shows the United States lags comparable countries in prime-age male participation. Many European nations show participation rates several percentage points higher among men aged 25 to 54. This gap suggests U.S. policy choices contribute to the problem.

The Organization for Economic Cooperation and Development tracks participation across member nations. Their data shows the U.S. ranks in the middle of developed nations overall. However, when focusing on prime-age adults, the U.S. position looks weaker. Countries with better childcare support, healthcare access, and education systems show stronger participation.

Japanese economists offer particularly relevant insights. Japan faced demographic aging earlier than the United States. Japanese policymakers implemented various measures to boost participation, including childcare expansion and flexible work arrangements. These interventions achieved modest success. U.S. observers study Japanese experience for applicable lessons.

Market Outlook and Investment Implications

Wall Street analysts incorporate participation trends into long-term forecasts. Goldman Sachs published analysis suggesting participation decline will reduce potential GDP growth by 0.2 to 0.3 percentage points annually through 2030. This implies significantly lower stock market returns than historical averages.

Morgan Stanley economists take a somewhat more optimistic view. They suggest automation and productivity gains might offset workforce constraints. If technology enables remaining workers to produce more output per hour, GDP growth could remain robust despite fewer workers. This scenario requires sustained productivity acceleration.

BlackRock’s investment institute has examined demographic trends extensively. Their analysis emphasizes the fiscal consequences of participation decline. Lower workforce participation reduces tax revenue while increasing social program spending. This creates growing budget deficits that eventually affect financial markets through higher interest rates.

Optimistic Scenario

Key Assumptions:

- Productivity growth accelerates to 2.5% annually

- Immigration policy reforms add workers

- Childcare investments bring women back

- Health improvements extend working years

Outcome: Participation stabilizes near 62.5%, GDP growth averages 2.5%

Pessimistic Scenario

Key Assumptions:

- Productivity growth remains below 1.5%

- Automation displaces more workers

- Health crises worsen (opioids, mental health)

- No major policy interventions

Outcome: Participation falls below 61%, GDP growth averages 1.5%

Risk Level Assessment

Synthesizing these expert perspectives yields a clear risk assessment. The threat posed by declining labor force participation rates as Medium to High on a comprehensive risk scale.

The rating reflects several factors. The trend appears firmly established with demographic drivers that cannot be easily altered. Baby boomer retirement will continue regardless of policy choices. This creates certainty about near-term downward pressure on participation rates.

However, the threat does not reach the highest risk category. The decline occurs gradually over years and decades rather than as a sudden crisis. This provides time for adaptation and policy responses. The economy can adjust slowly to lower workforce growth through automation, immigration, and productivity improvements.

The geographic and demographic concentration of participation challenges also affects risk assessment. Some regions and groups show stable or rising participation. This heterogeneity means targeted interventions might achieve significant results. Universal programs may prove unnecessary.

Financial market stability does not appear immediately threatened. Participation decline creates headwinds for growth and profits but does not trigger financial crises directly. Markets can adjust to lower growth expectations gradually. This differs from acute risks like banking crises or sovereign debt defaults.

The greatest risks emerge in the fiscal realm. Social Security and Medicare face funding pressures as the ratio of workers to beneficiaries declines. These programs require reform to remain solvent long-term. Political gridlock could prevent necessary adjustments, creating fiscal crisis risk in the 2030s.

For individual Americans, the risk level varies considerably. Workers with in-demand skills face minimal direct risk. Labor scarcity may actually improve their bargaining position and wages. However, workers displaced by automation or lacking education face significant challenges. Vulnerable populations bear disproportionate risk.

Free Resource: Economic Preparedness Guide

Understanding labor force participation is just the beginning. Get your comprehensive 23-page guide with actionable strategies to protect your finances during workforce volatility. Learn specific steps you can take today to safeguard your economic future.

- How to position your career in a changing labor market

- Investment strategies for slower growth environment

- Retirement planning adjustments you need to consider

- Real estate decisions in demographic transition

Possible Solutions or Policy Responses

Reversing or even stabilizing labor force participation decline requires coordinated action across multiple policy domains. No single intervention can address all the factors driving participation down. However, a comprehensive approach could significantly improve outcomes and mitigate economic consequences.

Government Actions to Boost Participation

Federal policymakers possess several tools to influence workforce participation. Implementing these measures requires political will and substantial public investment. The potential economic returns justify the costs if policies succeed in bringing more Americans into the workforce.

Childcare Investment and Support

Expanding affordable childcare represents the highest-impact intervention available. Research consistently shows that childcare costs prevent many parents, especially mothers, from working. Countries with universal childcare show significantly higher female labor force participation rates.

A federal childcare program modeled on public education could transform participation. Providing free or heavily subsidized care for children under age five would enable millions of parents to return to work. The Congressional Budget Office estimates such a program might cost $150 billion annually. However, increased tax revenue from additional workers could offset much of this expense.

The current child tax credit provides some support but proves insufficient. Direct childcare provision or vouchers would more effectively address the barrier. Several European nations demonstrate how comprehensive childcare systems boost participation while supporting child development.

Disability Program Reform

Social Security disability programs require careful redesign. Current rules create strong disincentives to return to work. Once enrolled in disability insurance, beneficiaries risk losing all benefits if they attempt employment. This all-or-nothing structure traps people in dependency.

Gradual benefit reduction as earned income rises would help. Allowing disabled individuals to work part-time while maintaining partial benefits could increase participation. Several demonstration programs have tested this approach with promising results. Broader implementation could bring hundreds of thousands back into the workforce.

Improved medical screening might also help. Some disability awards go to individuals with conditions that modern accommodations and treatments could address. Better assessment processes combined with return-to-work support could prevent unnecessary workforce exits.

Immigration Policy Modernization

Immigration provides the most direct path to workforce expansion. The United States has historically relied on immigration to supplement domestic workforce growth. Reforms that increase legal immigration, especially of working-age adults, would directly boost participation rates.

A comprehensive immigration reform package might include multiple elements. Expanding employment-based visa categories would help. Creating paths to legal status for unauthorized immigrants already in the country would formalize existing workforce participation. These changes face political obstacles but command support from business groups and many economists.

The U.S. Department of the Treasury has noted that immigration represents a key variable in long-term fiscal projections. Higher immigration levels improve the worker-to-beneficiary ratio for Social Security and Medicare. This fiscal benefit adds to the economic growth advantages of larger workforce.

Education and Training Investments

Better workforce preparation could boost participation among those currently outside the labor market. Many non-participants cite lack of skills or qualifications as reasons for not working. Expanded training programs could address these barriers.

Community college systems deserve enhanced funding. These institutions provide practical training aligned with local labor market needs. Expanding capacity and reducing costs would help more adults acquire marketable skills. Partnerships with employers ensure training matches actual job requirements.

Apprenticeship programs offer another promising avenue. Countries like Germany and Switzerland use apprenticeships extensively. These programs combine classroom learning with paid work experience. Young adults earn while learning, making training financially sustainable. Broader apprenticeship adoption in the United States could smooth school-to-work transitions.

Healthcare Access and Mental Health Services

Health barriers prevent many adults from working. Chronic conditions, disability, and mental health challenges keep millions on the sidelines. Improved healthcare access and treatment could enable more people to participate in the workforce.

The opioid crisis particularly demands attention. Communities devastated by addiction show dramatically lower participation rates. Expanded treatment capacity and harm reduction programs could help affected individuals return to employment. This public health challenge has clear economic dimensions.

Mental health parity in insurance coverage requires enforcement. Depression and anxiety increasingly appear as reasons people leave the workforce. Better mental health treatment access might prevent some workforce exits. Reducing stigma around mental health challenges would also help.

Federal Reserve Policies and Monetary Considerations

The Federal Reserve cannot directly increase labor force participation. Monetary policy tools work by influencing overall economic conditions rather than structural labor market factors. However, Fed decisions significantly affect the economic environment in which participation decisions occur.

Maintaining full employment without triggering excessive inflation represents the Fed’s contribution. When the economy operates near capacity, job opportunities proliferate. More available jobs with rising wages draw some people back into the workforce. The Fed’s interest rate policies aim to sustain this favorable environment.

However, Fed policy faces constraints when participation decline stems from structural factors. Monetary stimulus cannot address childcare costs, disability program design, or demographic aging. The Fed has acknowledged these limits. Chair Powell has called for fiscal policy action to address participation challenges beyond monetary policy reach.

The relationship between interest rates and participation creates complex tradeoffs. Very low interest rates might encourage early retirement among wealthy individuals living on investment income. Conversely, higher rates reduce business investment and job creation. Finding optimal policy balances competing considerations.

Market Adjustments and Private Sector Responses

Businesses adapt to labor scarcity through multiple strategies. These market-driven adjustments occur independently of government policy. While not solving the participation problem, they help the economy adjust to workforce constraints.

Wage Increases and Benefit Enhancements

Labor scarcity forces employers to offer better compensation. Wages have risen faster in recent years than the previous decade. This represents a positive development for workers. Higher pay draws some people back into employment and encourages longer careers.

Benefits improvements also help. Companies offer flexible schedules, remote work options, and better healthcare coverage. These enhancements make employment more attractive. Workers who previously felt pushed out by rigid workplace rules may return under more accommodating arrangements.

Signing bonuses and retention payments have become common. Businesses compete intensely for available workers. This competition benefits employees through improved terms. However, it also creates cost pressures that contribute to inflation.

Automation and Technology Adoption

Businesses invest in technology to substitute for scarce labor. Self-checkout systems, automated manufacturing, and artificial intelligence replace human workers in various tasks. This automation enhances productivity and reduces dependence on workforce availability.

Technology adoption creates both opportunities and challenges. Remaining workers often see productivity gains that justify higher wages. However, automation also eliminates jobs that previously provided employment for less-skilled workers. This displacement can discourage workforce participation among those replaced.

The net effect of automation on participation remains debated. Technology might enable some people with disabilities or caregiving responsibilities to work remotely. These positive effects could offset job displacement. The balance depends on how quickly displaced workers acquire new skills.

Organizational Restructuring

Companies redesign operations to function with fewer workers. This might involve simplifying product offerings, reducing service hours, or streamlining processes. Businesses accept these operational constraints to match available workforce.

Some establishments close locations or reduce capacity. This represents a real economic loss. The economy operates below potential when businesses cannot meet demand due to staffing limitations. These market adjustments illustrate the concrete costs of participation decline.

International Examples and Lessons

Other developed nations have confronted similar challenges. Their experiences offer valuable lessons for U.S. policymakers. No country has perfectly solved the participation puzzle, but some approaches show promise.

Nordic countries demonstrate how comprehensive family support boosts participation. Sweden, Denmark, and Norway combine generous parental leave, subsidized childcare, and flexible work arrangements. These nations show female participation rates five to ten percentage points higher than the United States.

Germany reformed its disability system in the 2000s. The country implemented graduated benefits and return-to-work support. These changes helped stabilize participation rates that had been declining. German experience suggests careful program design can mitigate disincentive effects.

Japan faces more severe demographic challenges than the United States. The country has encouraged older worker participation through age discrimination prohibitions and flexible retirement rules. Japanese companies increasingly employ workers into their seventies. This approach has partially offset demographic pressures.

Canada maintains higher immigration levels relative to population size. This choice directly supports workforce growth. Canadian policymakers explicitly view immigration as economic policy. Their point-based system prioritizes working-age immigrants with job skills.

What It Means for Americans

Economic statistics about labor force participation might seem abstract. However, these trends have concrete effects on daily life for millions of American families. Understanding the practical implications helps individuals prepare and adapt to changing economic realities.

Cost of Living Pressures

Declining labor force participation contributes directly to inflation and rising costs. When businesses cannot find enough workers, they raise wages to attract employees. These higher labor costs get passed to consumers through price increases. This wage-price dynamic affects virtually every purchase Americans make.

Grocery prices reflect workforce shortages throughout the supply chain. Farms struggle to hire agricultural workers. Food processing plants cannot maintain full production. Distribution networks face trucking shortages. Each bottleneck adds costs that appear at checkout counters.

Housing costs surge partly due to construction labor shortages. Builders cannot find enough skilled tradespeople. This constrains housing supply precisely when demand remains strong. Limited supply drives up both purchase prices and rents. Young adults find homeownership increasingly unaffordable.

Healthcare expenses rise as medical facilities compete for nurses and other staff. Hospitals offer signing bonuses and premium wages. Insurance companies pass these costs along through higher premiums. Americans face growing healthcare bills partly driven by workforce scarcity.

Service businesses operate with reduced hours or limited capacity. Restaurants close certain days or eliminate lunch service. Retail stores have fewer staff available to help customers. These service reductions represent hidden costs. Time spent waiting or dealing with limited options has real value.

Potential Benefits for Workers

- Higher wages as employers compete for talent

- Better benefits and working conditions

- More career advancement opportunities

- Greater workplace flexibility and remote options

- Increased worker bargaining power

Challenges for Households

- Rising costs across most goods and services

- Reduced availability of services

- Longer wait times for essential services

- Pressure on family caregivers

- Greater economic uncertainty

Employment and Career Implications

Workers who remain in the labor force often benefit from participation decline among others. Labor scarcity creates opportunities for those with skills and willingness to work. Understanding these dynamics helps individuals position themselves advantageously.

Job security improves when workers become scarce. Companies hesitate to lay off employees they struggled to hire. Recessions may cause fewer job losses when labor remains tight. This represents a significant shift from previous decades when worker abundance kept job security low.

Career advancement accelerates in tight labor markets. Companies promote from within when they cannot hire experienced workers externally. Younger workers gain opportunities that previous generations waited years to access. The condensed timeline for advancement benefits ambitious employees.

Wage growth sustains higher trajectories. Workers can demand raises knowing employers have limited alternatives. Job switching provides substantial pay increases. Those who remain in the workforce see compensation gains that outpace inflation.

However, career disruption poses greater risks for those who exit temporarily. Taking time off for caregiving or other reasons becomes more costly. Skills depreciate faster in rapidly changing fields. Re-entry proves difficult after extended absences. This particularly affects women who shoulder disproportionate caregiving responsibilities.

Automation threatens certain job categories even as overall labor shortages persist. Workers in routine occupations face displacement risk. Technology adoption accelerates when human workers prove expensive or unavailable. This creates a paradox where labor shortages coexist with job insecurity in specific roles.

Investment Portfolio Effects

Labor force participation trends influence investment returns across asset classes. Understanding these connections helps investors position portfolios appropriately for likely economic conditions.

Stock market returns may moderate as economic growth slows. Corporate earnings growth depends partly on overall economic expansion. When GDP growth declines due to workforce constraints, profit growth typically slows. This suggests lower equity returns than historical averages.

However, individual sectors respond differently. Technology companies benefit from automation demand. Healthcare businesses gain from aging demographics. Companies with strong pricing power can maintain margins despite wage pressures. Selective stock picking becomes more important in this environment.

Bond investments face competing pressures. Slower economic growth typically supports bonds as interest rates decline. However, inflation from labor shortages pushes rates higher. These offsetting forces create uncertainty about fixed income returns. Investors may need shorter duration positions to manage interest rate risk.

Real estate investments show mixed prospects. Residential real estate gains from housing shortages in desirable areas. However, demographic shifts alter demand patterns. Some regions may see declining populations as retirees relocate. Commercial real estate faces challenges from remote work trends. Property investors need careful market selection.

Alternative investments gain appeal in uncertain environments. Real assets like commodities provide inflation protection. Private equity offers access to companies adapting to labor scarcity. However, these investments require expertise and carry higher risks. Most investors should maintain diversified traditional portfolios.

Housing Market Dynamics

Labor force participation connects to housing markets in multiple ways. These relationships affect both homeowners and renters. Understanding the connections helps with residential real estate decisions.

Construction labor shortages constrain housing supply. This supports prices in areas with strong demand. Homeowners benefit from appreciation but find moving difficult when replacement housing proves expensive or unavailable. The lock-in effect intensifies as mortgage rates and prices rise.

Renting becomes relatively more expensive when construction lags. Landlords pass along rising costs while supply remains limited. Rent burden increases for many American households. This affects younger adults particularly hard as they struggle to save for down payments.

Geographic mobility declines when labor markets tighten everywhere. Workers historically moved to areas with better opportunities. However, when jobs exist broadly but workers prove scarce, migration incentives weaken. This reduced mobility can trap people in areas with limited economic prospects.

Multi-generational households become more common. Young adults delay moving out when housing costs surge. Elderly parents move in with children as caregiving needs increase. These arrangements help families manage costs but create crowding and privacy challenges.

Remote work partially decouples housing location from job location. This enables some workers to move to lower-cost areas. However, this flexibility concentrates among higher-income professionals. Many jobs still require physical presence. Geographic arbitrage opportunities remain limited for most Americans.

Retirement Planning Adjustments

Declining labor force participation creates significant retirement planning challenges. Both those nearing retirement and younger workers face affected by changing economic conditions and policy pressures.

Social Security faces growing financial stress. The ratio of workers to beneficiaries declines as participation falls and baby boomers retire. The Social Security Administration projects the trust fund will deplete by 2034 without reforms. This creates uncertainty about future benefit levels.

Individuals may need to save more for retirement given system uncertainties. Depending entirely on Social Security becomes riskier. Private retirement savings through 401(k) plans and IRAs gain importance. However, many Americans lack access to workplace retirement plans.

Working longer becomes necessary for many people. Financial advisors increasingly recommend delaying retirement to age 67 or beyond. This extended working period helps in multiple ways. It allows more saving time, delays claiming Social Security, and reduces years needing to fund from savings.

Healthcare costs in retirement require careful planning. Medicare faces similar financial pressures as Social Security. Supplemental insurance and out-of-pocket costs consume growing shares of retirement budgets. Planning for healthcare expenses becomes crucial for retirement security.

Part-time work in retirement grows more common. Many retirees return to work to supplement income or maintain social connections. Tight labor markets make finding suitable part-time employment easier. This trend helps individuals while modestly boosting participation rates.

Effects on Specific Demographic Groups

Labor force participation decline affects different Americans unequally. Understanding group-specific impacts helps target both personal planning and policy responses.

Women and Working Mothers

Women experienced particularly sharp participation declines during the COVID-19 pandemic. Childcare responsibilities fell disproportionately on mothers. Many left jobs to care for children during school closures. Recovery has been incomplete.

Women who remain in the workforce often benefit from labor scarcity. Wage gaps narrow slightly when employers desperately need workers. However, women still shoulder most unpaid caregiving work. This creates ongoing tension between employment and family responsibilities.

Affordable childcare availability directly determines many women’s employment decisions. Policy changes providing better childcare access would have the largest impact on female participation. Until such changes occur, many women face impossible choices between career and family.

Older Workers and Retirees

Americans approaching retirement face complex decisions. Some choose to work longer than previous generations. Others retire early due to health concerns or caregiving needs. These individual choices aggregate into significant economic effects.

Older workers who continue employment help moderate overall participation decline. They bring experience and institutional knowledge. However, age discrimination remains a concern despite legal protections. Some older workers report difficulty finding employment despite labor shortages.

The population aging creates the fundamental demographic challenge. By 2030, all baby boomers will exceed age 65. This represents approximately 73 million people. Supporting this large retired population with a smaller workforce creates fiscal pressures across government programs.

Young Adults and Career Entrants

Young Americans face both opportunities and challenges. They enter a labor market where workers command significant bargaining power. Starting salaries have risen sharply in many fields. Career advancement occurs faster than for previous generations.

However, young adults inherit economic challenges created by participation decline. They will shoulder higher tax burdens to support social programs. Economic growth constraints may limit lifetime earning potential. Student debt burdens compound these pressures for many graduates.

College enrollment decisions become more complex. Higher education delays workforce entry while accumulating costs. However, college graduates earn significantly more over lifetimes. Balancing these considerations requires careful individual assessment.

Less-Educated and Lower-Income Workers

Workers without college degrees have experienced the steepest participation declines. This group faces multiple barriers including limited job skills, health challenges, and caregiving responsibilities. Many have dropped out of active job searching entirely.

Labor market tightness helps these workers when they remain employed. Wages for lower-skilled positions have risen substantially. However, many potential workers in this demographic remain on the sidelines. Bringing them back into the workforce would require addressing multiple barriers simultaneously.

Communities where participation has collapsed face severe challenges. These areas show high rates of disability claims, drug abuse, and economic distress. Recovery requires comprehensive intervention addressing health, education, and economic development together.

Future Outlook (2026–2030)

Projecting economic trends five years forward requires assessing momentum from current conditions and evaluating likely policy responses. Labor force participation trajectories appear fairly predictable given demographic inevitability. However, policy choices could significantly alter outcomes.

Short-Term Outlook (2026-2027)

The immediate years ahead will likely see continued gradual participation decline. Baby boomer retirement continues at a pace of approximately four million people annually. This demographic wave swamps any potential gains from other sources.

The Congressional Budget Office projects the participation rate will fall to approximately 61.8 percent by end of 2026. This represents another 0.7 percentage point decline from current levels. The drop continues trends established over the past two decades.

Prime-age worker participation may stabilize or modestly increase. Many workers who left during the pandemic have already returned. Childcare availability improvements in some states help mothers re-enter employment. However, these gains prove insufficient to offset older worker retirement.

Immigration policy may shift depending on political developments. If policymakers increase legal immigration levels, workforce growth could accelerate. This represents one of the few variables capable of materially changing near-term trajectories. However, substantial policy changes face uncertain political prospects.

Economic growth will likely moderate to approximately 1.8 to 2.2 percent annually through 2027. This reflects both labor force constraints and productivity trends. The economy cannot sustain the 3+ percent growth rates common in previous decades without more workers or dramatic productivity acceleration.

Inflation pressures from labor scarcity should gradually ease. As wage growth moderates and businesses adjust to workforce constraints, price increases should slow. The Federal Reserve projects inflation will return to near the 2 percent target by late 2026. However, labor market tightness could prevent inflation from declining as quickly as hoped.

Business investment patterns will shift toward labor-saving technologies. Companies accelerate automation adoption and process redesign. This investment boom in productivity-enhancing technology represents a silver lining. However, implementation takes time and benefits accrue gradually.

Medium-Term Dynamics (2028-2030)

The late 2020s present a critical inflection point. By 2030, all baby boomers will have reached age 65. The retirement wave that drove participation decline for two decades approaches completion. What happens next depends significantly on policy choices made in the interim.

Demographic pressures should begin moderating after 2030. Generation X, smaller than the baby boom, enters retirement years. This demographic math suggests participation decline could slow or stabilize. The Congressional Budget Office projects stabilization near 61 percent by 2033.

However, this stabilization assumes no major negative shocks. Climate change impacts could disrupt labor markets in unexpected ways. Automation might accelerate worker displacement faster than new job creation. Public health crises similar to COVID-19 could trigger new participation drops. These tail risks deserve consideration even if not the base case.

Social Security reform becomes unavoidable during this period. The trust fund faces depletion in 2034 without changes. Congress will need to act through some combination of benefit cuts, tax increases, and eligibility changes. These reforms will affect retirement decisions and workforce participation incentives.

Medicare similarly requires adjustment. Healthcare costs continue rising while the worker-to-beneficiary ratio declines. Solutions might include higher Medicare eligibility ages, increased premiums, or benefit reductions. These changes ripple through the economy affecting both retirees and workers.

State and local government finances face growing pressure. Public pension systems struggle with insufficient funding. Many states have promised retirement benefits they cannot afford. This creates fiscal stress that affects public services and state economic climates differently.

Technology adoption reaches critical mass in many industries. Artificial intelligence, robotics, and automation transform entire sectors. This creates both opportunities for productivity gains and challenges for worker displacement. The net effect on participation remains uncertain but could prove substantial.

Educational system adaptations become visible. If policymakers invest in training programs and workforce development, the pipeline of skilled workers improves. However, education system changes show effects slowly. Interventions started today pay dividends primarily after 2030.

Scenario Analysis for Different Futures

Understanding potential outcomes requires considering multiple scenarios. The future does not follow a predetermined path. Policy choices and unexpected developments could produce various results.

Baseline Scenario: Continued Gradual Decline

The most likely outcome extends current trends with modest policy adjustments. Participation falls to approximately 61.3 percent by 2030. Economic growth averages 1.8 percent annually. This scenario assumes incremental policy responses but no major reforms.

In this future, the United States muddles through with slower growth and persistent fiscal pressures. Living standards advance gradually but less rapidly than previous generations experienced. Social programs face periodic crises requiring emergency fixes. This represents a manageable but suboptimal trajectory.

Optimistic Scenario: Policy Success and Productivity Surge

An upside scenario involves successful policy interventions combined with favorable technological developments. Childcare expansion brings mothers back to work. Immigration reform adds workers. Disability program changes enable more people to remain employed. These policies stabilize participation near 62 percent by 2030.

Simultaneously, productivity growth accelerates to 2.5 percent annually as technology investments pay off. The combination of stable workforce participation and rising productivity enables GDP growth near 2.8 percent. Fiscal pressures moderate as revenue growth improves. This optimistic path requires both political will and technological success.

Pessimistic Scenario: Accelerated Decline and Productivity Stagnation

A downside case combines policy gridlock with technological disappointment and unexpected negative shocks. Participation falls below 60 percent by 2030 as health crises worsen and automation displaces workers faster than anticipated. Productivity growth remains below 1.5 percent as promised technological revolutions fail to materialize.

In this scenario, GDP growth slows to barely 1 percent annually. Fiscal crises erupt as social program finances deteriorate rapidly. Political conflict intensifies as different groups compete for shrinking economic pie. This represents a significantly worse outcome than current trajectory suggests but remains within possibility.

Long-Term Structural Considerations

Looking beyond 2030 requires considering deeper structural factors. These long-run issues will determine economic prosperity for decades.

Climate change increasingly affects labor markets. Extreme weather disrupts work and displaces populations. Heat stress makes outdoor labor more difficult. These environmental pressures could reduce effective labor supply even among those nominally in the workforce. Adaptation requires substantial investment.

Artificial intelligence development could fundamentally transform work. Optimistic projections suggest AI might boost productivity dramatically. However, rapid automation could also trigger mass unemployment among certain worker categories. Managing this transition without social disruption represents a major policy challenge.

Global economic integration continues evolving. If the United States maintains openness to trade and immigration, workforce constraints moderate through international connections. However, if protectionist and restrictive policies dominate, labor shortages intensify. International policy choices thus matter greatly for domestic workforce availability.

Cultural attitudes toward work may shift. Younger generations sometimes express different priorities than their parents regarding career and life balance. If these preferences lead to reduced work hours or earlier retirement, participation could decline beyond demographic expectations. However, economic necessity might override cultural preferences.

Medical advances could extend healthy working years. Treatments for chronic conditions might enable people to remain employed longer. However, healthcare access disparities mean these benefits distribute unevenly. Population health trends show concerning developments in some areas including rising obesity and mental health challenges.

Technology Acceleration Path

Artificial intelligence and automation dramatically boost productivity, offsetting workforce decline through efficiency gains and enabling sustained economic growth.

- Productivity growth exceeds 3% annually

- AI handles routine cognitive tasks effectively

- Worker displacement managed through retraining

- GDP growth maintains 2.5%+ despite fewer workers

Policy Success Path

Comprehensive policy reforms successfully bring millions back into workforce through childcare support, immigration reform, and program redesign.

- Participation stabilizes above 62%

- Female participation rises 2-3 percentage points

- Immigration adds 500,000+ workers annually

- Disability reforms enable gradual workforce return

Muddling Through Path

Current trends continue with incremental adjustments but no major breakthroughs, resulting in slower but positive economic growth over the next decade.

- Participation stabilizes near 61% after 2030

- GDP growth averages 1.8-2.0% annually

- Periodic fiscal crises require emergency fixes

- Living standards advance gradually

Decline Acceleration Path

Multiple negative factors converge including policy gridlock, health crises, and automation displacement, creating significant economic challenges.

- Participation falls below 60% by 2030

- Productivity stagnates below 1.5% growth

- Social program crises trigger political conflict

- GDP growth slows to 1% or less annually

The World Bank and International Monetary Fund both project that workforce constraints will significantly affect advanced economies through 2050. The United States faces these challenges alongside peer nations. International coordination on immigration, technology policy, and social program design could help all nations navigate demographic transitions more successfully.

The Bureau of Labor Statistics will continue tracking participation monthly. These statistics will provide early warning if trends deviate from projections. Policymakers and individuals should monitor these data closely. Adjustments to plans and policies should respond to actual developments rather than outdated assumptions.

Conclusion

Declining labor force participation represents one of the most significant economic challenges facing the United States through 2030 and beyond. This comprehensive analysis has examined the trend from multiple angles including causes, economic impacts, expert forecasts, and potential solutions.

The trajectory appears clear without major interventions. Demographic aging as baby boomers retire creates inexorable downward pressure on participation rates. The Congressional Budget Office projects decline to approximately 61.3 percent by 2030. This structural shift constrains economic growth potential for years to come.

Multiple factors beyond demographics contribute to participation decline. Policy design flaws in disability programs create work disincentives. Lack of affordable childcare prevents many parents from employment. Automation and globalization displaced workers who never returned. Health challenges including the opioid crisis removed prime-age workers from the labor force. These factors interact and compound.

The economic consequences touch every American. Labor shortages drive inflation and constrain business operations. Slower GDP growth limits income gains and government revenue. Financial markets adjust to lower growth expectations. Social Security and Medicare face intensifying fiscal pressure. Individual living standards advance more slowly than previous generations experienced.

However, the situation is not hopeless. Policy interventions could significantly improve outcomes. Childcare expansion, immigration reform, disability program redesign, and workforce training investments would each help. No single solution suffices, but comprehensive action could stabilize or even reverse participation decline among key demographic groups.

Market forces also drive adaptation. Businesses raise wages and improve working conditions to attract scarce workers. Technology adoption and automation partially offset labor shortages. These adjustments help but cannot fully compensate for millions of missing workers.