U.S. Dollar Weakness: Understanding the Decline and Its Impact on Your Finances

The U.S. dollar has recently dropped to its weakest point in over a year, triggering concerns about what this means for both the global economy and personal finances. This decline represents more than just a number on currency charts—it has real-world implications for everything from the price of your morning coffee to your retirement savings. In this comprehensive guide, we’ll explore why the dollar is weakening, what it means for the world economy, and most importantly, how you can prepare your finances for this shifting economic landscape.

Why Is the U.S. Dollar Weakening?

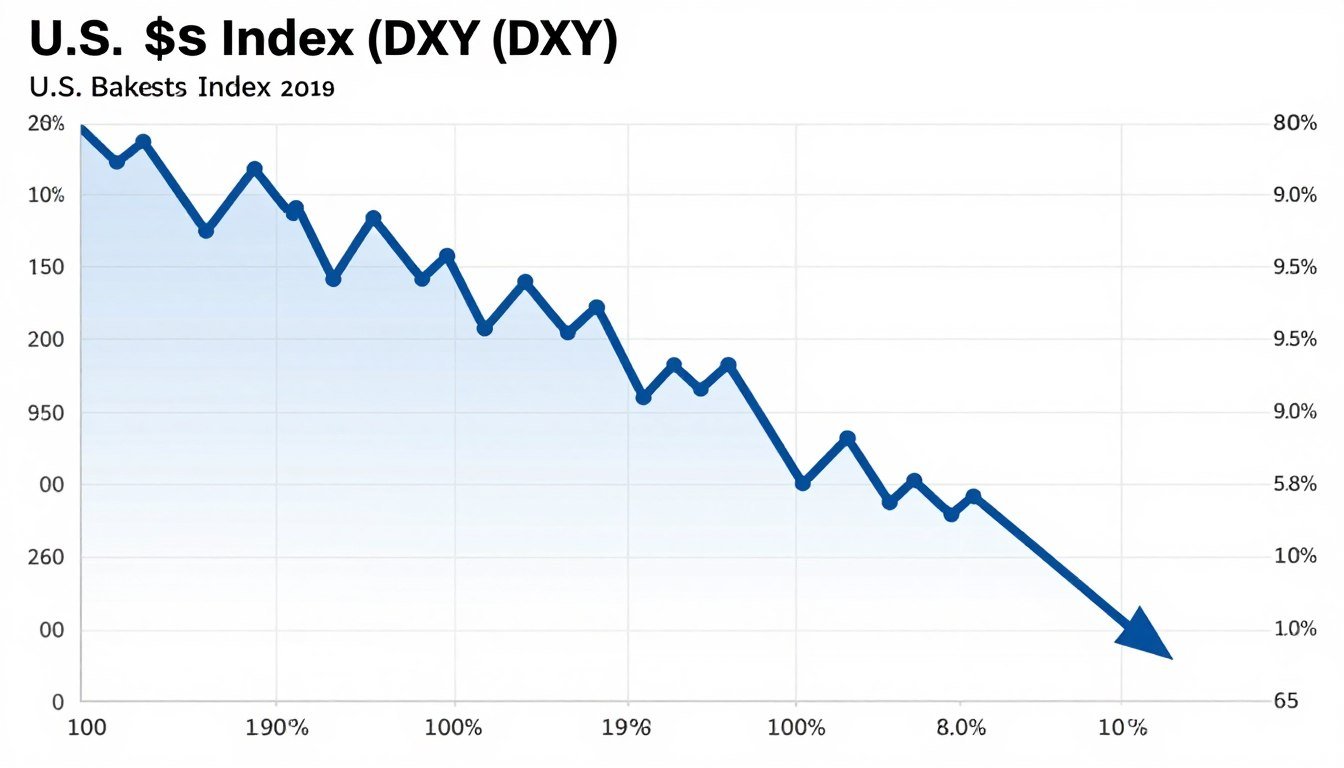

The U.S. Dollar Index has declined approximately 9-10% over the past year

The current U.S. dollar weakness can be attributed to several key factors working in concert. Understanding these causes helps provide context for the broader economic implications.

Monetary Policy Divergence

The Federal Reserve has begun cutting interest rates while many other central banks around the world have either stopped cutting or are nearing the end of their cutting cycles. This narrowing interest rate differential between the U.S. and other economies has reduced the dollar’s appeal to international investors seeking higher yields.

Growing Budget Deficits

The U.S. government continues to spend significantly more than it collects in taxes. These persistent and growing budget deficits raise concerns about long-term fiscal sustainability, putting downward pressure on the dollar as investors question America’s financial outlook.

Declining Foreign Demand

Foreign investors—both public and private—have historically been willing to hold dollars due to the strength of U.S. companies and the dollar’s status as the world’s primary reserve currency. However, recent trade tensions and policy shifts have dampened foreign willingness to hold U.S. assets, particularly Treasury securities.

Political Uncertainty

Questions about Federal Reserve independence and political pressure to cut interest rates despite elevated inflation have created uncertainty in markets. When investors believe monetary policy might be influenced by political factors rather than economic fundamentals, confidence in the currency can waver.

Global Economic Implications of U.S. Dollar Weakness

A weaker dollar creates ripple effects throughout the global economy, influencing trade relationships, debt obligations, and commodity markets worldwide.

Global economic impact of U.S. dollar weakness varies by region and economic relationship with the United States

International Trade Dynamics

A weaker dollar makes U.S. exports more competitive in international markets while making imports more expensive for American consumers and businesses. Countries with strong export relationships with the U.S. may see increased demand for their products, while those relying heavily on American imports may face higher costs.

Emerging Market Debt Relief

Many emerging market economies hold significant debt denominated in U.S. dollars. When the dollar weakens, this debt becomes less burdensome to service, providing some financial breathing room for these countries. This can potentially stimulate economic growth in developing nations with dollar-denominated obligations.

Commodity Price Increases

Most global commodities—including oil, gold, and agricultural products—are priced in U.S. dollars. A weaker dollar typically leads to higher commodity prices as the same dollar amount buys less of these resources. This benefits commodity-exporting nations while potentially creating inflationary pressures for importers.

Shifting Reserve Currency Dynamics

Central banks around the world hold foreign exchange reserves, with the U.S. dollar traditionally dominating these holdings. Persistent dollar weakness may accelerate diversification efforts, with central banks gradually increasing their holdings of other currencies, gold, and potentially digital assets.

How Governments and Institutions Are Responding

Various economic stakeholders are implementing strategies to navigate this period of dollar weakness, providing insights into potential future trends.

Central Bank Responses

Central banks globally are carefully calibrating their monetary policies in response to dollar movements. Some are intervening in currency markets to prevent excessive appreciation of their own currencies, while others are accelerating diversification of their reserve holdings away from dollar-denominated assets.

Corporate Hedging Strategies

Multinational corporations are implementing more sophisticated currency hedging strategies to protect profit margins from exchange rate volatility. Companies with significant international operations are reviewing their global footprint to optimize for the new currency reality.

Government Policy Adjustments

Governments are reassessing trade policies, considering how currency movements affect their competitive position. Some export-oriented economies may implement measures to prevent their currencies from strengthening too much against the dollar, while import-dependent nations may seek new trading partners.

Stay Informed About Global Economic Shifts

Get our free weekly economic briefing delivered straight to your inbox. Our team of analysts breaks down complex global trends into actionable insights.

What U.S. Dollar Weakness Means for Your Daily Life

Beyond abstract economic concepts, dollar weakness has tangible effects on your everyday financial situation. Understanding these impacts can help you make informed decisions.

Imported consumer goods often become more expensive during periods of dollar weakness

Rising Import Prices

As the dollar weakens, imported goods become more expensive. This affects everything from electronics and clothing to certain foods and medicines. Products with global supply chains may see price increases as components sourced internationally become costlier.

Travel Considerations

If you’re planning international travel, a weaker dollar means your money won’t stretch as far abroad. Popular destinations may become more expensive as hotel stays, meals, and attractions effectively cost more in dollar terms.

Investment Portfolio Implications

Your investment portfolio may be significantly affected by dollar movements. U.S. companies with substantial international sales often benefit from dollar weakness as their foreign earnings translate into more dollars. Conversely, businesses relying heavily on imports may face margin pressure.

Inflation and Purchasing Power

A weaker dollar can contribute to inflation as import prices rise. This gradually erodes purchasing power, particularly for households that consume a high proportion of imported goods or services with international components.

Job Market Considerations

Dollar weakness can boost employment in export-oriented sectors as American goods become more competitive internationally. Manufacturing, agriculture, and tourism may see job growth. However, industries relying heavily on imported components might face cost pressures that could affect hiring.

Practical Strategies to Protect Your Finances

While you can’t control currency movements, you can take proactive steps to position your personal finances advantageously during periods of dollar weakness.

Consulting with a financial advisor can help develop personalized strategies for navigating currency fluctuations

Diversify Your Investment Portfolio

Consider increasing exposure to international investments, particularly in markets that may benefit from dollar weakness. International bonds (especially from countries with strong currencies), global equities, and multinational companies with significant foreign earnings can provide a hedge against dollar depreciation.

Investment Options to Consider:

- International equity funds focusing on developed markets

- Emerging market bonds denominated in local currencies

- U.S. multinationals with significant overseas revenue

- Real assets like real estate investment trusts (REITs)

- Precious metals like gold and silver

Investments to Approach Cautiously:

- Long-term U.S. Treasury bonds

- Companies heavily dependent on imports

- Businesses with significant dollar-denominated debt

- Cash holdings without inflation protection

- Fixed-income investments without inflation adjustments

Consider Hard Assets

Tangible assets often perform well during periods of currency weakness. Real estate, precious metals, and certain commodities can serve as stores of value when paper currencies decline. These assets typically have intrinsic value independent of any particular currency.

Manage Debt Strategically

If inflation rises due to dollar weakness, fixed-rate debt can actually become less burdensome over time as you repay it with dollars that are worth less in real terms. However, variable-rate debt may become more expensive if interest rates rise to combat inflation.

Budget for Higher Prices

Anticipate potential price increases for imported goods and services. Review your budget to identify areas where you might be exposed to import-related inflation and consider alternatives or build in additional financial cushion.

Protect Your Financial Future

Download our free guide “Navigating Dollar Weakness: A Personal Finance Strategy” for detailed advice on positioning your investments, protecting your purchasing power, and making smart financial decisions during currency fluctuations.

Looking Ahead: The Future of the U.S. Dollar

While short-term fluctuations in the dollar’s value are normal, the current weakness appears to be part of a longer-term trend reflecting shifts in the global economic order. The dollar will likely remain the world’s primary reserve currency for the foreseeable future, but its dominance may gradually erode as the global economy becomes increasingly multipolar.

For individuals, the key takeaway is not to panic but to adapt. Currency movements are complex and influenced by countless factors, many beyond any individual’s control. By understanding the fundamental drivers of dollar weakness and implementing thoughtful financial strategies, you can protect your purchasing power and potentially even benefit from this economic shift.

Remember that diversification, thoughtful planning, and staying informed are your best tools for navigating any economic environment—including one characterized by U.S. dollar weakness. By taking proactive steps now, you can position your finances to remain resilient regardless of which way the currency winds blow.