Trump’s Big Beautiful Bill Border Wall: Funding, Politics, and America’s Future

President Donald Trump’s “Big Beautiful Bill” has emerged as one of the most consequential pieces of legislation in recent American history, with its border wall funding provisions generating intense debate across the political spectrum. This comprehensive package, which allocates approximately $150 billion for border security initiatives including wall construction, represents a dramatic shift in U.S. immigration policy and border enforcement strategy.

As the bill moves from proposal to implementation, understanding its key provisions, funding mechanisms, and potential impacts becomes essential for anyone concerned with America’s immigration system, national security posture, and fiscal priorities. This analysis breaks down what’s in the bill, how it compares to previous border security efforts, and what it means for America’s future.

What’s in Trump’s “Big Beautiful Bill”

The legislation, spanning nearly 900 pages, represents a sweeping collection of Republican priorities centered around border security, immigration enforcement, and tax policy. At its core, the bill provides unprecedented funding for Trump’s border security agenda while making significant changes to America’s immigration system.

Border Wall Funding

The centerpiece of the bill’s border security provisions is $46.5 billion allocated for what the House Homeland Security Committee describes as an “integrated border barrier system.” This funding aims to complete 701 miles of primary walls and 900 miles of river barriers along the U.S.-Mexico border, making it the largest expenditure in the entire package.

According to Republican Rep. Mark Green of Tennessee, chairman of the Homeland Security Committee, “Any lawmaker who claims to care about border security will need to put their money where their mouth is and work to advance these recommendations.” The funding covers not just physical barriers but also supporting infrastructure including:

- Border fencing and wall construction

- Water barriers in strategic locations

- Law enforcement access roads

- Advanced technology including movement sensors

- Supporting infrastructure for border patrol operations

Detention and Enforcement

Beyond physical barriers, the bill allocates $45 billion to expand the network of immigrant detention facilities for adult migrants and families. This massive investment aims to increase ICE’s current detention capacity from about 41,000 people to 100,000, supporting what ICE’s acting director Todd Lyons has described as a deportation system that could function “like Amazon, trying to get your product delivered in 24 hours.”

Additionally, more than $12 billion is earmarked for hiring 18,000 new ICE and Border Patrol personnel, dramatically expanding the enforcement capabilities of these agencies. The bill gives the Secretary of Homeland Security sole discretion to set standards in adult detention facilities.

Immigration Court System

The legislation allocates $1.25 billion for the immigration court system, which has struggled for years with chronic understaffing and a backlog that has reached more than 3.6 million cases. This funding aims to hire more immigration judges and support staff while expanding courtroom capacity.

Greg Chen, director of government relations for the American Immigration Lawyers Association, noted that the proposed funding would be “a significant increase, and from an institutional perspective it’s urgently needed money.” However, critics argue that recent courthouse arrests reflect an administration looking for ways to bypass immigration courts entirely.

New Immigration Fees

The bill dramatically overhauls the system of immigration costs, with steep increases and new fees imposed for once-free services. Some of the most significant changes include:

| Service | Previous Fee | New Fee | Increase |

| Asylum Application | Free | $1,000 | New fee |

| Employment Application (for asylum seekers) | Varies | $550 | New fee |

| Immigration Judge Decision Appeal | $110 | $900 | 718% |

| Temporary Protected Status | $50 | $500 | 900% |

Critics argue these fee increases will effectively price out many immigrants from accessing legal pathways, while supporters contend they help offset the costs of processing applications and maintaining the immigration system.

Beyond the Border: Other Key Provisions

While border security dominates headlines, the “Big Beautiful Bill” contains numerous other provisions that will significantly impact American policy and society.

Tax Cuts and Economic Measures

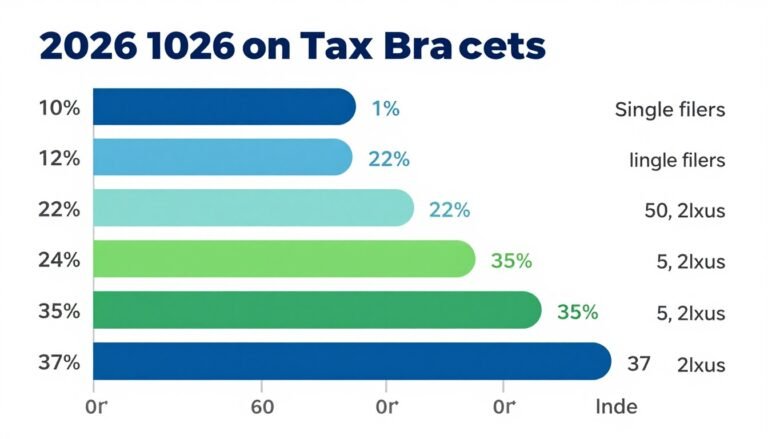

The legislation contains approximately $4.5 trillion in tax cuts, making permanent the tax rates and brackets approved during Trump’s first term. It also adds new tax deductions on tips, overtime, and auto loans, along with a $6,000 deduction for older adults earning no more than $75,000 annually—a nod to Trump’s pledge to end taxes on Social Security benefits.

The bill boosts the child tax credit from $2,000 to $2,200, though critics note that millions of families at lower income levels would not receive the full credit. It also quadruples the cap on state and local tax deductions (SALT) to $40,000 for five years, a provision important to high-tax states like New York.

Program Cuts and Offsets

To partially offset the lost tax revenue and new spending, the bill cuts back on Medicaid and food assistance programs. It implements new 80-hour-per-month work requirements for many adults receiving Medicaid and food stamps, including older people up to age 65. Parents of children 14 and older would also have to meet these work requirements.

The Congressional Budget Office estimates that 11.8 million more Americans would become uninsured by 2034 if the bill became law, and 3 million more would not qualify for food stamps (SNAP benefits).

Stay Informed on Immigration Policy Changes

Get expert analysis and updates on Trump’s border wall funding and immigration policy changes delivered to your inbox.

Energy Policy Shifts

The bill dramatically rolls back tax breaks designed to boost clean energy projects fueled by renewable sources such as solar and wind. These tax breaks were central components of President Biden’s 2022 climate change legislation.

Senator Ron Wyden (D-OR) described these provisions as a “death sentence for America’s wind and solar industries and an inevitable hike in utility bills.” Meanwhile, the bill expands tax credits for the production of critical materials to include metallurgical coal used in steelmaking.

Political Context and Legislative Journey

The passage of the “Big Beautiful Bill” represents a significant political victory for both President Trump and Republican congressional leadership. House Speaker Mike Johnson (R-LA) described the legislation as laying “a key cornerstone of America’s new golden age,” emphasizing its importance to the Republican agenda.

The bill’s journey through Congress was marked by intense partisan division. It passed the House by a narrow margin of 218-214, with two Republicans—Reps. Thomas Massie (KY) and Brian Fitzpatrick (PA)—joining all Democrats in opposition. In the Senate, Vice President JD Vance cast the tiebreaking vote to secure passage.

Marathon Negotiations

The final push to pass the bill involved marathon negotiation sessions, with procedural votes left open for a combined 14 hours as Republican leaders and White House aides worked behind closed doors to secure support from holdouts. One of these votes set the record for the longest vote in House history, according to Rep. Jim McGovern (D-MA).

In a dramatic moment just before 3:30 a.m., Speaker Johnson convened GOP holdouts on the House floor and prayed with the group. Shortly after, he snapped a photo of the opponents-turned-supporters, marking the turning point that secured the bill’s passage.

Democratic Opposition

Democrats unanimously opposed the legislation, with House Minority Leader Hakeem Jeffries (D-NY) delivering a marathon 8-hour and 44-minute speech to delay the final vote—surpassing the previous record set by then-Minority Leader Kevin McCarthy in 2021.

Democrats characterized the bill as a reverse-Robin Hood “scam” that slashes federal benefits for low- and middle-income Americans to fund tax cuts for the wealthy. They’ve vowed to use the bill as a political weapon in the 2026 midterm elections, targeting vulnerable Republican lawmakers who supported it.

The Border Wall: Effectiveness and Controversy

The effectiveness of border walls remains one of the most hotly debated aspects of the “Big Beautiful Bill.” While the Trump administration has long championed physical barriers as essential to border security, experts remain divided on their impact.

Current Impact Assessment

Illegal border crossings have plunged since Trump took office in January, amid a string of executive orders on immigration, including the suspension of the asylum system. However, many experts attribute this decline more to policy changes than physical barriers, noting that ending asylum meant tens of thousands of people who would have surrendered to law enforcement instead of trying to avoid capture didn’t even attempt to cross.

Potential Benefits

- Channels migration to monitored entry points

- Creates physical deterrent in populated areas

- Provides more time for Border Patrol to respond

- Creates construction jobs in border communities

- Serves as visible symbol of border enforcement

Potential Drawbacks

- High construction and maintenance costs

- Circumvented by tunnels, ladders, and power tools

- Environmental disruption to sensitive ecosystems

- Private land seizures through eminent domain

- Diverts resources from technology and personnel

Human smugglers, often linked to drug cartels, have demonstrated their ability to overcome physical barriers using tunnels, ladders, and power tools. However, experts note that while illegal crossings are down now, migration patterns can change rapidly in response to economic, political, and environmental factors.

Environmental and Land Concerns

The expansion of border wall construction raises significant environmental and land ownership concerns. Environmental advocates have documented disruption to wildlife migration patterns, damage to sensitive desert ecosystems, and impacts on water flow in border regions.

Additionally, completing the wall as outlined in the bill would require the federal government to acquire substantial private land along the border, potentially through eminent domain. This has already generated legal challenges from landowners in border states, particularly in Texas where much of the border land is privately owned.

Economic Implications

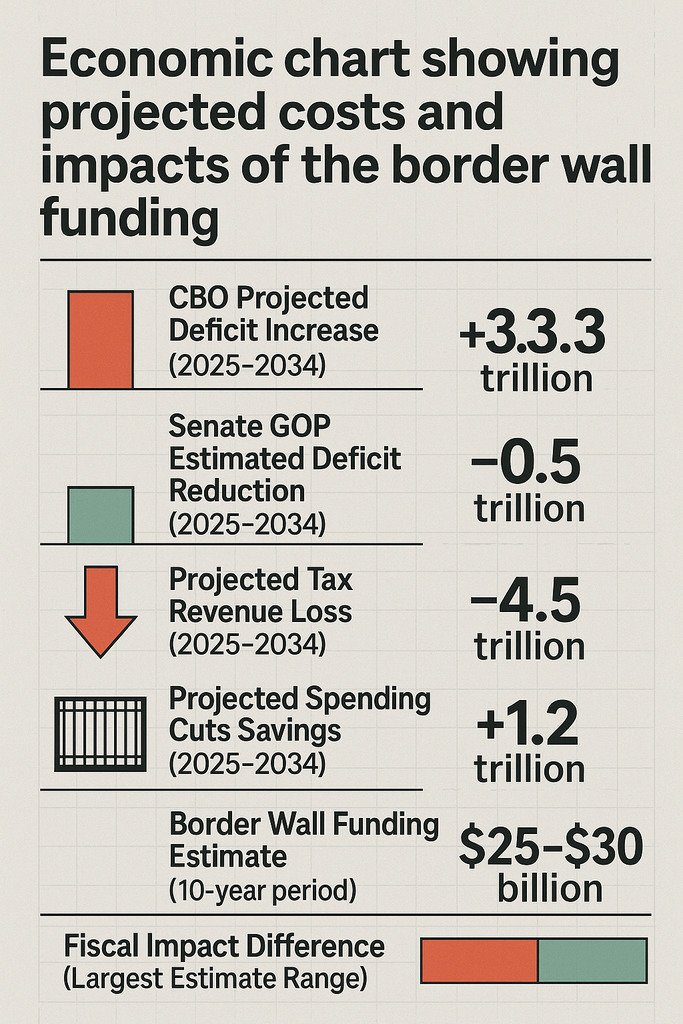

The Congressional Budget Office projects that the bill would increase federal deficits by nearly $3.3 trillion over the next decade (2025-2034). However, Senate Republicans have proposed an alternative accounting approach that doesn’t count the existing tax breaks as a new cost because they are already “current policy.” Under this view, the bill would reduce deficits by almost half a trillion dollars.

Critics, including the Committee for a Responsible Federal Budget, have described this as an “accounting gimmick that would make Enron executives blush.” The debate highlights the challenges of accurately assessing the fiscal impact of such sweeping legislation.

Private Sector Impacts

The bill represents a significant boon to America’s private prison industry. Stock prices for the two dominant companies in this sector, Geo Group Inc. and CoreCivic, have risen more than 50% since Trump’s election, reflecting investor confidence in expanded detention operations.

Construction companies specializing in large infrastructure projects also stand to benefit from the wall construction funding. However, businesses relying on immigrant labor may face challenges as deportations increase and the labor pool potentially shrinks in certain sectors.

State and Local Economic Effects

Border states will experience the most direct economic impacts from the bill’s implementation. Construction projects will create jobs and stimulate local economies in the short term, but the long-term economic effects remain uncertain.

The bill also shifts some costs to states, particularly for SNAP benefits. Beginning in 2028, states will be required to contribute a percentage of benefit costs if their payment error rate exceeds 6%. Alaska, with the highest error rate at nearly 25%, secured a temporary delay in this cost-sharing requirement through Senator Lisa Murkowski’s negotiations.

Future Outlook and Implementation Challenges

As the “Big Beautiful Bill” moves from legislation to implementation, several key challenges and uncertainties remain. The ambitious scope of the border wall construction project faces logistical hurdles, potential legal challenges, and questions about long-term maintenance costs.

Implementation Timeline

The bill’s border security provisions will take years to fully implement. Wall construction requires environmental assessments, land acquisition, contracting processes, and actual building time. Similarly, expanding detention capacity and hiring thousands of new immigration officers involves lengthy recruitment, training, and facility construction periods.

Adam Isacson, a researcher with the Washington-based human rights advocacy organization WOLA, noted that many sections of the bill are “super vague,” including multibillion-dollar expenditures sometimes explained in just a few lines. “There’s no real specificity in the bill about how it’s going to be spent,” he observed, suggesting that implementation details will largely be determined by executive branch agencies.

Legal and Political Challenges

The bill’s provisions, particularly those related to immigration enforcement and Medicaid changes, are likely to face legal challenges from advocacy groups, states, and affected individuals. These challenges could delay implementation or alter how certain provisions are carried out.

Additionally, future elections could shift the political landscape, potentially affecting funding priorities or enforcement approaches. While the legislation establishes a framework and funding, much of its impact will depend on how aggressively the administration pursues its implementation.

Conclusion: A Transformative Moment in Immigration Policy

The “Big Beautiful Bill” represents one of the most significant shifts in American immigration policy in decades. With unprecedented funding for border wall construction, detention facilities, and enforcement personnel, the legislation aims to fundamentally reshape how the United States manages its southern border and approaches immigration enforcement.

The bill’s passage marks a major political victory for President Trump and congressional Republicans, fulfilling key campaign promises and establishing a legislative framework for the administration’s immigration agenda. However, the true impact of these policies will only become clear as implementation proceeds and the various provisions take effect.

As America embarks on this new approach to border security and immigration enforcement, the debate over its effectiveness, costs, and humanitarian implications will continue. The “Big Beautiful Bill” may be law, but the conversation about America’s border and immigration policy is far from over.

Get the Complete Analysis

Download our comprehensive guide to Trump’s Big Beautiful Bill and its impact on border security, immigration, and American policy.

Frequently Asked Questions

How much does the border wall funding in the bill cost?

The bill allocates .5 billion for what’s described as an “integrated border barrier system,” which includes wall construction, fencing, water barriers, access roads, and technology. This represents the largest single expenditure in the entire package.

How effective are physical barriers like border walls?

The effectiveness of border walls is debated among experts. While physical barriers can channel migration to monitored entry points and provide Border Patrol with more response time, they can be circumvented using tunnels, ladders, and power tools. Many experts attribute recent declines in border crossings more to policy changes like asylum restrictions than to physical barriers.

How will the bill affect immigration courts?

The legislation allocates

Frequently Asked Questions

How much does the border wall funding in the bill cost?

The bill allocates $46.5 billion for what’s described as an “integrated border barrier system,” which includes wall construction, fencing, water barriers, access roads, and technology. This represents the largest single expenditure in the entire package.

How effective are physical barriers like border walls?

The effectiveness of border walls is debated among experts. While physical barriers can channel migration to monitored entry points and provide Border Patrol with more response time, they can be circumvented using tunnels, ladders, and power tools. Many experts attribute recent declines in border crossings more to policy changes like asylum restrictions than to physical barriers.

How will the bill affect immigration courts?

The legislation allocates $1.25 billion for the immigration court system, which currently has a backlog of more than 3.6 million cases. The funding aims to hire more immigration judges and support staff while expanding courtroom capacity. However, some critics believe the administration is looking for ways to bypass immigration courts entirely through increased deportations.

What are the new fees for immigration services?

The bill implements significant fee increases, including a new $1,000 fee for asylum applications (previously free), a $550 fee for employment applications for asylum seekers, an increase in the cost of appealing immigration judge decisions from $110 to $900, and raising the fee for temporary protected status applications from $50 to $500.

How will the bill impact federal deficits?

According to the Congressional Budget Office, the bill would increase federal deficits by nearly $3.3 trillion over the next decade (2025-2034). However, Senate Republicans have proposed an alternative accounting approach that doesn’t count existing tax breaks as new costs, under which they claim the bill would reduce deficits by almost half a trillion dollars.

.25 billion for the immigration court system, which currently has a backlog of more than 3.6 million cases. The funding aims to hire more immigration judges and support staff while expanding courtroom capacity. However, some critics believe the administration is looking for ways to bypass immigration courts entirely through increased deportations.

What are the new fees for immigration services?

The bill implements significant fee increases, including a new

Frequently Asked Questions

How much does the border wall funding in the bill cost?

The bill allocates $46.5 billion for what’s described as an “integrated border barrier system,” which includes wall construction, fencing, water barriers, access roads, and technology. This represents the largest single expenditure in the entire package.

How effective are physical barriers like border walls?

The effectiveness of border walls is debated among experts. While physical barriers can channel migration to monitored entry points and provide Border Patrol with more response time, they can be circumvented using tunnels, ladders, and power tools. Many experts attribute recent declines in border crossings more to policy changes like asylum restrictions than to physical barriers.

How will the bill affect immigration courts?

The legislation allocates $1.25 billion for the immigration court system, which currently has a backlog of more than 3.6 million cases. The funding aims to hire more immigration judges and support staff while expanding courtroom capacity. However, some critics believe the administration is looking for ways to bypass immigration courts entirely through increased deportations.

What are the new fees for immigration services?

The bill implements significant fee increases, including a new $1,000 fee for asylum applications (previously free), a $550 fee for employment applications for asylum seekers, an increase in the cost of appealing immigration judge decisions from $110 to $900, and raising the fee for temporary protected status applications from $50 to $500.

How will the bill impact federal deficits?

According to the Congressional Budget Office, the bill would increase federal deficits by nearly $3.3 trillion over the next decade (2025-2034). However, Senate Republicans have proposed an alternative accounting approach that doesn’t count existing tax breaks as new costs, under which they claim the bill would reduce deficits by almost half a trillion dollars.

,000 fee for asylum applications (previously free), a 0 fee for employment applications for asylum seekers, an increase in the cost of appealing immigration judge decisions from 0 to 0, and raising the fee for temporary protected status applications from to 0.

How will the bill impact federal deficits?

According to the Congressional Budget Office, the bill would increase federal deficits by nearly .3 trillion over the next decade (2025-2034). However, Senate Republicans have proposed an alternative accounting approach that doesn’t count existing tax breaks as new costs, under which they claim the bill would reduce deficits by almost half a trillion dollars.